Underpricing is the Silent Killer of Small Businesses. Here's the Cure.

Let’s be honest. Setting your prices can feel like walking a tightrope in the dark. On one side, there’s the fear of scaring away customers with a price that’s “too high.” On the other, there’s the nagging suspicion that you’re working far too hard for far too little. This is the great pricing dilemma, and it’s a place where countless small business owners get stuck.

But what if I told you that one side of that tightrope is infinitely more dangerous than the other?

Underpricing is the silent killer of cash flow. Here's how to know if you're doing it.

It’s a quiet and insidious problem. It doesn’t announce itself with a loud bang, but with a slow, draining exhaustion. It’s the feeling of being busy but broke, of ending the month with a flurry of sales but a pit in your stomach when you look at your bank account. You’re delivering amazing value, your customers love you, but your business isn’t growing. It’s stagnating, and you’re on the fast track to burnout.

If this sounds familiar, you are not alone. But it’s time to switch on the lights and find your footing. This article is your guide to navigating the pricing maze. We’ll break down why we fall into the underpricing trap, how to understand your true costs, and most importantly, how to adopt a pricing strategy that not only covers your bills but fuels your growth and lets you confidently charge what you're worth.

The Hidden Dangers of "Playing It Safe" with Low Prices

The instinct to price low often comes from a good place. We’re passionate about what we do and we want to make it accessible. We look at our competitors and think, “Maybe if I’m just a little cheaper, I’ll win the business.” This thinking, while common, is a dangerous trap that undermines your business profitability from day one.

Here’s what really happens when your prices are too low:

- You Eviscerate Your Profit Margins: Profit isn’t a dirty word; it’s the lifeblood of your business. It’s the money you use to reinvest in marketing, upgrade your equipment, hire help, and innovate. When your prices barely cover your costs, you have zero wiggle room. An unexpected expense or a slow month can become a full-blown crisis. Healthy cash flow is impossible without healthy margins.

- You Signal Low Quality (Even When It’s Not!): Price is a powerful psychological cue. In the absence of other information, customers equate low price with low value. You could have the best-quality handmade product or the most transformative consulting service in your industry, but a bargain-basement price tag tells a different story. It can make potential customers skeptical and question your credibility.

- You Attract the Wrong Customers: A strategy built on being the cheapest option attracts customers who care about one thing: the price. These are rarely loyal customers. They will leave you the second a competitor undercuts you by a dollar. They are also often the most demanding, draining your time and energy with complaints and requests that your thin margins can’t possibly support.

- You Starve Your Business of Growth: Want to run a marketing campaign? Launch a new product line? Hire your first employee? All of that requires capital. Underpricing ensures you’re always stuck in survival mode, unable to make the strategic investments required to scale your business and build a lasting brand.

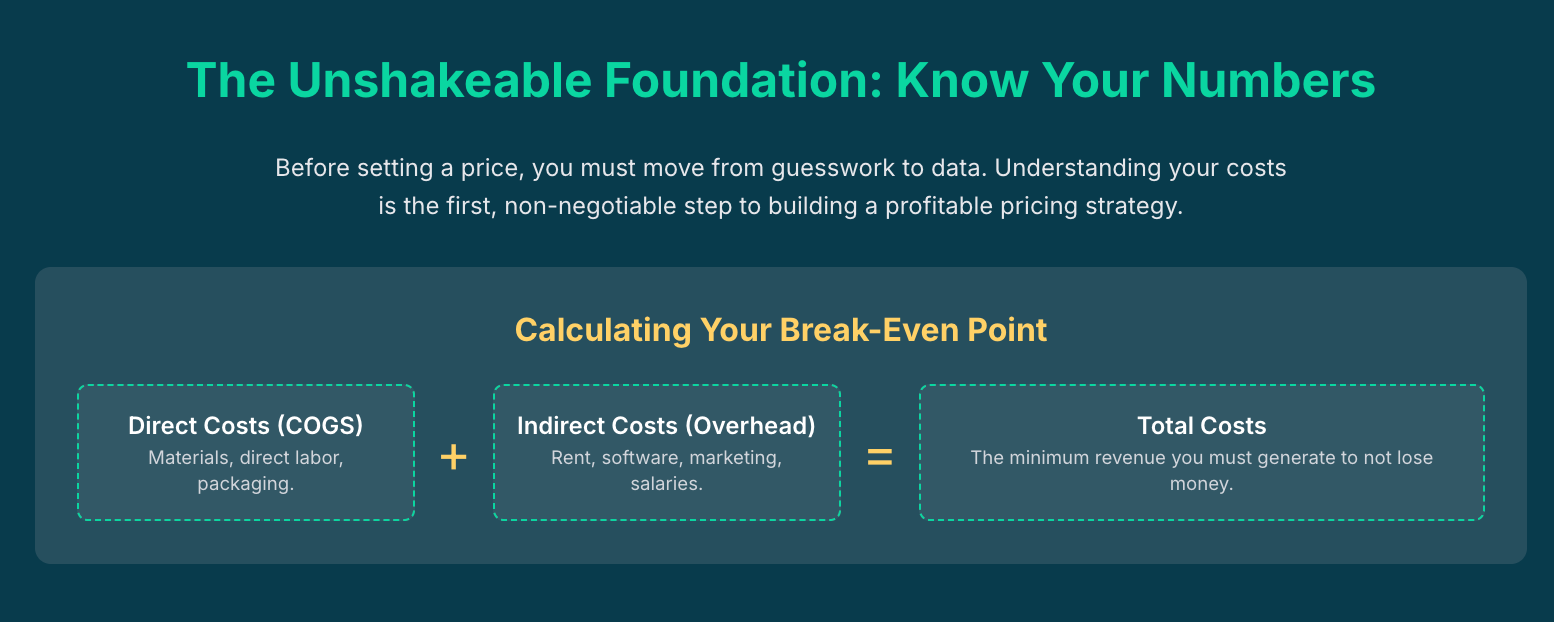

The Unshakeable Foundation: Knowing Your Numbers Cold

Before you can set a price, you have to stop guessing. Pricing based on a “gut feeling” or what “feels right” is a recipe for failure. The first step toward a powerful pricing strategy is a non-negotiable, crystal-clear understanding of your costs.

Let’s break them down into two categories:

1. Direct Costs (or Cost of Goods Sold - COGS)

These are the expenses directly tied to producing your product or delivering your service.

- For product businesses: This includes raw materials, packaging, and the direct labor costs involved in making one unit.

- For service businesses: This can be a bit trickier, but it includes the cost of any software, tools, or subscriptions that are essential for you to deliver your service to a single client.

Example: A baker’s direct costs for one cake include flour, sugar, eggs, a specialty box, and the time it takes to bake and decorate it.

2. Indirect Costs (or Overhead)

These are the costs of keeping your business running, whether you make one sale or one hundred. They are the expenses you have to pay every single month just to keep the lights on.

- Common examples include: Rent for your office or workshop, utilities, website hosting, marketing and advertising expenses, accounting software, business insurance, salaries (including your own!), and professional development.

Best Practice: Tally up all your indirect costs for a typical month. If your business is seasonal, it’s wise to calculate this for the entire year and then divide by 12 to get a monthly average.

Once you have these numbers, you can calculate your break-even point. This is the absolute minimum you need to sell just to cover your total costs. Selling below this means you are actively paying to be in business. While there are many free break-even calculators online, the basic concept is simple: you need to generate enough profit per sale to cover your entire monthly overhead.

Knowing your numbers isn’t just an accounting exercise; it’s an act of empowerment. It’s the data you need to make strategic, confident decisions.

Choosing Your Pricing Strategy: Moving Beyond the Obvious

Once you know your costs, you can start thinking about how to build profit into your price. Many business owners stop at the simplest method, but that’s often where they leave the most money on the table.

The Old Standby: Cost-Plus Pricing

This is the most basic strategy: Costs + Desired Markup % = Price. For example, if your cake costs $20 in materials and labor to make, and you want a 50% markup, you charge $30.

- Pros: It’s simple and guarantees you’re covering your costs.

- Cons: This is its critical flaw: it completely ignores the customer and the market. Your costs are your problem, not your customer’s reality. The value they receive from that beautiful, delicious cake for their child’s birthday is worth far more than the cost of your flour and sugar. Cost-plus pricing ensures you don’t lose money, but it doesn’t help you maximize your earnings.

The Reactive Approach: Competitor-Based Pricing

This involves looking at what your competitors are charging and setting your prices somewhere in that same ballpark.

- Pros: It’s a quick way to get a sense of the market and ensure you’re not wildly off-base.

- Cons: This strategy assumes your business is identical to your competitors. Are your materials the same quality? Is your customer service as good? Is your level of expertise the same? It puts you in a reactive position and can easily lead to a “race to the bottom,” where everyone competes on price and no one wins.

The Gold Standard: Value-Based Pricing

This is where the magic happens. Value-based pricing flips the entire script. Instead of starting with your costs, you start with your customer. The core question is not “What does it cost me?” but “What is this worth to my ideal client?”

This strategy anchors your price to the immense value, transformation, or solution you provide.

- A business consultant isn’t selling an hour of their time; they’re selling a strategy that could save their client $50,000 in operational waste. What is that solution worth?

- A wedding photographer isn’t just selling digital files; they’re selling timeless, cherished memories of the most important day in a couple’s life. What is that peace of mind and artistry worth?

- A software developer isn’t just selling lines of code; they’re selling a tool that automates a tedious task, saving a team 10 hours of work every single week. What is that reclaimed time worth?

When you shift to a value-based pricing mindset, you decouple your price from your time and costs and connect it to the outcome. This is the single most powerful way to dramatically increase your business profitability and finally charge what you're worth.

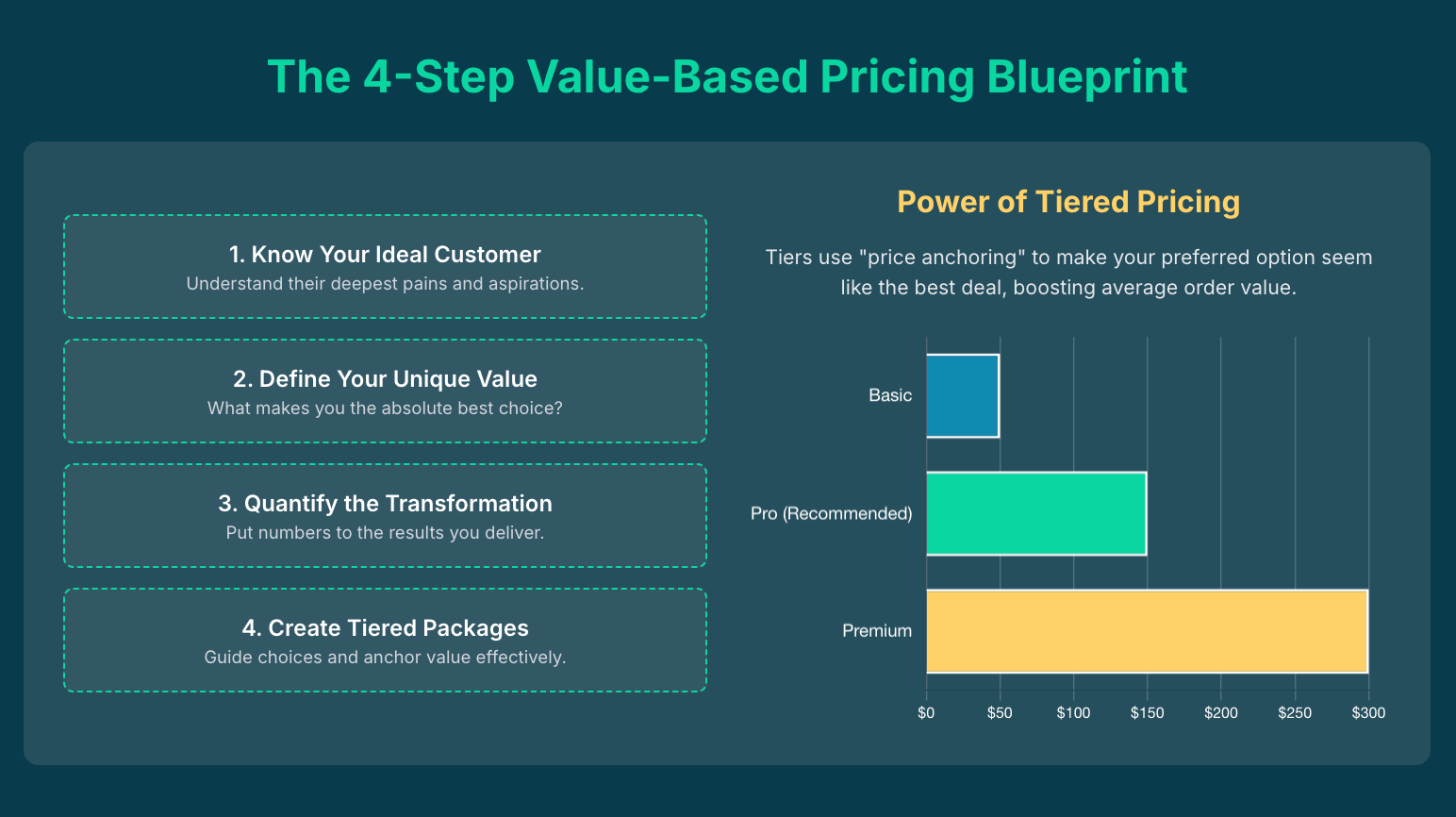

How to Confidently Charge What You’re Worth

Adopting a value-based approach feels great in theory, but how do you actually do it? Here is a practical, step-by-step guide.

Step 1: Get Obsessed with Your Ideal Customer You need to know them better than they know themselves. What are their deepest frustrations? Their biggest aspirations? What problem is keeping them up at night? When you understand their pain points intimately, you can position your product or service as the perfect solution.

Step 2: Articulate Your Unique Value Proposition (UVP) What makes you the absolute best choice? It’s rarely just about the features. It’s about the benefits. Do you offer unparalleled customer service? Do you use sustainable, high-end materials? Is your process faster and more convenient? Do you have a level of expertise no one else does? Write down 3-5 things that truly set you apart. This is the foundation of your value.

Step 3: Quantify the Transformation Whenever possible, put numbers to the value you provide.

- "We help our clients increase their web traffic by an average of 40% in 6 months."

- "Our organizational system saves busy moms an average of 5 hours per week."

- "This mattress leads to a deeper sleep, so you feel 2x more energized in the morning."

Even if the value is emotional (e.g., peace of mind, confidence, status), you can describe that feeling in vivid detail.

Step 4: Create Tiers and Packages One of the best ways to implement value-based pricing is to stop selling one-off items and start selling packaged solutions. Create three tiers: a basic option, a mid-range option (your ideal choice for most), and a premium, all-inclusive option.

This strategy is brilliant for several reasons:

- It caters to different budgets.

- It clearly demonstrates the added value at each level.

- It uses a psychological trick called "price anchoring." By showing the high-priced premium option first, the mid-range option suddenly looks incredibly reasonable.

The Final Frontier: Testing, Communicating, and Adjusting

Pricing is not a one-and-done task. It’s a dynamic part of your business strategy that you should revisit regularly.

- Test Your Prices: You don’t have to change your prices for everyone overnight. Test a new, higher price with the next few new clients who come your way. See it as an experiment. You might be shocked to find that no one bats an eye.

- Communicate Price Increases with Confidence: When it’s time to raise prices for existing customers, be direct, honest, and focus on the value. Send an email a month or two in advance. Don’t apologize. Explain that the increase allows you to continue improving your service, investing in better materials, and ultimately, delivering even more value to them.

- Schedule an Annual Price Review: At least once a year, sit down and review your prices. Have your costs gone up? Have you added new skills or features to your offering? Has the market changed? Make adjustments as needed to ensure your pricing keeps pace with your business.

Your Price is a Statement of Your Value

Moving away from underpricing is a journey. It requires a shift in mindset—from seeing yourself as a cost that needs to be covered to seeing yourself as a valuable investment that delivers a return.

Your price tag is more than just a number. It’s a reflection of your confidence, your expertise, and the incredible value you bring to your customers. By understanding your numbers, choosing a strategy that centers on value, and having the courage to charge what you’re worth, you do more than just improve your cash flow. You build a resilient, profitable, and sustainable business that has the power to thrive for years to come.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm