The Ultimate Guide to Negotiating Vendor Contracts and Payment Terms: How to Negotiate Like a Big Company and Instantly Improve Cash Flow

As a small business owner, you wear a lot of hats. You're the CEO, the head of marketing, the chief salesperson, and often, the janitor. With so much on your plate, it's easy to overlook one of the most powerful tools you have for improving your bottom line: negotiation. Specifically, negotiating your vendor contracts and payment terms.

Many small business owners feel like they have to accept the terms a vendor offers them. They see a contract and think it's set in stone. But what if I told you that's not the case? What if I told you that with a little preparation and the right strategies, you could negotiate with your vendors like a big company and instantly improve your cash flow?

This isn't about bullying your vendors or squeezing every last penny out of them. It's about creating mutually beneficial partnerships that set your business up for long-term success. In this guide, we'll walk you through everything you need to know to become a master negotiator, from the initial preparation to the final handshake and beyond.

The Small Business Negotiation Mindset: Thinking Like a Big Company

Before we dive into the nitty-gritty of negotiation tactics, let's talk about mindset. The biggest difference between how small businesses and large corporations approach vendor negotiations often comes down to this:

- Big companies see negotiation as a standard part of the procurement process. They have entire departments dedicated to it. They know that the first offer is just a starting point.

- Small businesses often see negotiation as a confrontation. They worry about damaging relationships or appearing "cheap."

To negotiate like a big company, you need to adopt their mindset. This means:

- Shifting from a transactional to a partnership mindset. You're not just buying a product or service; you're entering into a business relationship. A good vendor wants you to succeed because your success means their success.

- Understanding the power of preparation and information. The more you know, the more confident you'll be, and the better your outcomes will be.

- Believing that everything is negotiable. From the price to the payment terms to the delivery schedule, there's always room for discussion.

Before the Negotiation: Your Preparation Playbook

Sun Tzu famously wrote, "Every battle is won before it is ever fought." The same is true for negotiations. The time you invest in preparation will pay dividends at the negotiating table. Here's your playbook:

Know Your Needs

Before you even think about talking to a vendor, you need to have a crystal-clear understanding of what you need. Ask yourself:

- What are my "must-haves"? What are the absolute non-negotiables for this product or service?

- What are my "nice-to-haves"? What are the things that would be great to have but aren't deal-breakers?

- What is my budget? What is the maximum I'm willing to spend?

- What are my ideal payment terms? How would I prefer to pay for this?

Do Your Homework

Information is your greatest asset in a negotiation. Before you engage with a vendor, you should:

- Research the vendor thoroughly. What is their reputation? What do their other customers say about them?

- Research their competitors. Who else offers this product or service? What are their prices and terms?

- Get multiple quotes. This is non-negotiable. Even if you have a preferred vendor, getting quotes from their competitors will give you leverage and a better understanding of the market rate.

Understand the Vendor's Perspective

A successful negotiation is a win-win. To get there, you need to understand what the other side wants. Consider:

- What are the vendor's goals? Are they trying to hit a quarterly sales target? Are they looking to break into a new market?

- What are their pressures? Are they facing stiff competition? Are they dealing with rising costs?

- What is their pricing structure? Do they have room to move on price? Or are their margins already razor-thin?

Assemble Your Team

You don't have to go into a negotiation alone. Depending on the size and complexity of the contract, you may want to involve:

- Your business partner or a key employee. They can offer a different perspective and help you stay focused.

- Your accountant or bookkeeper. They can help you understand the financial implications of different payment terms.

- Your lawyer. For any significant contract, it's always a good idea to have a lawyer review it.

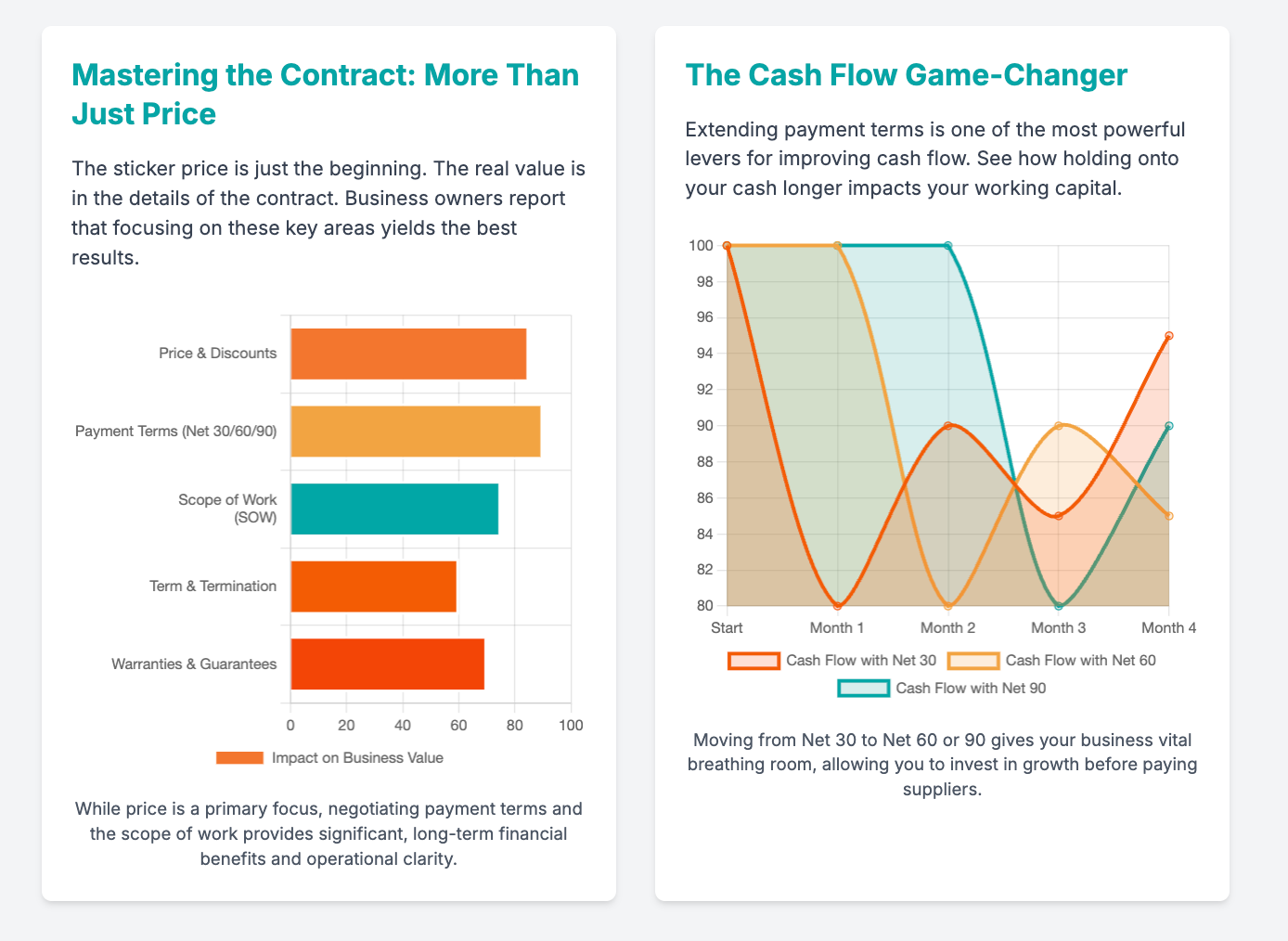

Mastering the Art of Contract Negotiation: More Than Just Price

While price is often the first thing that comes to mind when we think of negotiation, it's just one piece of the puzzle. A well-negotiated contract can save you money, reduce your risk, and set you up for a successful vendor relationship. Here are the key terms to focus on:

Key Contract Terms to Negotiate

- Price and Pricing Models: Don't just accept the sticker price. Can you get a discount for paying upfront? For signing a longer-term contract? For buying in bulk? Explore different pricing models, such as fixed, tiered, or volume-based pricing.

- Scope of Work (SOW): This is where you get incredibly specific about what the vendor will deliver. A vague SOW is a recipe for disaster. Make sure it includes detailed descriptions of all deliverables, timelines, and milestones.

- Service Level Agreements (SLAs): An SLA defines the level of service you can expect from the vendor. For example, if you're hiring an IT company, your SLA might specify a guaranteed uptime of 99.9%. It should also outline what happens if the vendor fails to meet the agreed-upon standards (e.g., a credit to your account).

- Warranties and Guarantees: What happens if the product is defective or the service is not up to par? A strong warranty or guarantee will protect your business from poor quality.

- Term and Termination: How long is the contract for? Can you terminate it early if you're not satisfied? A flexible termination clause can be a lifesaver if the relationship sours.

- Indemnification and Limitation of Liability: These are the legal clauses that determine who is responsible for what if something goes wrong. It's crucial to have a lawyer review these to ensure you're not taking on unnecessary risk.

- Intellectual Property: If the vendor is creating anything for you (e.g., a logo, a website, a piece of software), the contract should clearly state who owns the intellectual property.

Negotiation Tactics

- The First Offer Anchor: The person who makes the first offer often sets the "anchor" for the negotiation. If you've done your research, don't be afraid to make the first offer.

- The Power of Silence: After you've made an offer or asked a question, be quiet. People are often uncomfortable with silence and will rush to fill it, sometimes by making a concession.

- "If you can do X, I can do Y." This is a great way to frame a counter-offer. For example, "If you can give me a 10% discount, I can sign a two-year contract."

- Always Aim for a Win-Win: Remember, you're building a relationship. A good deal is a deal that both parties feel good about.

The Cash Flow Game-Changer: Negotiating Favorable Payment Terms

For a small business, cash flow is king. You can be profitable on paper but still go out of business if you don't have enough cash to pay your bills. This is where negotiating payment terms can be a game-changer.

Understanding Common Payment Terms

- Net 30, Net 60, Net 90: This means you have 30, 60, or 90 days to pay the invoice. The longer you can extend your payment terms, the better it is for your cash flow.

- 2/10 Net 30: This means you can take a 2% discount if you pay the invoice within 10 days; otherwise, the full amount is due in 30 days.

Strategies for Extending Your Payment Terms

- Be Upfront About Your Cash Flow Cycle: Explain to the vendor that you get paid by your clients on a certain schedule and that you'd like to align your payments to them with that schedule.

- Leverage Your Relationship and Order Volume: If you're a good, long-term customer, or if you're placing a large order, you have more leverage to ask for better terms.

- Offer a Longer-Term Contract in Exchange for Better Terms: A vendor may be willing to give you Net 60 or Net 90 terms if you commit to a longer contract.

Early Payment Discounts: A Win-Win?

An early payment discount can be a great way to save money, but it's not always the right move. You need to weigh the savings from the discount against the benefit of holding onto your cash for longer. If you're tight on cash, it's probably better to take the full 30 days to pay.

Milestone-Based Payments

For larger projects, consider negotiating milestone-based payments. This means you pay the vendor in installments as they complete certain parts of the project. This is a great way to reduce your risk and ensure that you're only paying for work that has been completed to your satisfaction.

Beyond the Handshake: Building Strong Vendor Relationships

The negotiation doesn't end when the contract is signed. In fact, that's just the beginning. The best vendor relationships are partnerships built on trust and communication.

- Vendor Management is an Ongoing Process: Don't just file the contract away and forget about it. Regularly review your vendor's performance to ensure they're meeting their obligations.

- Clear Communication and Regular Check-ins: Keep the lines of communication open. Let your vendors know what's going on with your business, and ask them about theirs.

- Performance Monitoring: Track the key performance indicators (KPIs) you agreed to in your SLA. If a vendor is underperforming, address it immediately.

- Turning Vendors into Partners: When you treat your vendors like partners, they'll be more invested in your success. They'll be more willing to go the extra mile for you and more flexible when you need a little help.

When Negotiations Get Tough: What to Do

Not every negotiation will be a walk in the park. Sometimes, you'll run into a vendor who is unwilling to budge. Here's what to do:

- Handle Pushback and Objections: Try to understand the root of the objection. Is it about money? Is it about risk? Once you understand their concern, you can try to find a creative solution that addresses it.

- Know When to Walk Away: If you can't get to a deal that works for you, don't be afraid to walk away. There are other vendors out there.

- The Importance of a "Plan B": This is why you get multiple quotes. Your "Plan B" is your best alternative to a negotiated agreement.

Final Thoughts

Negotiating vendor contracts and payment terms is not just a "big company" game. It's a skill that every small business owner can and should master. By adopting the right mindset, preparing thoroughly, and focusing on creating win-win partnerships, you can save your business thousands of dollars, significantly improve your cash flow, and build a network of vendors who are as invested in your success as you are.

So, what are you waiting for? Pick one vendor this week and start a conversation. You might be surprised at what you can achieve.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm