The Ticking Time Bomb in Your Business: Why Being Profitable Doesn't Mean You're Safe

Your business can be profitable and still go bankrupt. Here's why.

For a small business owner, the word "profitable" feels like reaching the summit. It’s the validation for every early morning, every late night, every risk taken. Your accountant gives you a thumbs-up, your income statement is glowing, and by all traditional metrics, you are winning. So why are you staring at your bank account, struggling to make payroll? Why does it feel like you’re one unexpected bill away from disaster?

This terrifying gap between being profitable and being broke is not just a fluke; it's a minefield that has claimed countless small businesses. It stems from the single most dangerous misunderstanding in business finance: the belief that profit is the same as cash.

It’s not. And failing to grasp this distinction is like trying to fly a plane by only looking at the altitude, while ignoring your fuel gauge. This article will serve as your guide to small business finance 101, demystifying the critical difference between cash flow vs profit. We will explore exactly how a business can be profitable but no cash, and most importantly, we’ll give you the tools to manage your working capital and ensure your business's success is not just on paper, but in the bank.

Profit is an Opinion, Cash is a Fact

The first step to financial security is understanding the fundamental difference between two key reports: your Income Statement (P&L) and your Cash Flow Statement.

Profit, as shown on your Income Statement, is an accounting calculation. It’s your total revenue minus your total expenses over a given period.

Profit = Revenue - Expenses

This is a crucial metric for measuring your business's efficiency, pricing strategy, and long-term viability. However, it’s based on accrual accounting, which means revenue is recorded when it's earned (e.g., when you send an invoice), not when you actually receive the money. Likewise, expenses are recorded when they're incurred (e.g., when you receive a bill), not when you pay it. This makes profit, to some extent, an informed opinion about your performance.

Cash Flow, on the other hand, is brutally factual. It is the literal movement of money into and out of your bank account. It’s the cash you have on hand to pay your suppliers, your employees, your rent, and yourself. It’s the lifeblood of your operation. A positive cash flow means more money came in than went out. A negative cash flow means you spent more cash than you brought in, regardless of what your profit statement says.

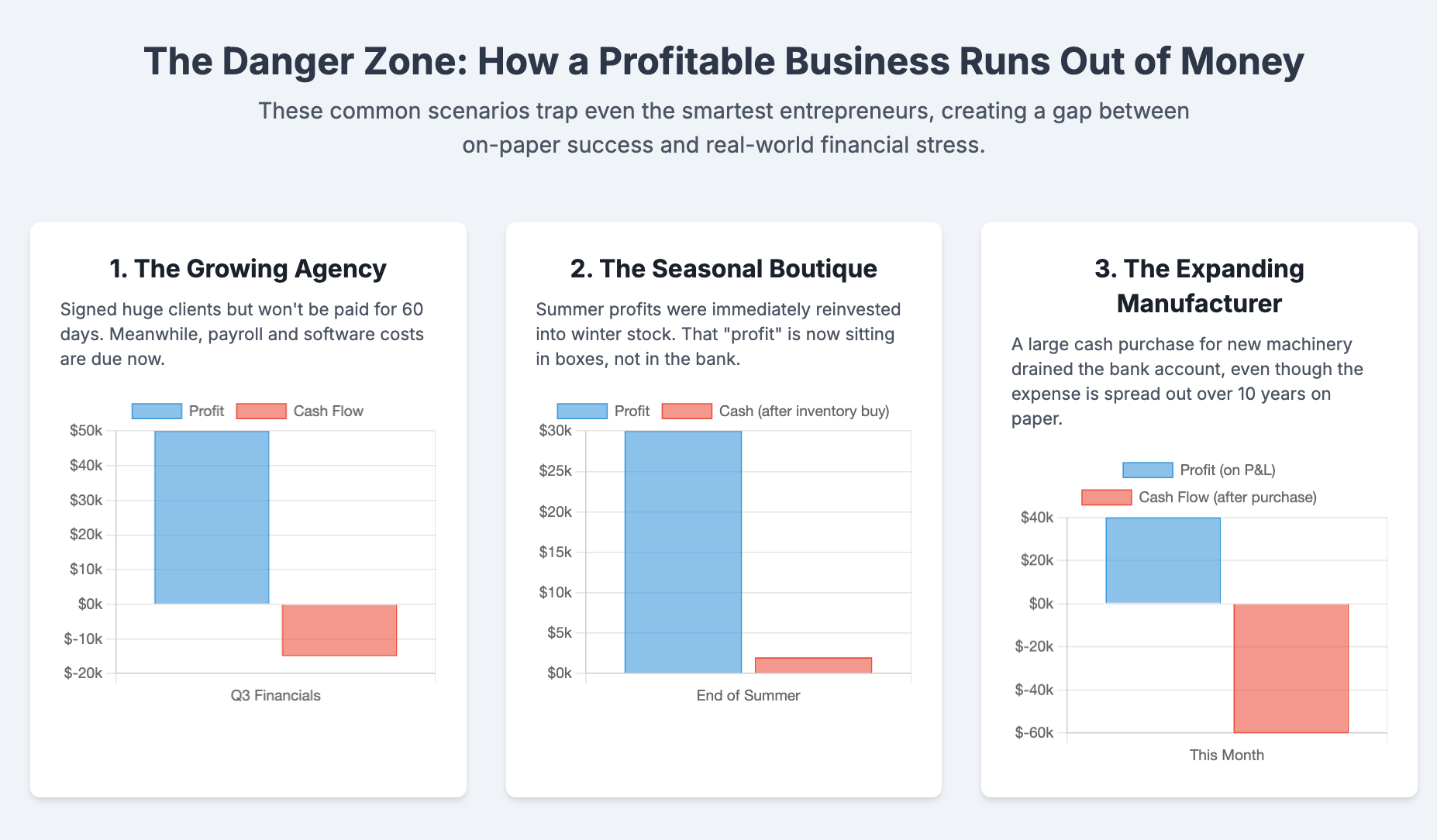

The Danger Zone: How a Profitable Business Runs Out of Money

Let's look at how this plays out in the real world. These aren't just hypotheticals; they are common scenarios that trap even the smartest entrepreneurs.

Case Study 1: The Growing Marketing Agency

Meet Alex, who runs a small digital marketing agency. Q3 was a record-breaker. He signed three major new clients, and his P&L shows a handsome $50,000 profit for the quarter. He’s officially a success. But Alex is panicking. To service these new clients, he had to hire two new specialists and invest in expensive software licenses, paying for these costs upfront. The problem? His new clients are on a "Net 60" payment term, meaning he won't see a dime from them for two months. His P&L says he's profitable, but his bank account is bleeding cash. He has profit, but no money to make next month's payroll.

Case Study 2: The Seasonal Retail Boutique

Chloe owns a trendy clothing boutique. Her summer collection was a massive hit, and she posted a significant profit. Excited by her success, she took that "profit" and invested heavily in her fall and winter inventory, hoping to replicate her success. She bought the inventory in August, but her peak selling season won't start until October. In the meantime, her rent is due, her utility bills are piling up, and a slow September has drained her cash reserves. Her profit is sitting on her shelves in the form of boxes of sweaters and coats. She’s asset-rich, but cash-poor.

Case Study 3: The Expanding Manufacturer

Ben's manufacturing business is profitable, consistently showing a healthy bottom line. To increase efficiency, he just purchased a new piece of machinery for $100,000, paying for it with cash he had saved. For accounting purposes, this machine will be depreciated over 10 years, so his P&L only shows a $10,000 expense for the year. However, the full $100,000 in cash is gone from his bank account. That same month, a large loan payment was due. Despite his business being fundamentally profitable, these two large cash outflows in a single month have created a massive cash crunch.

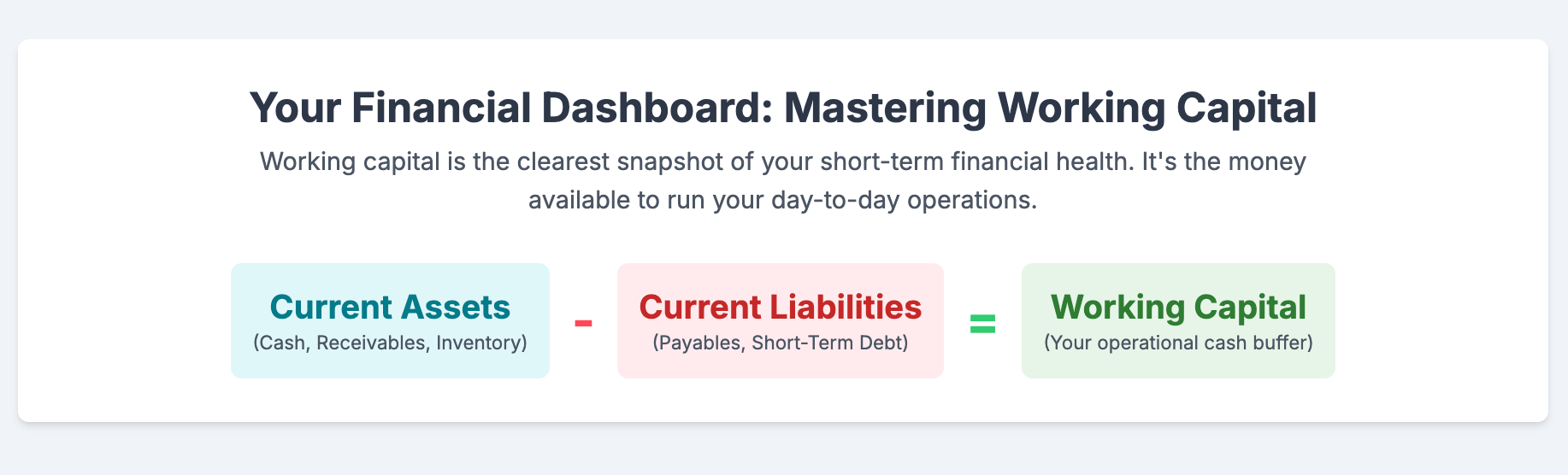

Your Financial Dashboard: Mastering Working Capital

So, how do you avoid these scenarios? You need to shift your focus from solely looking at profit to actively managing your working capital.

Working capital is the clearest indicator of your company's short-term financial health and operational efficiency.

Working Capital = Current Assets - Current Liabilities

- Current Assets: These are assets that can be converted into cash within a year. This includes cash itself, accounts receivable (money owed to you), and inventory.

- Current Liabilities: These are your obligations due within a year. This includes accounts payable (money you owe to suppliers) and short-term loan payments.

A positive working capital means you have more than enough liquid assets to cover your upcoming bills. A negative working capital is a flashing red light that you may not be able to meet your short-term obligations.

To get an even clearer picture, you can look at two simple ratios:

- Current Ratio: Current Assets / Current Liabilities. This shows you how many dollars of current assets you have for every dollar of current liabilities. A ratio between 1.5 and 2 is generally considered healthy.

- Quick Ratio (or Acid-Test Ratio): (Current Assets - Inventory) / Current Liabilities. This is a more conservative measure because it removes inventory (which isn't always easy to turn into cash quickly). It tells you if you can pay your bills without relying on selling any stock. A ratio of 1 or higher is a good sign.

From Surviving to Thriving: Your Cash Flow Action Plan

Understanding these concepts is the first step. Taking action is what will protect your business. Here’s a practical plan to take control of your cash flow.

1. Shorten Your Cash Conversion Cycle

This cycle is the time it takes for a dollar you spend (on inventory or payroll) to make its way back into your bank account as cash from a customer. The shorter, the better.

- Shrink Your Days Sales Outstanding (DSO): This is how fast you get paid.

- Invoice immediately and accurately. Don't wait until the end of the month.

- Offer a small discount (e.g., 2%) for payments within 10 days.

- Make it easy to pay you. Accept online payments, credit cards, and ACH transfers.

- Have a firm but professional follow-up process for overdue invoices.

- Reduce Your Days Inventory Outstanding (DIO): This is how fast you sell your inventory.

- Use inventory management software to avoid overstocking.

- Analyze sales data to understand what moves quickly and what doesn't.

- Run sales or promotions to clear out slow-moving or old inventory to convert it back to cash.

- Optimize Your Days Payable Outstanding (DPO): This is how fast you pay your bills.

- Negotiate for the best possible payment terms with your suppliers (e.g., Net 45 or Net 60 instead of Net 30).

- Important: This doesn't mean paying late. Always pay your bills on time to maintain good relationships. It simply means using the full payment term to your advantage, holding onto your cash as long as ethically possible.

2. Build a Cash Buffer

Every business needs a "sleep-at-night" fund. This is a cash reserve set aside for emergencies, unexpected opportunities, or slow periods. Aim to have 3 to 6 months of essential operating expenses in a separate, easily accessible savings account. This buffer is your ultimate protection against cash flow shocks.

3. Forecast, Forecast, Forecast

The single most powerful tool for managing cash flow is a 13-week cash flow forecast. This is a simple spreadsheet where you project your cash inflows and outflows on a weekly basis for the next quarter. It doesn't need to be complicated.

- Week 1: Starting Cash Balance

- Add: Expected Cash In (payments from clients, etc.)

- Subtract: Expected Cash Out (payroll, rent, supplier payments, taxes)

- Result: Ending Cash Balance (which becomes next week's starting balance)

This forward-looking view allows you to spot potential cash shortfalls weeks or months in advance, giving you plenty of time to arrange a line of credit, step up collections, or delay a non-essential purchase.

The Bottom Line: Cash Flow is the Journey

Profit is the destination. It’s the reward for building a successful, sustainable business model. But cash flow is the journey. It's the fuel, the air, and the momentum that gets you there. Without it, the most profitable business in the world is just a stalled engine on the side of the road.

Stop looking only at your profit statement. Embrace a cash-centric mindset. Build your forecast, manage your working capital, and build your cash reserve. By taking control of your cash flow, you are taking true control of your business's destiny. You now understand why a profitable business can go bankrupt, which means you have the power to ensure yours never will.Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a Small Business Top Advisory Firm