The Small Business Owner's Complete Guide to Financial Mastery

Your roadmap to understanding your numbers, growing your business, and sleeping better at night

Introduction: Why Your Numbers Matter More Than You Think

Let's be honest – you didn't start your business to become an accountant. You had a passion, a skill, or a product that you knew could make a difference. But here's the hard truth: even the most brilliant business idea can fail without proper financial management.

Think of financial planning as the GPS for your business. Without it, you're driving blindfolded, hoping you'll somehow arrive at your destination. With it, you can see exactly where you are, where you're going, and what obstacles might be ahead.

This guide will teach you everything you need to know about managing your business finances – without the jargon, without the complexity, and definitely without boring you to tears. By the end, you'll have the confidence to make informed decisions that will help your business not just survive, but thrive.

Chapter 1: Financial Planning & Analysis (FP&A) – Your Business X-Ray Vision

What is FP&A and Why Should You Care?

Financial Planning & Analysis is like having X-ray vision for your business. It's the process of looking at your financial data to understand what's really happening behind the scenes and making informed decisions about the future.

Think of it this way: If your business were a patient, FP&A would be the complete health checkup that tells you not just how you're feeling today, but what you need to do to stay healthy tomorrow.

The Three Pillars of FP&A

1. Looking Back (Historical Analysis)

- What happened in your business over the past months/years?

- Which products or services made the most money?

- When do you typically see seasonal dips or spikes?

2. Looking Around (Current Performance)

- How are you performing right now compared to your goals?

- Where is your money actually going?

- What's working and what isn't?

3. Looking Forward (Future Planning)

- What do you expect to happen next month, next quarter, next year?

- How will different decisions impact your bottom line?

- What resources will you need to achieve your goals?

Getting Started with FP&A: The 5-Minute Daily Check

Don't overcomplicate this. Start with a simple daily habit:

Every morning, ask yourself these three questions:

- How much money do I have in the bank today?

- How much money do I expect to come in this week?

- How much money do I need to spend this week?

Write these numbers down. After just 30 days, you'll start seeing patterns that will blow your mind.

Common FP&A Mistakes to Avoid

❌ The "Shoebox Accountant" Mistake Throwing receipts in a shoebox and dealing with them later. This makes it impossible to understand your business in real-time.

✅ Better Approach: Spend 10 minutes every evening categorizing your expenses. Use simple categories like "Marketing," "Materials," "Rent," etc.

❌ The "Revenue Tunnel Vision" Mistake Only focusing on how much money is coming in, ignoring where it's going.

✅ Better Approach: Track both income AND expenses daily. Profit = Revenue - Expenses. Both sides of this equation matter equally.

❌ The "Perfect System" Mistake Waiting until you have the perfect software or system before you start tracking anything.

✅ Better Approach: Start with a simple spreadsheet today. You can always upgrade later.

Chapter 2: Budgeting That Actually Works

Forget Everything You Know About Personal Budgeting

Business budgeting is NOT like personal budgeting. Personal budgets are about restriction – "Don't spend more than X on groceries." Business budgets are about allocation – "We're investing X in marketing because we expect it to generate Y in return."

Your business budget should answer this question: "If I spend money on X, what return can I expect, and when will I see it?"

The Three Types of Business Budgets You Need

1. Operating Budget (Your Monthly Survival Guide) This covers your day-to-day expenses – rent, salaries, utilities, supplies. Think of this as your "keeping the lights on" budget.

2. Capital Budget (Your Growth Investment Plan) This covers big purchases or investments – equipment, technology, major marketing campaigns. These are investments that should pay off over time.

3. Cash Flow Budget (Your Timing Master Plan) This shows when money comes in and goes out. You might be profitable on paper but still run out of cash if timing is off.

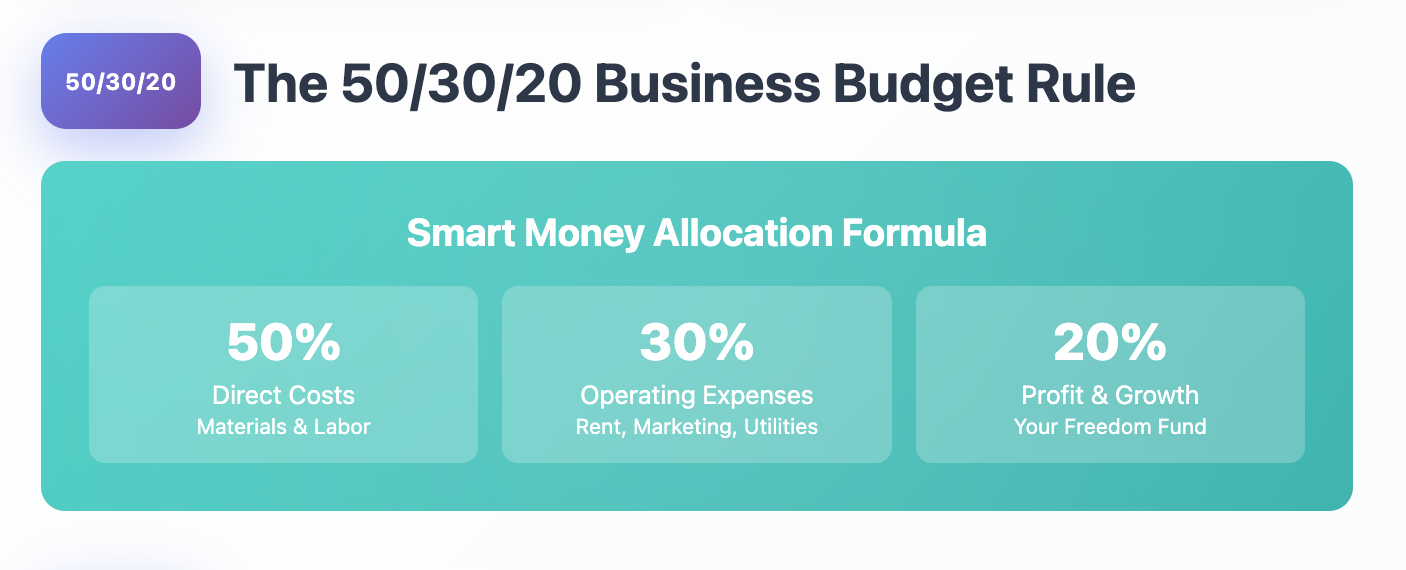

Building Your First Operating Budget: The 50/30/20 Rule for Business

Here's a simple starting framework:

- 50% of revenue: Direct costs (materials, labor directly tied to sales)

- 30% of revenue: Operating expenses (rent, marketing, utilities, insurance)

- 20% of revenue: Profit and growth fund

Example: If you make $10,000/month:

- $5,000 goes to direct costs

- $3,000 goes to operating expenses

- $2,000 goes to profit/growth

Note: These percentages will vary by industry, but this gives you a starting point

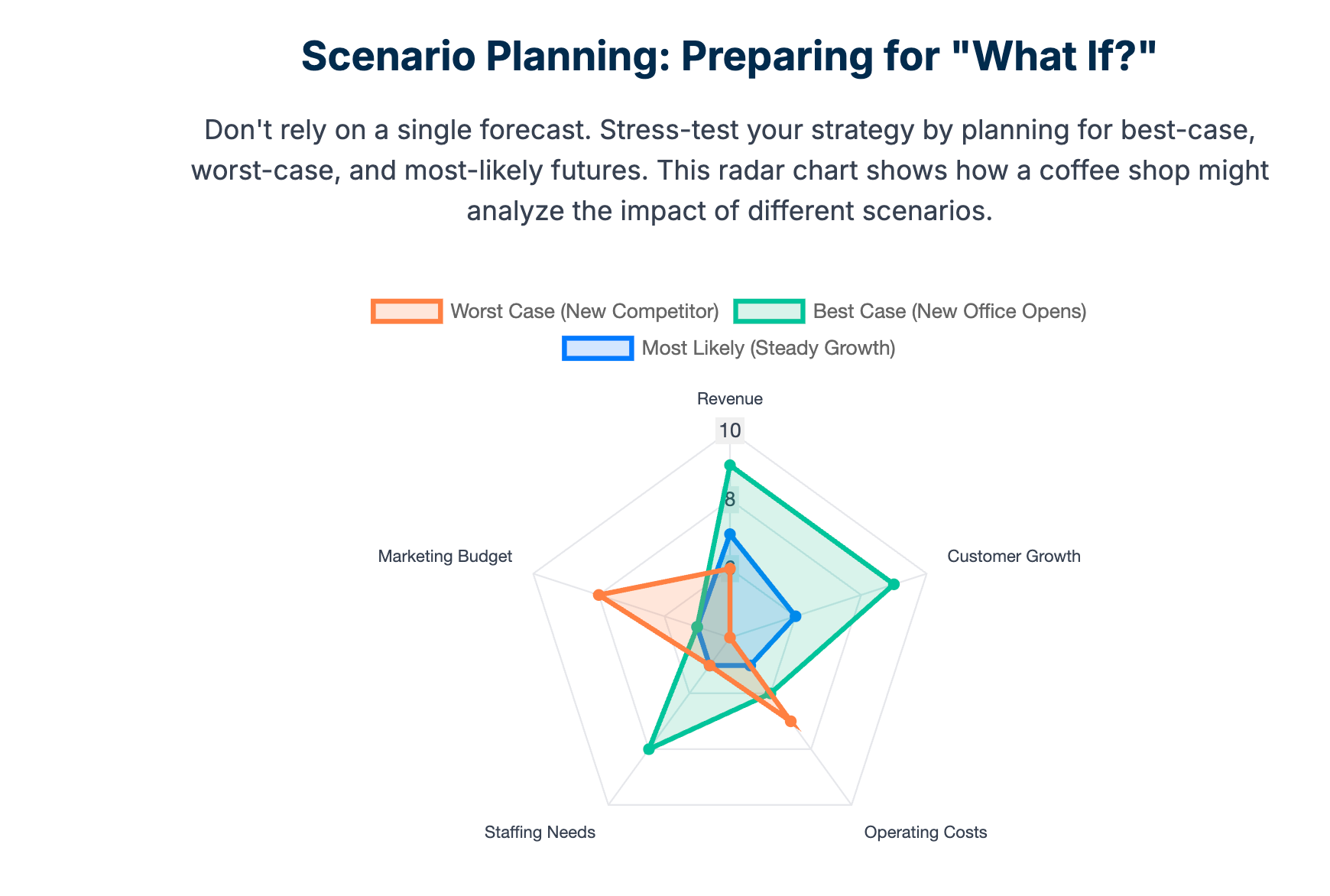

The "What If" Budget Planning Method

Instead of creating one budget, create three:

1. Conservative Budget (90% confidence) What numbers are you 90% sure you can hit, even if everything goes slightly wrong?

2. Realistic Budget (70% confidence) What do you genuinely expect to happen based on current trends?

3. Optimistic Budget (30% confidence) What could happen if several things go better than expected?

This approach helps you plan for multiple scenarios instead of betting everything on one outcome.

Budgeting Mistakes That Kill Small Businesses

❌ The "Set It and Forget It" Mistake Creating a budget in January and never looking at it again.

✅ Better Approach: Review your budget monthly and adjust as needed. Your budget is a living document, not a stone tablet.

❌ The "Perfection Paralysis" Mistake Spending weeks creating a complex budget that's too complicated to actually use.

✅ Better Approach: Start simple. A basic budget you actually use is infinitely better than a perfect budget that sits in a drawer.

❌ The "Feast Mode Planning" Mistake Budgeting based on your best month ever, assuming it will continue forever.

✅ Better Approach: Base your budget on your average performance over the last 6-12 months, not your best month.

Chapter 3: Forecasting – Your Crystal Ball (That Actually Works)

What is Forecasting?

Forecasting is making educated guesses about your future financial performance based on historical data, current trends, and planned changes to your business.

It's NOT about predicting the future perfectly. It's about being prepared for the most likely scenarios so you can make better decisions today.

The Simple 3-Step Forecasting Method

Step 1: Start with Last Year Look at your monthly revenue and expenses from the past 12 months. This is your baseline.

Step 2: Adjust for Known Changes

- Are you launching a new product next quarter?

- Are you hiring new staff?

- Are you moving to a more expensive office?

- Do you have seasonal patterns?

Step 3: Apply the Reality Check Ask yourself: "Based on what I know today, what's most likely to happen?" Adjust your numbers accordingly.

The Rolling 13-Week Forecast

This is the most practical forecasting tool for small businesses:

How it works:

- Every week, forecast the next 13 weeks

- Update your forecast based on what actually happened

- Always have a 13-week view of your expected cash position

Why 13 weeks?

- Long enough to spot trends and plan ahead

- Short enough to be reasonably accurate

- Covers a full business quarter

Example Layout:

Week 1: Starting Cash + Expected In - Expected Out = Ending Cash

Week 2: Previous Ending Cash + Expected In - Expected Out = Ending Cash

... and so on for 13 weeksLeading vs. Lagging Indicators

Lagging Indicators tell you what already happened:

- Last month's revenue

- Quarterly profit

- Annual growth rate

Leading Indicators give you clues about what's coming:

- Website traffic

- Sales calls booked

- Proposals sent

- Social media engagement

- Customer inquiries

Pro Tip: Track 3-5 leading indicators that typically predict your sales. For example, if you usually close 20% of proposals, and you sent 10 proposals this week, you can forecast 2 new customers.

Forecasting Mistakes That Sink Ships

❌ The "Linear Growth" Mistake Assuming steady growth every month (real businesses have ups and downs).

✅ Better Approach: Build in seasonality and natural fluctuations based on your historical data.

❌ The "Best Case Only" Mistake Only planning for everything to go perfectly.

✅ Better Approach: Create three forecasts – conservative, realistic, and optimistic. Plan for the conservative case.

❌ The "Forget the Details" Mistake Forecasting total revenue without thinking about the underlying drivers.

✅ Better Approach: Break down your forecast by customer type, product line, or sales channel to make it more accurate.

Chapter 4: Scenario Planning – Your Strategic Superpower

What is Scenario Planning?

Scenario planning is asking "What if?" and actually working through the numbers. It's like having multiple game plans ready depending on how the game unfolds.

Think of it like this: A football coach doesn't just plan for perfect weather and a healthy team. They have different plays for rain, injured players, and different opponents. Your business needs the same approach.

The Big 3 Scenarios Every Business Should Plan For

Scenario 1: The Growth Explosion What if sales increased by 50% over the next 6 months?

- Could you handle the increased demand?

- Would you need more staff, equipment, or inventory?

- How would your cash flow change?

- What would be your biggest bottleneck?

Scenario 2: The Economic Downturn What if sales dropped by 30% for 6 months?

- Which expenses could you cut immediately?

- How long could you survive?

- Which customers are most likely to stick with you?

- What's your minimum viable operation?

Scenario 3: The Key Person Problem What if you (or your most important employee) couldn't work for 3 months?

- Who would handle your most critical tasks?

- How would operations change?

- What knowledge needs to be documented?

- How would revenue be affected?

The Scenario Planning Worksheet

For each scenario, work through these questions:

Revenue Impact:

- How would total revenue change?

- Which products/services would be most affected?

- How long would the impact last?

Cost Impact:

- Which costs would increase/decrease?

- Which expenses are truly fixed vs. variable?

- What new costs might emerge?

Cash Flow Impact:

- How would the timing of money in/out change?

- Would you need additional financing?

- What's your cash runway in this scenario?

Action Plan:

- What would you do in the first 30 days?

- What would you do if the scenario lasted 6 months?

- What early warning signs would tell you this scenario is happening?

Real-World Scenario Planning Example

Sarah's Bakery: Let's say Sarah runs a small bakery that makes $15,000/month with $12,000 in expenses.

Growth Scenario: A local food blogger features her bakery, and orders triple.

- Revenue jumps to $45,000/month

- She needs 2 part-time bakers ($3,000/month)

- Additional ingredients and supplies ($18,000/month)

- New scenario: $45,000 revenue - $33,000 expenses = $12,000 profit

- Action needed: Find and train staff BEFORE the rush hits

Downturn Scenario: Economic recession cuts orders in half.

- Revenue drops to $7,500/month

- She reduces hours and works alone (saves $2,000 in wages)

- Negotiates lower rent ($1,000 savings)

- New scenario: $7,500 revenue - $9,000 expenses = -$1,500/month

- Action needed: Find additional revenue streams or further cost cuts

Scenario Planning Mistakes to Avoid

❌ The "It Won't Happen to Me" Mistake Only planning for positive scenarios.

✅ Better Approach: Spend equal time planning for challenges as opportunities.

❌ The "Analysis Paralysis" Mistake Creating 20 different scenarios and getting overwhelmed.

✅ Better Approach: Start with 3 scenarios. Master those before adding more complexity.

❌ The "Plan and Forget" Mistake Creating scenarios but never updating your action plans.

✅ Better Approach: Review scenarios quarterly and adjust based on new information.

Chapter 5: Cash Flow Management – The Oxygen of Your Business

Why Cash Flow Matters More Than Profit

Here's a truth that might shock you: More profitable businesses fail due to cash flow problems than unprofitable ones.

Why? Because profit is an accounting concept, but cash flow is reality. You can't pay your rent with profit that's tied up in unpaid invoices or inventory.

The Golden Rule: Cash flow is the oxygen of your business. Without it, even the most profitable business will die.

Understanding the Cash Flow Cycle

Every business has a cash flow cycle:

1. Cash Out First: You spend money on materials, labor, rent, etc. 2. Create Value: You turn those inputs into products or services 3. Make Sales: You deliver value to customers 4. Wait for Payment: Customers take time to pay you 5. Cash In Finally: Money hits your bank account

The challenge: Steps 1-4 can take weeks or months, but your bills don't wait.

The 4 Types of Cash Flow

1. Operating Cash Flow Money from your core business operations (sales minus operating expenses).

2. Investment Cash Flow

Money spent on or received from investments (equipment, property, etc.).

3. Financing Cash Flow Money from loans, investors, or returns to owners.

4. Free Cash Flow What's left after all necessary expenses and investments. This is your "freedom money."

The Weekly Cash Flow Ritual

Every Monday morning, create a simple cash flow statement for the week:

Starting Cash Balance: $X

Expected Money In This Week:

- Customer payments: $X

- Other income: $X

- Total In: $X

Expected Money Out This Week:

- Payroll: $X

- Rent/utilities: $X

- Supplies: $X

- Other expenses: $X

- Total Out: $X

Projected Ending Balance: Starting + In - Out = $XIf your projected ending balance is negative, you have 7 days to fix it.

Cash Flow Management Strategies

Strategy 1: Speed Up Cash Coming In

- Offer early payment discounts (2% if paid within 10 days)

- Require deposits for large orders

- Switch to weekly or monthly billing instead of quarterly

- Accept credit cards (yes, even with fees)

- Follow up on overdue invoices immediately

Strategy 2: Slow Down Cash Going Out (Without Damaging Relationships)

- Negotiate better payment terms with suppliers

- Take advantage of early payment discounts only when cash is abundant

- Time large purchases strategically

- Spread annual payments into monthly ones when possible

Strategy 3: Build Cash Reserves

- Aim for 3-6 months of operating expenses in the bank

- Set aside a percentage of every payment received

- Create a separate "tax and emergency" account

Strategy 4: Create Multiple Revenue Streams

- Develop products/services with different payment cycles

- Mix project-based and recurring revenue

- Consider offering financing to customers

Cash Flow Mistakes That Kill Businesses

❌ The "Profit Equals Cash" Mistake Assuming that because you're profitable, you have plenty of cash.

✅ Better Approach: Track cash and profit separately. Profitable months can still have negative cash flow.

❌ The "Payment Terms Generosity" Mistake Offering 60-90 day payment terms to win business.

✅ Better Approach: Shorter payment terms are better for cash flow. Offer discounts for early payment instead.

❌ The "Seasonal Amnesia" Mistake Forgetting about seasonal cash flow patterns and getting caught off-guard every year.

✅ Better Approach: Map out your seasonal patterns and build cash reserves during good months to cover slow periods.

❌ The "Growth at Any Cost" Mistake Accepting every order without considering cash flow impact.

✅ Better Approach: Sometimes you need to say no to opportunities that would strain your cash flow beyond breaking point.

Chapter 6: Calculating Your Cash Flow Runway

What is Cash Flow Runway?

Your cash flow runway is how long your business can survive if no new money comes in. It's your business's life expectancy based on current cash reserves and burn rate.

Think of it like this: If your business were an airplane, runway is how long you can stay in the air before you need to land (get more revenue) or crash.

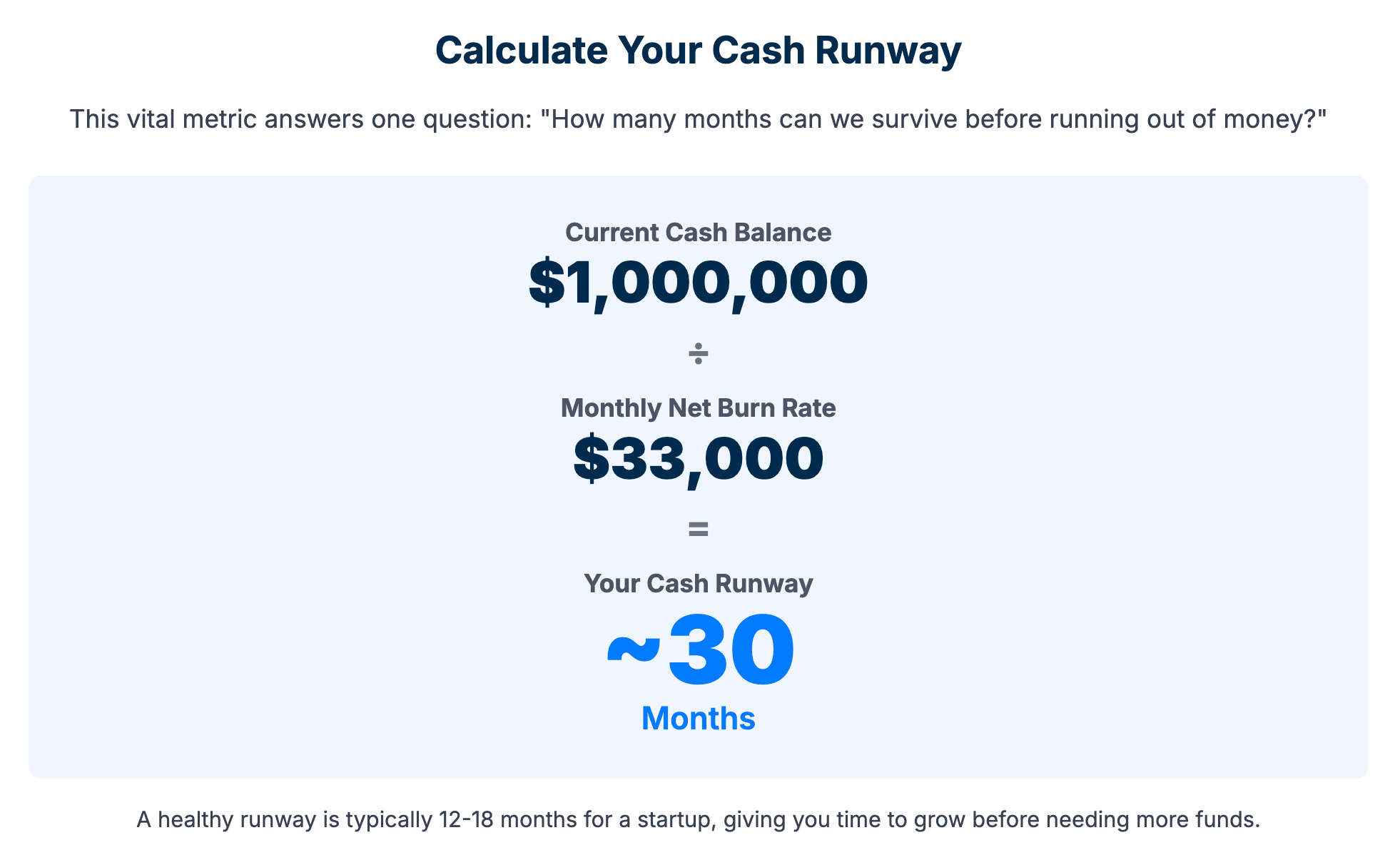

The Simple Runway Calculation

Basic Formula: Runway = Current Cash ÷ Monthly Burn Rate

Where:

- Current Cash = Money in your bank accounts

- Monthly Burn Rate = How much cash you spend each month minus how much comes in

Example:

- Current Cash: $50,000

- Monthly expenses: $15,000

- Monthly revenue: $12,000

- Monthly Burn Rate: $15,000 - $12,000 = $3,000

- Runway: $50,000 ÷ $3,000 = 16.7 months

The More Accurate Runway Calculation

The basic calculation assumes everything stays exactly the same. Real life is messier.

Enhanced Formula: Consider these factors:

1. Seasonal Variations If you're calculating runway in December but January is always slow, adjust for that.

2. Known Changes

- Are you hiring someone next month?

- Do you have a large expense coming up?

- Are you launching a marketing campaign?

3. Receivables Money owed to you should be added to current cash (discounted for probability of collection).

Example Enhanced Calculation:

Current Cash: $50,000

Accounts Receivable (90% collectible): $15,000 × 0.9 = $13,500

Adjusted Cash: $63,500

Month 1 Burn: $3,000

Month 2 Burn: $5,000 (hiring new person)

Month 3-6 Burn: $4,000/month (new person working)

Average Monthly Burn: $3,750

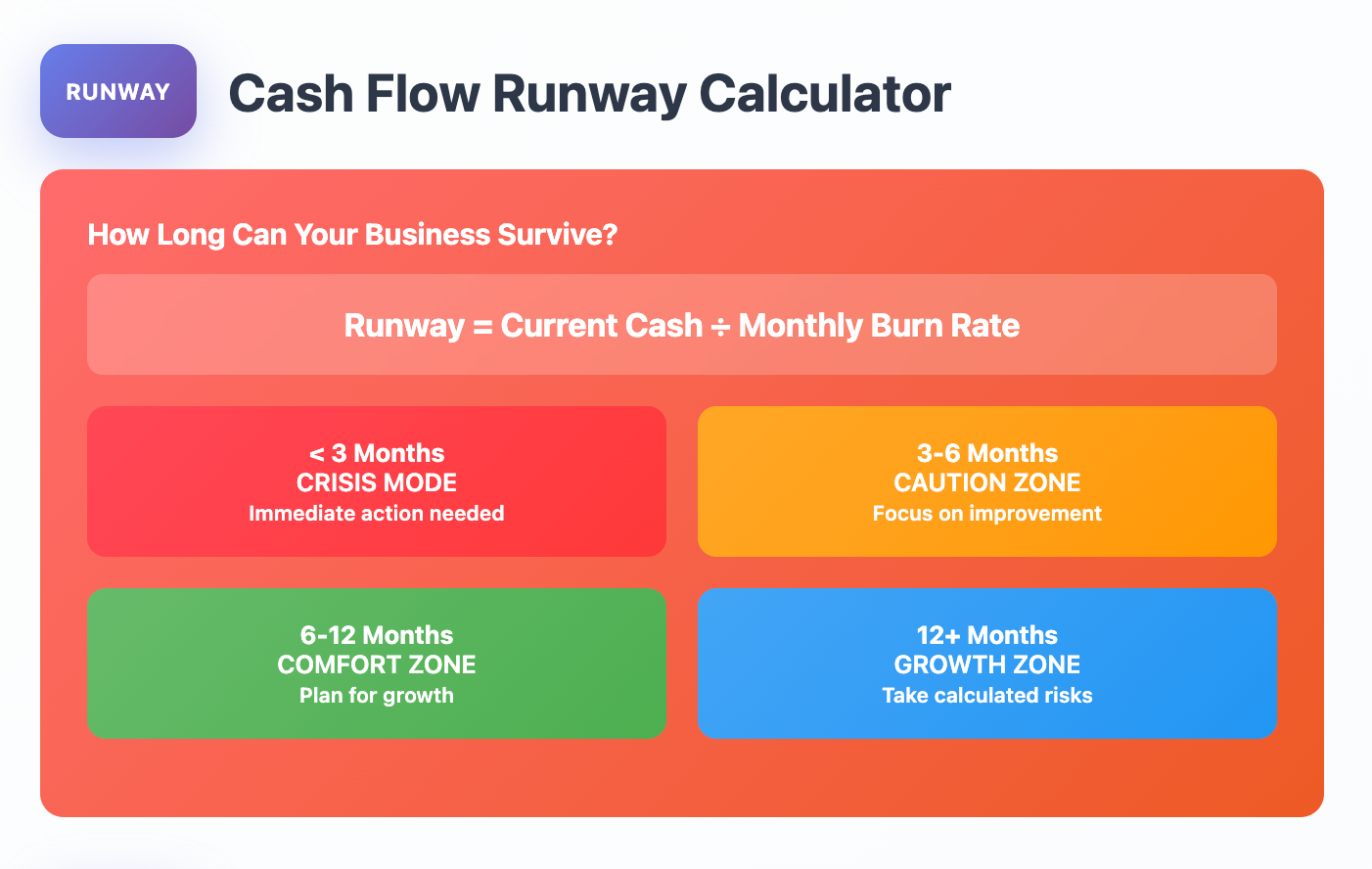

Adjusted Runway: $63,500 ÷ $3,750 = 16.9 monthsRunway Scenarios: The Good, The Bad, and The Ugly

The Danger Zone: Less than 3 months

- Status: Crisis mode

- Action needed: Immediate drastic action

- Options: Cut all non-essential expenses, get bridge financing, or find emergency revenue

The Caution Zone: 3-6 months

- Status: Concerning but manageable

- Action needed: Focused improvement efforts

- Options: Accelerate sales efforts, reduce expenses, secure additional funding

The Comfort Zone: 6-12 months

- Status: Stable but should improve

- Action needed: Strategic growth planning

- Options: Invest in growth initiatives, build larger cash reserves

The Growth Zone: 12+ months

- Status: Strong position

- Action needed: Strategic expansion

- Options: Take calculated risks, invest in new opportunities, build competitive advantages

How to Extend Your Runway

Option 1: Increase Revenue (Faster Impact)

- Launch a quick-win marketing campaign

- Offer existing customers additional services

- Raise prices on new customers

- Collect overdue receivables aggressively

Option 2: Decrease Expenses (Immediate Impact)

- Cut non-essential subscriptions and services

- Negotiate better terms with suppliers

- Reduce discretionary spending

- Consider temporary salary cuts (including your own)

Option 3: Raise Additional Capital

- Small business loan

- Line of credit

- Equipment financing

- Investor funding

- Friends and family funding

Option 4: Change Business Model

- Shift from project-based to recurring revenue

- Require deposits or payment upfront

- Offer financing to customers

- Create passive income streams

Runway Monitoring System

Weekly Check: Update your runway calculation every week. This becomes a vital sign for your business.

Monthly Deep Dive: Once a month, recalculate your runway considering:

- Updated revenue forecasts

- Planned expenses

- Seasonal adjustments

- New opportunities or threats

Quarterly Strategic Review: Every quarter, ask:

- What's our target runway length?

- What strategies can extend our runway?

- Are we taking appropriate risks given our runway?

Common Runway Calculation Mistakes

❌ The "Best Case Only" Mistake Calculating runway assuming everything goes perfectly.

✅ Better Approach: Use conservative assumptions. Better to be pleasantly surprised than caught off-guard.

❌ The "Static Calculation" Mistake Calculating runway once and never updating it.

✅ Better Approach: Update weekly. Your runway changes as your business changes.

❌ The "Ignore Receivables" Mistake Not including money owed to you in runway calculations.

✅ Better Approach: Include receivables but discount for collection probability and timing.

❌ The "Forget Seasonality" Mistake Using average monthly burn rate without considering seasonal variations.

✅ Better Approach: Model out each month individually if you have significant seasonal patterns.

Chapter 7: Putting It All Together – Your Financial Management System

The 30-Day Financial Management Habit

Week 1: Set Up Your Foundation

- Choose your tracking method (spreadsheet or software)

- Set up basic categories for income and expenses

- Start daily cash position tracking

- Begin weekly cash flow forecasting

Week 2: Build Your Budget

- Create your first operating budget using the 50/30/20 rule

- Set up your three scenario budgets (conservative, realistic, optimistic)

- Establish your weekly budget review routine

Week 3: Start Forecasting

- Create your first 13-week rolling forecast

- Identify your leading indicators

- Set up monthly forecast review and update process

Week 4: Plan Your Scenarios

- Develop your three key scenarios (growth, downturn, key person)

- Calculate your current cash flow runway

- Create action plans for each scenario

Your Monthly Financial Dashboard

Track these key metrics every month:

Cash Flow Metrics:

- Current cash position

- Monthly burn rate

- Cash flow runway

- Accounts receivable aging

Performance Metrics:

- Revenue vs. budget

- Expense vs. budget

- Profit margin

- Customer acquisition cost

Growth Metrics:

- Revenue growth rate

- Customer growth rate

- Average order value

- Leading indicator performance

Warning Signs to Watch For

Immediate Danger Signals:

- Runway less than 3 months

- Missing payroll or supplier payments

- Borrowing to pay operating expenses

- Declining cash position for 3+ consecutive months

Yellow Flag Warnings:

- Revenue declining 2+ months in a row

- Expenses growing faster than revenue

- Customer payment times increasing

- Leading indicators trending down

Building Your Support Network

Professional Help You May Need:

- Bookkeeper: Monthly transaction recording and reconciliation

- Accountant: Tax planning and compliance

- Fractional CFO: Strategic financial planning and analysis

- Business Coach: Overall strategy and accountability

When to Get Help:

- When you're spending more than 5 hours/week on financial tasks

- When your business reaches $500K+ in annual revenue

- When you're planning major growth or changes

- When financial stress is affecting your sleep or relationships

Creating Your Financial Action Plan

Step 1: Assess Your Current Situation

- Complete a full cash flow analysis

- Calculate your runway

- Identify your biggest financial challenges

Step 2: Set Your Financial Goals

- Target runway length

- Revenue growth goals

- Profit margin targets

- Cash reserve objectives

Step 3: Create Your 90-Day Plan Choose 3 financial improvements to focus on over the next 90 days:

- One cash flow improvement

- One expense reduction

- One revenue enhancement

Step 4: Set Up Your Systems

- Daily cash tracking

- Weekly cash flow forecasting

- Monthly performance review

- Quarterly strategic planning

Chapter 8: Advanced Tips and Strategies

Cash Flow Optimization Hacks

The Invoice Timing Strategy If you bill monthly, don't send all invoices on the 1st. Spread them throughout the month to create more consistent cash flow.

The Progress Payment Method For larger projects, break payments into milestones: 25% upfront, 25% at 25% completion, 25% at 75% completion, 25% at completion.

The Subscription Model Shift Where possible, shift from one-time payments to recurring subscriptions. Even small recurring revenue dramatically improves cash flow predictability.

Tax Planning for Cash Flow

Quarterly Tax Savings Strategy Set aside 25-30% of profit monthly in a separate tax account. This prevents year-end tax surprises that can crush cash flow.

Equipment Purchase Timing Plan major equipment purchases for maximum tax benefit while maintaining cash flow health.

Expense Timing Optimization Sometimes it makes sense to accelerate or delay expenses based on tax implications and cash flow needs.

Building Relationships with Banks and Lenders

Before You Need Money:

- Establish relationships with 2-3 local banks

- Maintain clean, organized financial records

- Set up a business line of credit while cash flow is strong

- Meet with bankers annually to update them on your business

The Banker's Perspective: Bankers want to see:

- Consistent cash flow

- Strong management

- Clear business plan

- Appropriate use of funds

- Ability to repay

Crisis Management Strategies

If Cash Flow Turns Negative:

Week 1: Immediate Actions

- List all upcoming expenses in order of priority

- Contact key suppliers to negotiate payment terms

- Accelerate collection of receivables

- Cut all non-essential expenses immediately

Week 2-4: Short-term Fixes

- Implement emergency pricing increases

- Launch quick-revenue initiatives

- Consider factoring receivables

- Explore emergency funding options

Month 2-3: Structural Changes

- Restructure operations for profitability

- Renegotiate contracts and leases

- Consider strategic partnerships

- Evaluate business model changes

Growth Management

The Growth Cash Crunch Fast growth often creates cash flow problems because:

- You need cash to fulfill orders before customers pay

- Working capital requirements increase

- Fixed costs may need to increase to handle volume

Growth Funding Strategies:

- Line of credit for working capital

- Equipment financing for necessary assets

- Invoice factoring for immediate cash

- Strategic partnerships for resources

Technology and Tools

Essential Software Categories:

- Accounting: QuickBooks, Xero, or FreshBooks

- Cash Flow Forecasting: Float, Pulse, or simple spreadsheets

- Invoice Management: Invoice2go, Wave, or integrated accounting tools

- Expense Tracking: Expensify, Receipt Bank, or mobile apps

Key Features to Look For:

- Bank integration for automatic transaction import

- Invoice automation and payment reminders

- Cash flow forecasting capabilities

- Mobile access for real-time updates

- Integration between different tools

Conclusion: Your Financial Mastery Journey

Congratulations! You now have the knowledge to take control of your business finances. But knowledge without action is just entertainment. The real work begins when you start implementing these systems in your business.

Your Next Steps

This Week:

- Set up basic cash tracking (even if it's just a simple spreadsheet)

- Calculate your current cash flow runway

- Create a simple weekly cash flow forecast

This Month:

- Build your first operating budget

- Establish your monthly financial review routine

- Identify your key leading indicators

Next Quarter:

- Develop your three key scenarios

- Create detailed action plans for each scenario

- Consider getting professional help for areas where you're struggling

Remember the Fundamentals

Cash Flow is King: Always prioritize cash flow over paper profits.

Measure What Matters: Track the numbers that actually drive your business.

Plan for Multiple Futures: Hope for the best, but plan for challenges.

Systems Beat Perfection: A simple system you use is better than a perfect system you don't.

Get Help When Needed: Knowing when to get professional help is a sign of wisdom, not weakness.

The Compound Effect of Good Financial Management

Every day you spend managing your finances well compounds. Better decisions lead to better results, which create more options, which enable even better decisions.

Start today. Your future self will thank you.

Small steps consistently taken will transform your business and give you the financial confidence you deserve.

Feel complicated and need help?

Get a Free 30-Minute Consultation with a Top Advisory Firm.