The Psychology of Small Business Spending: Why We Splurge and How to Stop

Let’s be honest. We’ve all been there. That late-night scroll through a SaaS website that ends with a subscription to a "game-changing" tool you use twice. The "must-have" piece of equipment that’s now gathering dust in a corner. The premium-tier conference tickets bought on a whim of FOMO (Fear Of Missing Out). As a small business owner, you’re the captain of the ship, the head chef, and the chief bottle washer. You make hundreds of decisions a day, and many of them involve spending money. But have you ever stopped to ask why you make the spending decisions you do?

Why do we, as smart, driven founders, buy things we don’t truly need for our businesses? It’s not a simple question of budgeting. It’s a complex dance of emotion, ego, and instinct. Understanding the psychology behind your spending is the first, most crucial step to building a more resilient, profitable, and sustainable business. It’s about shifting from a reactive spender to a conscious, frugal entrepreneur.

This isn't about being cheap. It's about being strategic. It’s about mastering your founder mindset to ensure every dollar you spend is an investment in your future, not a bandage for your insecurities.

The Psychological Traps That Drain Your Business Bank Account

Before you can change your spending habits, you need to understand the invisible forces that shape them. These psychological triggers are powerful, and they often operate just below the surface of our consciousness.

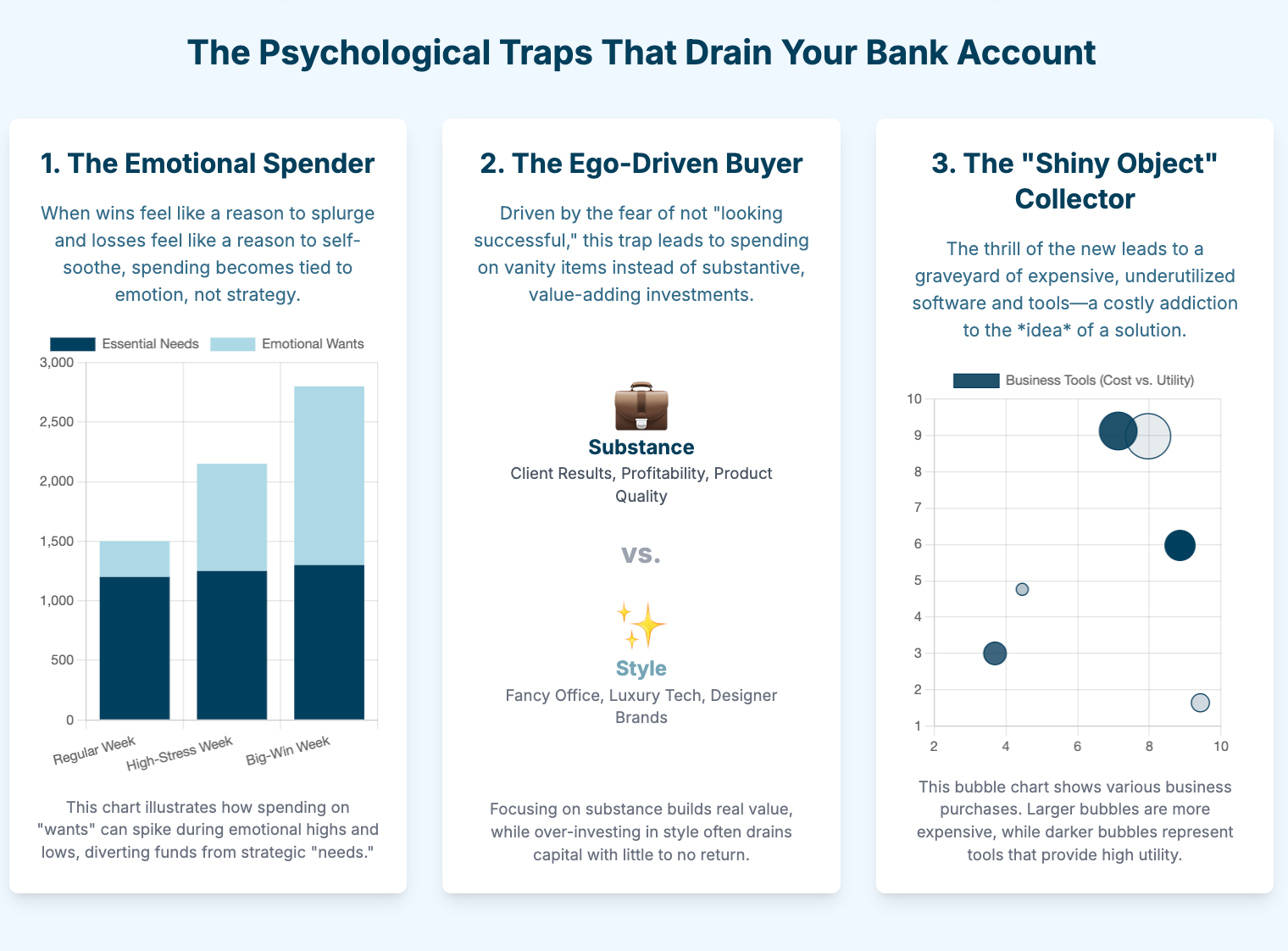

1. The Emotional Spender: "I Deserve This"

The Scenario: You’ve just landed a huge client after weeks of grueling work. You feel euphoric, and you immediately think, "I've earned this!" You splurge on the top-of-the-line laptop you’ve been eyeing, even though your current one works perfectly fine. Or maybe it’s the opposite: you’ve had a terrible week, lost a client, and feel dejected. To lift your spirits, you invest in a fancy new office chair or an expensive online course, seeking a quick hit of dopamine.

The Psychology: This is emotional spending, and it’s one of the most common traps. We link our business performance directly to our sense of self-worth. A win makes us feel deserving of a reward; a loss makes us feel we need a pick-me-up. The purchase isn't about a business need; it's about regulating our emotions.

Best Practice: Implement a "72-Hour Rule." When you feel the urge to make a non-essential purchase over a certain amount (say, $200), force yourself to wait 72 hours. This cooling-off period allows the initial emotional high or low to fade, enabling you to re-evaluate the purchase with a clearer, more logical mind. Ask yourself: "Is this an emotional want or a strategic need?"

2. The Ego-Driven Buyer: "I Need to Look Successful"

The Scenario: You’re meeting a potential high-value client, and you feel a pang of insecurity about your home office. You rush out and lease a swanky downtown office space you can’t really afford. You buy designer suits or the latest smartphone, not for their function, but for the image of success you believe they project.

The Psychology: This is the "fake it 'til you make it" philosophy taken to a dangerous extreme. The founder mindset can sometimes be plagued by imposter syndrome. We fear that if we don't look the part of a successful business owner, no one will take us seriously. This leads to spending on vanity metrics—things that look good on the surface but have little impact on the bottom line.

Best Practice: Focus on substance over style. True success is reflected in your client testimonials, your product quality, and your profitability—not the glossiness of your business cards. Invest in things that directly improve your customer's experience. A happy client who gets amazing results is your best marketing asset, and they won't care if you're working from your kitchen table.

3. The "Shiny Object Syndrome" Collector

The Scenario: You're constantly bombarded with ads for the "next big thing" in marketing automation, a revolutionary project management tool, or a "must-attend" industry webinar. You get a thrill from being an early adopter, and you can’t resist signing up or buying the new software, convinced this will be the magic bullet that solves all your problems. The result? A folder of expensive, underutilized software subscriptions and a feeling of being perpetually behind.

The Psychology: This is a classic manifestation of business psychology meeting our brain's love for novelty. New things trigger a release of dopamine, making us feel excited and optimistic. We overestimate the potential benefit of the new tool and underestimate the time and effort required to implement it properly. We're addicted to the idea of a solution, not the actual work of solving the problem.

Best Practice: Create a "Needs vs. Wants" flowchart. Before purchasing any new tool or software, map out the exact problem you're trying to solve.

- Need: What is the core business function that is currently broken or inefficient?

- Current Solution: How are you handling it now? What are its specific limitations?

- Proposed Solution: How, specifically, will this new tool solve that exact problem? What is the ROI in terms of time or money saved?

- Implementation Plan: Who will set it up? How long will it take? What is the learning curve? This structured approach forces you to move beyond the marketing hype and focus on tangible value.

Cultivating the Frugal Entrepreneur Mindset: Your Action Plan

Understanding the psychology is half the battle. The other half is building the systems and habits to counteract these impulses. Becoming a frugal entrepreneur isn’t about deprivation; it’s about intentionality.

Tip 1: Create a "Growth Budget," Not Just an "Expense Budget"

An expense budget feels restrictive. A growth budget feels empowering. Reframe your financial planning around this question: "How can I allocate my capital to fuel sustainable growth?"

- Categorize ruthlessly: Divide all potential spending into three buckets:

- Essential: Things the business cannot operate without (rent, payroll, core software).

- Growth: Investments that have a direct, measurable link to acquiring customers or increasing revenue (a well-researched ad campaign, a proven SEO consultant, a critical piece of production equipment).

- Optional: Nice-to-haves that don't directly fuel growth (premium office furniture, the most expensive CRM tier when a cheaper one will do, conference after-parties).

- Allocate strategically: Fund "Essential" first. Then, allocate the majority of your remaining capital to "Growth." The "Optional" bucket gets the scraps, if anything. This simple reframing ensures your money is always working for you.

Tip 2: Embrace the "Just-in-Time" Philosophy

In manufacturing, "just-in-time" means ordering materials exactly when they are needed for production, reducing waste and storage costs. Apply this to your business spending.

- Don't buy for "someday": Don't buy a powerful video editing computer in case you decide to launch a YouTube channel one day. Wait until you have a content plan and are ready to shoot your first video.

- Rent or borrow before you buy: Need a high-end camera for a one-off project? Rent it. Need a specific tool for a single job? Borrow it from a fellow entrepreneur. This allows you to test the waters and validate the need before committing significant capital.

- Start with the Minimum Viable Product (MVP): This applies to more than just software. Whether it’s a service offering or an internal process, start with the simplest, most low-cost version possible. Get feedback, validate the demand, and only then invest in scaling it up.

Tip 3: Automate Your Financial Discipline

Willpower is a finite resource. Don't rely on it to control your spending. Instead, build systems that make financial discipline the default.

- The Two-Account System: Set up two separate business checking accounts.

- Operating Account: All your revenue goes into this account. From here, you pay all your "Essential" bills and taxes.

- Discretionary/Growth Account: On a set schedule (e.g., every Friday), transfer a fixed, budgeted amount from your Operating Account to this one. This is the only account you use for "Growth" and "Optional" spending. When the money is gone, it's gone. You have to wait until the next transfer.

- Use virtual cards for subscriptions: Use services that provide virtual credit cards for every subscription. You can set spending limits and easily cancel a card without affecting your other services. This puts a hard stop on sneaky price increases and makes it simple to audit your recurring costs.

Tip 4: Conduct a Monthly Spending Review (The "Splurge Autopsy")

Set a non-negotiable calendar appointment with yourself for the first of every month. Go through every single business expense from the previous month. For each one, ask:

- "Did this purchase help me acquire a customer?"

- "Did this purchase improve my product or service?"

- "Did this purchase save me a significant amount of time?"

- "What was my ROI on this expense?"

- "Knowing what I know now, would I make this purchase again?"

This isn’t about shaming yourself. It's about learning. You might discover that a tool you thought was a splurge is actually saving you 10 hours a month, making it a brilliant investment. Or you might realize that your daily "fancy coffee" meetings are costing you $300 a month without generating any real business. This regular audit sharpens your spending habits and turns every expense into a data point for future decisions.

The Ultimate Shift: From Spending Money to Buying Freedom

Every dollar you save by avoiding a psychological spending trap is a dollar you can reinvest in what truly matters: your freedom. It's the freedom to survive a slow month without panicking. The freedom to seize a genuine opportunity when it arises. The freedom to pay yourself a proper salary and build long-term wealth.

The journey to becoming a frugal entrepreneur is a journey of self-awareness. It requires you to untangle your ego from your expenses and your emotions from your financial statements. It demands that you build a founder mindset rooted in resilience, strategy, and a relentless focus on value.

So the next time you feel that urge to splurge, pause. Take a breath. Ask yourself the hard questions. Is this purchase a tool for growth, or a crutch for your ego? Is it a strategic investment, or a fleeting emotional fix? By mastering the psychology of your spending, you’re not just saving money—you’re buying yourself the most valuable asset of all: a business built to last.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm