The Founder's Guide to Cash Flow: How to Build a Forecast That Actually Works

Stop guessing. Build a financial MRI for your business in 30 minutes and finally gain control.

If the term "cash flow forecast" makes your eyes glaze over, you're not alone. For most founders, it sounds like a tedious chore best left to accountants. You're busy building a product, chasing leads, and putting out the daily fires of a growing business. Who has time to become a financial wizard?

Here’s the hard truth: you don’t have time not to.

Ignoring your cash flow is like flying a plane without an instrument panel. You might feel the thrill of climbing, but you have no idea if you're about to run out of fuel and fall out of the sky. A profitable business can go bankrupt. A business with happy customers can fail. The one thing no business can survive without is cash.

This guide is your crash course in financial planning for beginners. We will demystify the process and show you how to build a practical cash flow forecast that is less about accounting and more about strategy. This isn't just about avoiding disaster; it's about building a resilient, adaptable, and ultimately more valuable company.

The Three Cash Flow Mindsets: Which One Are You?

Before we build, let's diagnose. Most founders fall into one of three camps:

- The Ostrich: Head buried in the sand, hoping for the best. You check your bank balance, feel a momentary pang of anxiety or relief, and get back to work. You're flying completely blind.

- The Gambler: You run on gut feel. You make big bets on hiring, marketing, and inventory based on a "feeling" that things are going well. Sometimes you win, but a single bad bet could be catastrophic.

- The Pilot: You use data to navigate. You understand that to control your business's destiny, you need to see what's ahead. You use your forecast as your instrument panel, making informed decisions to avoid turbulence and chart a course for growth.

This guide is about turning you into The Pilot.

Cash Flow vs. Profit: The Most Dangerous Misconception in Business

Let's clear this up immediately: Cash is not the same as profit. This is the single most important concept in startup finance.

Your Profit & Loss (P&L) statement can show a healthy profit, but it includes "paper" transactions. It records a sale the moment you send an invoice, not when your client actually pays you 60 days later. It includes non-cash expenses like depreciation.

You can be profitable and still run out of money. Cash is the oxygen your business breathes. A cash flow forecast tracks the actual cash moving in and out of your bank account. It is the ultimate source of truth about your company's health.

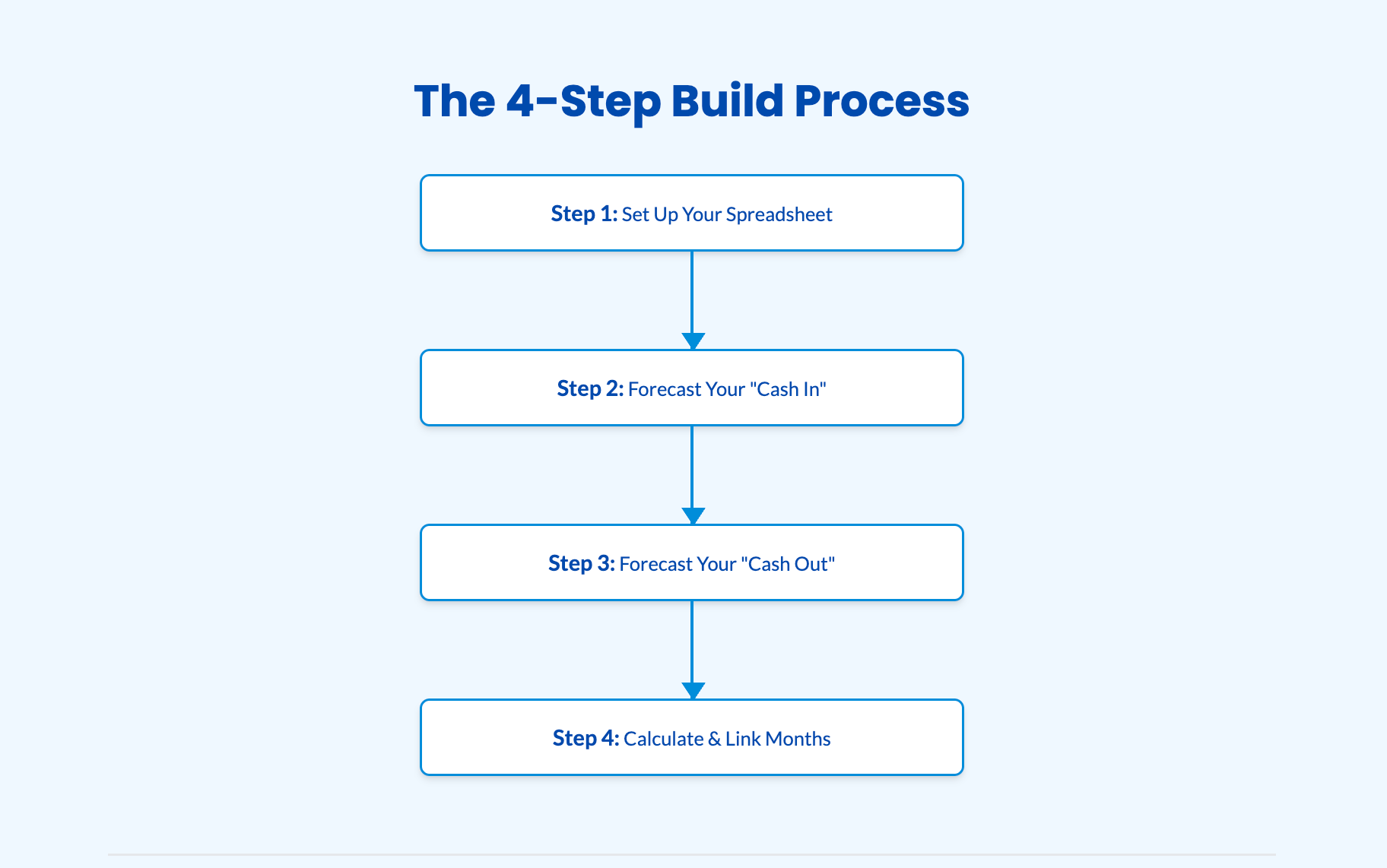

Building Your 30-Minute Cash Flow Forecast: A Step-by-Step Guide

Ready to build your instrument panel? Open your favorite spreadsheet program (Google Sheets or Excel is perfect).

Step 1: The Basic Framework

Create a simple table. Across the top, list the next 6-12 months. Down the side, create these essential rows:

Category | Month 1 | Month 2 | Month 3 |

|---|---|---|---|

Opening Bank Balance | [Your starting cash] | ||

Cash In | |||

Total Cash In | |||

Cash Out | |||

Total Cash Out | |||

Net Cash Flow | |||

Closing Bank Balance |

- Opening Bank Balance: The total cash you have in the bank at the start of the month.

- Closing Bank Balance: The cash you have at the end of the month. The closing balance of Month 1 becomes the opening balance of Month 2. This is what connects the forecast over time.

Step 2: Forecast Your "Cash In" (The Realism Phase)

List every single source of cash you expect to receive. Be brutally realistic, not optimistic.

- Sales Revenue: Don't just project sales. Project collections. If your payment terms are 30 days, a sale made in January is February's cash.

- Recurring Revenue (SaaS/Subscriptions)

- Project-Based Payments

- Retail/E-commerce Sales

- Other Income: Loans, tax refunds, asset sales, etc.

Example "Cash In" Section:

Category | Month 1 | Month 2 | Month 3 |

|---|---|---|---|

Cash In | |||

Subscription Revenue | $5,000 | $5,200 | $5,400 |

Project X (Deposit) | $3,000 | $0 | $0 |

Project X (Final Pmt) | $0 | $3,000 | $0 |

Total Cash In | $8,000 | $8,200 | $5,400 |

Step 3: Forecast Your "Cash Out" (The Honesty Phase)

This is where you must be ruthlessly honest. Comb through your bank and credit card statements for the last three months.

- Fixed Costs (The Predictables):

- Rent/Mortgage

- Salaries & Payroll Taxes

- Software Subscriptions (CRM, accounting, etc.)

- Insurance

- Loan Repayments

- Variable Costs (The Fluctuators):

- Cost of Goods Sold (COGS) / Inventory

- Marketing & Advertising (break it down by channel)

- Contractor & Freelancer Payments

- Shipping & Fulfillment

- Utilities

- Don't Forget These:

- Your Own Salary: Pay yourself!

- Taxes: Set aside a percentage for sales tax, payroll, and income tax.

- Contingency: Add a line for 5-10% of your total cash out for unexpected costs. Because they will happen.

Step 4: Calculate and Analyze

Now, do the simple math for each month:

- Net Cash Flow:

Total Cash In - Total Cash Out - Closing Bank Balance:

Opening Bank Balance + Net Cash Flow

You now have a forecast. It might look scary, or it might look great. Either way, it's actionable intelligence.

From Insight to Action: What to Do With Your Forecast

A forecast is useless if it sits in a spreadsheet. Here’s how to use it as a strategic tool.

Scenario 1: Your Forecast Flashes RED (A Cash Crunch is Coming)

Seeing a future cash shortage is a gift. It gives you time to act.

- Pull the Cash Levers:

- Collections: Who owes you money? Start calling. Offer a small discount for early payment.

- Billing: Can you invoice for a project deposit today instead of next week?

- Delay Payables: Call your vendors. Ask for a 15 or 30-day extension. It's a tough call, but it's better than not being able to pay them at all.

- Cut Spending: What's a "nice to have"? Pause it.

- Secure a Buffer:

- Line of Credit: The best time to apply for a line of credit is when you don't need it. If you see a crunch in 3 months, apply now.

- Owner Injection: Can you inject personal funds as a loan to the business?

Scenario 2: Your Forecast Flashes GREEN (A Cash Surplus is Coming)

A surplus is an opportunity. Don't let it sit idle.

- Build Your War Chest: Aim to have 3-6 months of fixed operating expenses in a separate savings account. This is your ultimate protection against uncertainty.

- Accelerate Debt Repayment: Pay down high-interest debt faster.

- Make Strategic Investments: This is the time to make smart bets.

- Marketing: Double down on the channel that's working.

- Hiring: Bring on that person who can accelerate your growth.

- Equipment/Software: Invest in tools that create efficiency.

Advanced Tactics: "What If" Scenarios

The real power of your forecast is its ability to model the future. Duplicate your spreadsheet and play with the numbers:

- The "Late Client" Scenario: What happens if your biggest client pays 60 days late instead of 30?

- The "Big Win" Scenario: What does your cash position look like if you land that huge contract next month?

- The "Recession" Scenario: What if sales drop by 20% for three months?

This kind of scenario planning turns your forecast from a static report into a dynamic decision-making machine.

The Most Common (and Deadly) Mistakes

- Confusing Profit with Cash: We've covered this, but it's worth repeating. It's the #1 killer of small businesses.

- Being Too Optimistic: Your forecast should be your most conservative document. Under-promise on income and over-promise on expenses.

- Forgetting Taxes: A surprise tax bill can wipe you out. Work with an accountant to plan for it.

- Setting It and Forgetting It: This is a living document. It must be updated monthly with actuals. This 20-minute ritual is one of the highest-leverage activities you can do as a founder.

You Are Now in Control

Building a cash flow forecast isn't about predicting the future with perfect accuracy. It's about understanding the levers in your business so you can react to challenges and seize opportunities.

You've just built a tool that gives you clarity and control—the two things every founder craves. You've replaced anxiety with intelligence. Now, you can get back to building your dream, not as a gambler hoping for the best, but as a pilot, confidently navigating the journey ahead.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm