The Definitive, No-Fluff Guide to Creating Your First Real Business Budget

Let’s be honest. For a small business owner, the word “budget” can feel less like a helpful tool and more like a four-letter word. It can conjure images of restrictive spreadsheets, complicated financial jargon, and a constant reminder of every penny spent. You’re a visionary, a creator, a problem-solver—not necessarily an accountant.

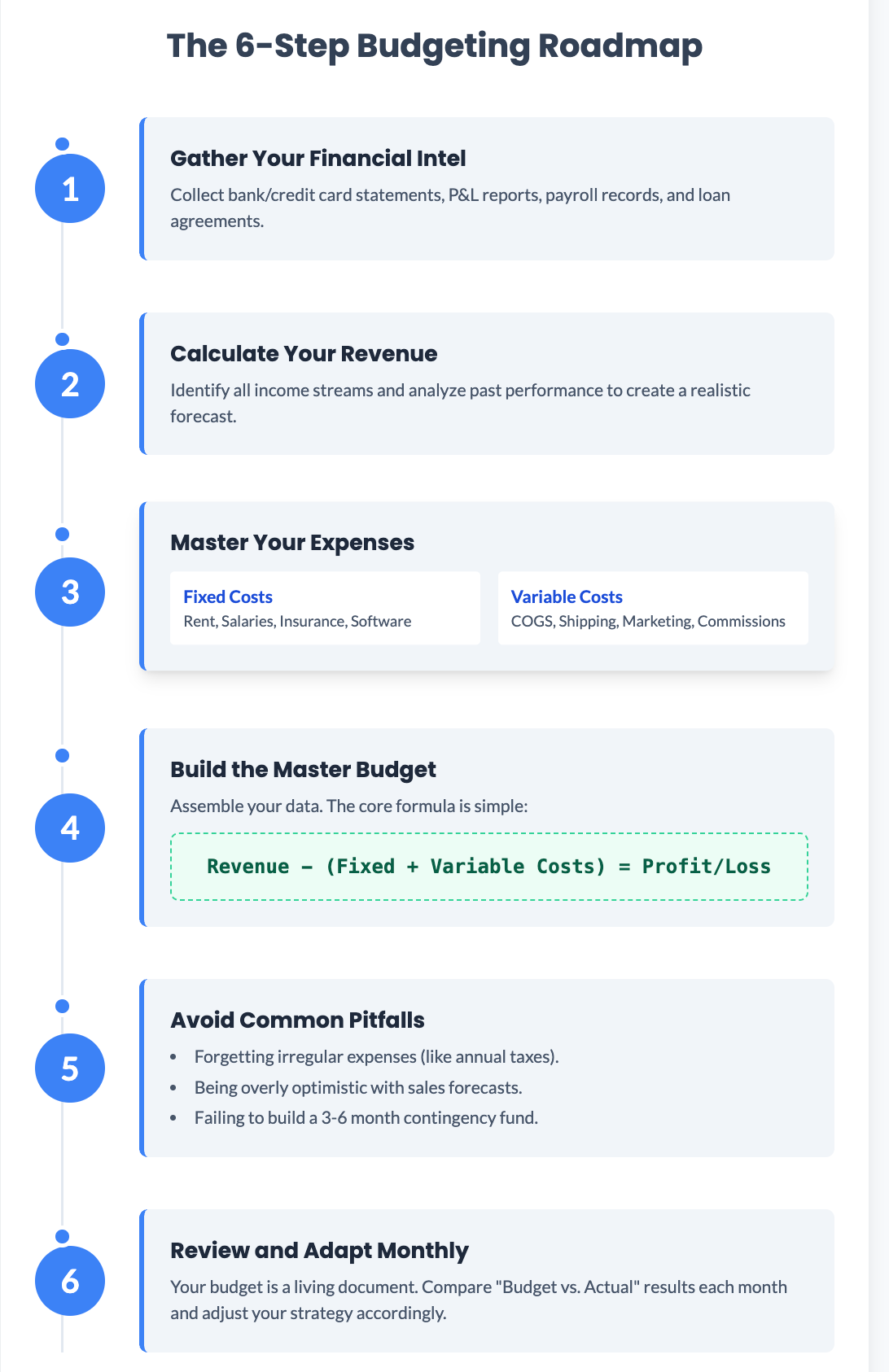

But what if we told you that a budget isn't a financial straitjacket, but rather your roadmap to freedom? A well-crafted budget is one of the most powerful, liberating tools in your arsenal. It provides the clarity to silence financial anxiety, the control to navigate uncertainty, and the confidence to turn your brilliant business vision into a profitable reality. This is your definitive, no-fluff guide to creating your first real business budget—a step-by-step journey to finally mastering your small business finances.

This guide will demystify the process, offer practical tips, and help you build a financial plan that works for you, not against you. So, let’s leave the dread behind and get ready to take control of your financial future.

Why Your Small Business Desperately Needs a Budget

Before we roll up our sleeves, let's solidify the "why." A budget is far more than a list of numbers; it's a strategic document that empowers you to:

- Make Decisions with Confidence: Should you invest in that new marketing campaign? Can you afford to hire your first employee? Your budget replaces guesswork with data-driven answers.

- Secure Funding: Whether you're approaching a bank for a loan or pitching to investors, a detailed budget is non-negotiable. It proves you understand your business's financial health and its potential for growth.

- Spot Trouble Before It Starts: A budget is your financial early-warning system. It can flag potential cash flow shortages or areas of overspending long before they escalate into crises.

- Turn Goals into Reality: A budget translates your abstract business goals into tangible financial targets, allowing you to track your progress and celebrate real, measurable wins.

- Reduce Entrepreneurial Stress: Financial uncertainty is a primary source of stress for founders. A clear budget brings order to the chaos, providing a sense of control that lets you focus on what you do best: running your business.

Step 1: Gather Your Financial Intelligence

The foundation of any good budget is good data. Your first mission is to gather all the financial intelligence you can find. Don’t worry if it feels messy at first; we’re simply collecting the puzzle pieces. You'll need:

- Bank Statements: Print or download statements from all your business bank accounts for the last 6-12 months.

- Credit Card Statements: Do the same for any business credit cards. This is a goldmine for understanding your spending patterns.

- Previous Financial Reports: If you have them, your Profit and Loss (P&L) statements and Balance Sheets are invaluable.

- Payroll Records: A summary of what you've paid employees or contractors.

- Loan Agreements: For any business loans, note the total amount, interest rate, and monthly payment.

- Major Receipts & Invoices: For a more granular view, especially for recent large purchases.

If you’re a brand-new business without this history, you’ll be doing more forecasting. Start by researching industry averages for businesses of a similar size and scope.

Pro-Tip: Create a dedicated folder on your computer (or a physical binder) to keep all this information in one place. Staying organized from the start will save you countless hours later.

Step 2: Calculate Your Revenue (The Fun Part!)

Now, let's look at the money coming in. Your revenue is the lifeblood of your business. When forecasting, it's critical to be realistic, not just optimistic.

- Identify All Income Streams: List every single way your business generates money. This could be from selling different products, offering various services, subscription fees, affiliate income, etc.

- Analyze Past Performance: If you have historical data, chart your revenue month-by-month. Do you see seasonal trends? For example, a landscaping business will have higher revenue in the summer, while a retailer might see a spike in Q4.

- For New Businesses: Base your projections on solid market research. How many customers can you realistically serve? What is your average price point? It's always better to create three forecasts: a conservative (pessimistic) case, a realistic case, and an optimistic (best-case) scenario. Base your budget on the realistic case.

Step 3: Master Your Expenses with Meticulous Tracking

This is where you gain true control. Understanding where every dollar is going is a non-negotiable part of small business finance basics. This process, known as expense tracking, requires you to categorize your costs.

There are two main categories of expenses:

- Fixed Costs: These are your predictable, recurring expenses that don't change much month-to-month, regardless of your sales activity.

- Rent or mortgage for your office/store

- Salaries for full-time staff

- Insurance premiums

- Loan payments

- Software subscriptions (e.g., your website hosting, accounting software)

- Business licenses and permits

- Variable Costs: These expenses fluctuate directly with your level of business activity. The more you sell, the higher these costs will be.

- Cost of Goods Sold (COGS): The direct costs to create your product or deliver your service (e.g., raw materials, direct labor).

- Shipping and packaging supplies

- Sales commissions

- Advertising costs (e.g., pay-per-click ads)

- Contractor or freelance payments

- Transaction fees (e.g., credit card processing fees)

Case Study: Sarah's Sustainable Crafts Sarah runs an online store selling handmade soaps. Her fixed costs include her $50/month website hosting and her $30/month accounting software. Her variable costs include the oils, herbs, and packaging for each bar of soap she sells, as well as the shipping costs. When she sells more soap, these costs go up.

Step 4: Building Your Master Budget

It’s time to assemble the puzzle. Using a spreadsheet or budgeting software, create a document that lists all your projected revenue streams and all your categorized expenses on a monthly basis for the next 12 months.

The core formula is simple:

Let's check back with Sarah:

- Projected Monthly Revenue: $2,500

- Total Fixed Costs: $80

- Total Variable Costs: $900 (for materials, packaging, shipping)

This simple calculation shows Sarah her estimated monthly profit. She now has a clear baseline to measure her performance against.

Pro-Tip: Don't forget to budget for your own salary! Pay yourself a consistent, realistic wage. This is a crucial fixed cost that ensures the business can sustain you, its most important asset.

Step 5: Avoiding the Pitfalls: Common Budgeting Mistakes

Creating a budget is one thing; creating an effective one is another. Here are some common traps to avoid:

- Forgetting Irregular Expenses: Property taxes, annual insurance premiums, or quarterly tax payments can wreck your cash flow if you don't plan for them. Break these down into monthly amounts and set that cash aside.

- Being Overly Optimistic: Your budget should be grounded in reality, not hope. A budget based on inflated sales projections is a recipe for disaster.

- Not Building a Contingency Fund: What happens if your main computer dies or a key client pays late? A contingency fund of 3-6 months' worth of essential operating expenses is your safety net. This is not optional.

- Making It Too Complicated: A 100-tab spreadsheet is intimidating. Start with the basics. As your business grows, your budget can grow in complexity.

- Setting It and Forgetting It: A budget is not a historical artifact. It's a living document that needs to be reviewed and adjusted regularly.

Step 6: The Monthly Budget Review: Your Ritual for Success

Schedule a non-negotiable meeting with yourself (and your team, if you have one) at the end of each month. During this review, perform a "budget vs. actual" analysis.

- Compare: How did your actual revenue and expenses compare to what you projected?

- Analyze: Where were the biggest variances? Did you overspend on marketing? Did a new product sell better than expected?

- Adapt: Use these insights to adjust your forecast for the next month. If a marketing channel isn't working, reallocate those funds. If a product is flying off the shelves, ensure you have enough inventory.

Your Budgeting Toolkit: Tools and Resources

Mastering budgeting for beginners is easier with the right tools.

- Spreadsheet Templates:

- SCORE offers a free, comprehensive 12-month cash flow template.

- Google Sheets and Microsoft Excel both have numerous free, built-in budgeting templates to get you started.

- Accounting & Budgeting Software:

- QuickBooks: An industry standard that integrates accounting, invoicing, and expense tracking.

- Xero: Known for its user-friendly interface and robust features, great for small businesses.

- Wave: Offers free accounting and invoicing, making it an excellent choice for startups and freelancers.

- Further Reading:

- "Profit First" by Mike Michalowicz: A book that offers a revolutionary, behavior-based approach to cash management that can be a game-changer for entrepreneurs.

Conclusion: Your Budget is Your Blueprint for Freedom

Creating a budget is not an act of restriction; it is the ultimate act of empowerment for a business owner. It transforms financial chaos into clarity, anxiety into action, and guesswork into strategy. It is the solid foundation upon which you can build, grow, and scale your vision.

By following this guide, you have the blueprint to take definitive control of your company's financial destiny. Embrace this process not as a chore, but as a core business strategy. Use your budget as your trusted guide, review it regularly, and adapt as you go. You’ll not only build a healthier, more resilient business—you'll also gain the peace of mind that every entrepreneur deserves. Now, go build your empire.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm