The 2025 Tax Deduction Checklist That Could Save Your Small Business Thousands.

The Ultimate Small Business Tax-Deductible Expense Checklist

We’ll break these down into logical categories. Grab a coffee, open a spreadsheet, and let’s start saving you some money.

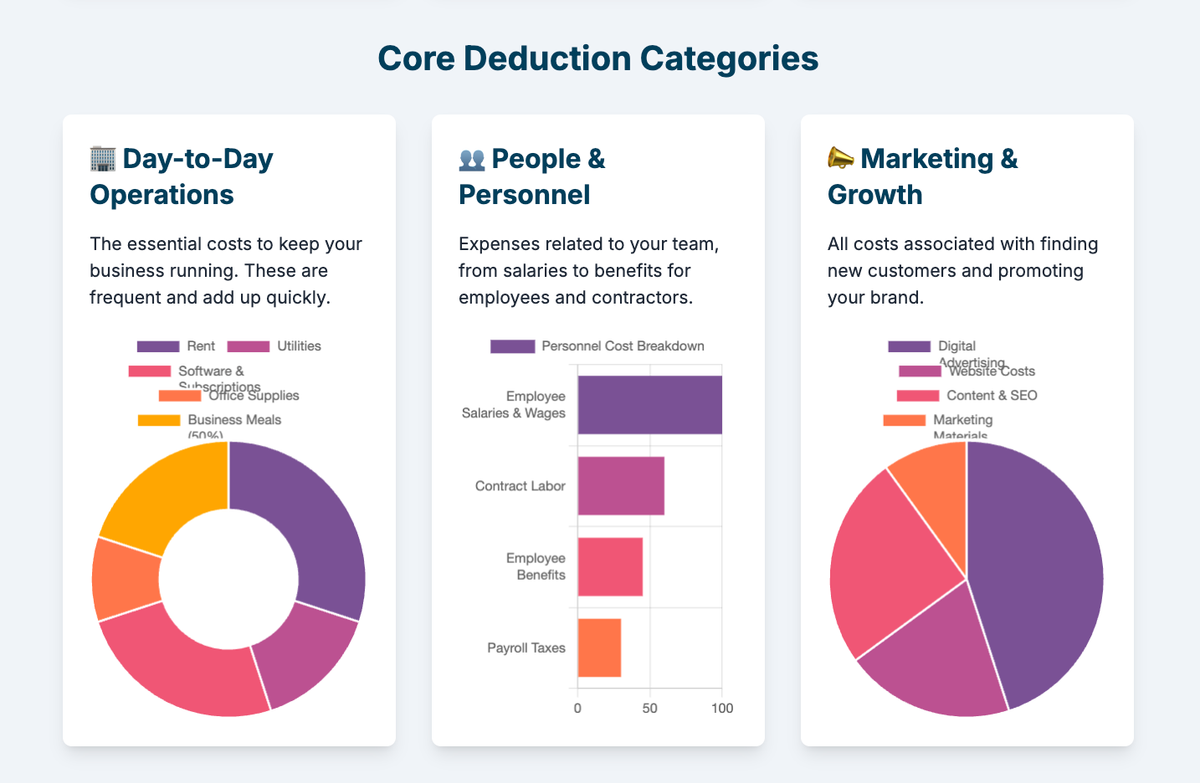

1. Day-to-Day Operations & Office Expenses

These are the costs of keeping the lights on and the engine running. They are often the most common and easily overlooked deductions.

- Rent: If you rent an office, storefront, or other commercial space, your monthly lease payments are fully deductible. (Note: The home office deduction is different—we’ll cover that later!)

- Utilities: Electricity, gas, water, internet, and business phone lines are all deductible. If you have a home office, you can deduct the business percentage of these bills.

- Office Supplies: Pens, paper, ink cartridges, planners, sticky notes, folders—all those small items add up. Keep those receipts from Staples or Amazon.

- Software & Subscriptions: Your subscription to QuickBooks, Adobe Creative Cloud, Microsoft 365, your project management tool (like Asana or Trello), your social media scheduler, and even your subscription to industry publications are all deductible.

- Business Meals: This one has specific rules. You can generally deduct 50% of the cost of business-related meals. This could be a lunch with a potential client, a meal with an employee to discuss a project, or food you eat while traveling for business. The key is that business must be discussed, and you must document who you were with and what was discussed.

Pro-Tip: Pay for a business lunch with a client on your business debit or credit card. On the receipt (or in your accounting software’s notes), jot down "Lunch with Jane Doe of XYZ Corp to discuss Q3 marketing plan." This creates a bulletproof record.

2. People & Personnel Costs

If you have a team, these are some of your biggest and most important deductions.

- Employee Salaries & Wages: The gross salaries, wages, and commissions you pay to your employees are fully deductible.

- Contract Labor (Freelancers & Independent Contractors): The fees you pay to non-employees (like a freelance graphic designer, a consultant, or a contract bookkeeper) are deductible. Remember, if you pay a contractor more than $600 in a year, you must issue them a Form 1099-NEC.

- Employee Benefits: The costs of providing benefits are deductible. This includes your contributions to employees' health insurance, retirement plans (like a 401(k) or SIMPLE IRA), life insurance, and education assistance.

- Payroll Taxes: The employer's share of FICA taxes (Social Security and Medicare) and federal and state unemployment taxes (FUTA and SUTA) are deductible business expenses.

3. Marketing, Advertising & Growth

How do you get the word out? The costs associated with finding and keeping customers are almost always deductible.

- Digital Advertising: Costs for Google Ads, Facebook/Instagram ads, LinkedIn ads, etc.

- Website Costs: Fees for web design, development, domain registration, and hosting.

- Traditional Advertising: Print ads, billboards, radio spots, and direct mail.

- Marketing Materials: Business cards, brochures, flyers, and other promotional items.

- Content & SEO: Fees paid to a marketing agency or freelancer for search engine optimization or content creation.

Example: Let's say you're a local plumber. You spend $500 on Google Ads, $200 on new business cards, and $1,000 to have your van professionally wrapped with your logo and phone number. That's $1,700 in fully deductible advertising expenses.

4. Equipment, Assets & Depreciation

This is where things get a bit more complex, but the savings can be huge.

- Small Equipment & Tools: Items with a short lifespan can often be fully deducted in the year you buy them as "supplies" or "other expenses."

- Large Equipment & Assets (Depreciation): When you buy a significant asset that will last for more than a year—like a computer, a vehicle, machinery, or office furniture—you generally can't deduct the entire cost upfront. Instead, you deduct a portion of its cost over several years through a process called depreciation.

However, there are two powerful provisions that allow you to accelerate these deductions:

- Section 179 Deduction: This fantastic rule allows you to treat a large asset purchase as an immediate expense. For 2024 and 2025 (with limits adjusted for inflation), you can deduct the full purchase price of up to $1,220,000 in qualifying new or used equipment, with a total investment limit of $3,050,000. This is a game-changer for businesses buying big-ticket items.

- Bonus Depreciation: This allows you to deduct a large percentage of the cost of new and used assets in the first year. For 2024, it's 60%, and it's scheduled to phase down further in coming years, so it's wise to plan major purchases accordingly.

Actionable Tip: If you're planning a major equipment purchase near the end of the year, buying and putting it into service before December 31st could generate a significant tax deduction for the current tax year, thanks to Section 179.

5. Travel & Vehicle Expenses

If you travel for work, your expenses can be a goldmine of deductions.

- Airfare, Train Tickets, and Bus Fares: The cost to get to your business destination.

- Lodging and 50% of Meals: Your hotel costs and half the cost of your food while away from home overnight for business.

- Transportation: Cabs, Ubers, Lyfts, or rental cars used for business at your destination.

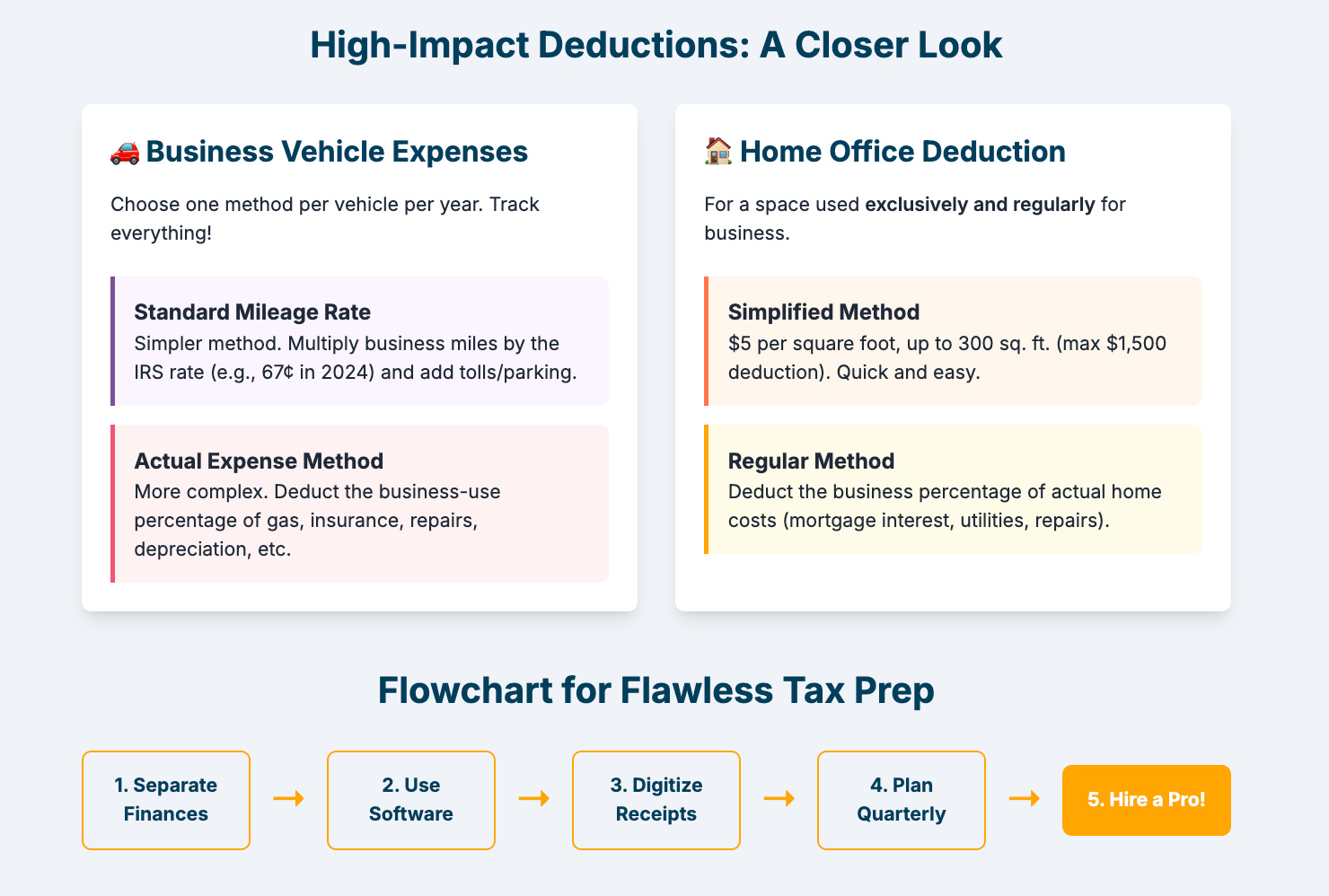

For your business vehicle, you have two options for deductions:

- Standard Mileage Rate: This is the simpler method. You track all your business miles and multiply the total by the IRS's standard rate (for 2024, it was 67 cents per mile; the 2025 rate will be announced late in 2024). You can also deduct parking fees and tolls.

- Actual Expense Method: This is more work but can yield a larger deduction if you have a more expensive vehicle or high operating costs. You track and deduct the business-use percentage of all your car-related expenses: gas, oil changes, insurance, repairs, tires, registration fees, and even depreciation on the vehicle's cost.

Best Practice: Use a GPS-enabled mileage tracking app like MileIQ or Everlance. They run in the background on your phone and make it effortless to categorize drives as business or personal, creating a perfect log for tax time.

6. Insurance & Professional Fees

Protecting and managing your business has tax benefits.

- Business Insurance: General liability, professional liability (errors and omissions), property insurance, and commercial auto insurance premiums are all deductible.

- Health Insurance Premiums (for S-Corp Owners): If you are an S-Corp owner with more than 2% ownership, the health insurance premiums the company pays for you can be deducted by the business and included as wages on your W-2. You can then potentially deduct them on your personal return. It's a specific rule, so talk to your CPA.

- Legal & Professional Fees: The money you pay to your lawyer, accountant, bookkeeper, or business coach is a deductible cost of doing business.

7. Education & Development

Investing in your own skills is an investment in your business.

- Continuing Education: Courses, workshops, and seminars that maintain or improve the skills required for your current business are deductible.

- Industry Subscriptions & Books: Subscriptions to trade journals, business books, and relevant magazines.

- Conferences & Seminars: The cost of admission and travel to industry conferences is deductible.

Important Caveat: Education expenses to qualify you for a new trade or business are generally not deductible. It must be related to your existing business.

Deeper Dives: The High-Impact Deductions

Let's zoom in on two of the most powerful—and often misunderstood—deductions available.

The Home Office Deduction

With the rise of remote work, this is more relevant than ever. To qualify, you must have a space in your home used exclusively and regularly as your principal place of business. "Exclusively" means that part of your home is used only for business (your desk in the corner of your bedroom doesn't count if you also use the room for sleeping).

You have two methods to calculate it:

- The Simplified Method: This is the easy way. You deduct $5 per square foot of your home office, up to a maximum of 300 square feet (for a max deduction of $1,500).

- The Regular (Actual Expense) Method: This is more complex but can lead to a much larger deduction. You calculate the percentage of your home that your office occupies (e.g., a 150 sq ft office in a 1,500 sq ft home is 10%). You then deduct that percentage of your actual home expenses, including mortgage interest, property taxes, homeowners insurance, utilities, and repairs.

The Qualified Business Income (QBI) Deduction

Also known as the Section 199A deduction, this is a major tax break for "pass-through" entities—Sole Proprietorships, Partnerships, S-Corporations, and LLCs. It allows eligible business owners to deduct up to 20% of their qualified business income.

This deduction is complex and has income limitations and rules about what kind of business you're in. For example, "Specified Service Trades or Businesses" (SSTBs) like doctors, lawyers, and consultants have lower income thresholds to qualify. This is a prime example of where a tax professional is essential to ensure you calculate it correctly and get the maximum benefit.

Best Practices to Make Tax Time a Breeze

Knowing the deductions is one thing. Being able to prove them is another.

- Separate Your Finances: Open a dedicated business bank account and get a business credit card. Never mix personal and business expenses. This is Rule #1 for a reason. It simplifies bookkeeping and protects you in an audit.

- Embrace Accounting Software: Use a program like QuickBooks, Xero, or Wave from day one. Connect your business accounts, and categorize transactions as they happen. A year-end report will have 90% of your deductions ready to go.

- Keep Meticulous Records: Digitize everything. Scan receipts and store them in a dedicated cloud folder. The IRS can audit you for years back, and paper receipts fade.

- Plan Year-Round: Don't wait until April. Meet with your accountant or review your finances quarterly. This allows you to make strategic decisions—like buying that piece of equipment before year-end—to optimize your tax position.

- Hire a Pro: We'll say it one last time. A good CPA or Enrolled Agent doesn't just do data entry; they provide strategic advice that can save you far more than their fee. They are an investment, not an expense.

Final Thoughts: You've Got This

Taxes don't have to be a source of fear. By viewing your expenses through the lens of "ordinary and necessary" and by diligently tracking your spending throughout the year, you transform tax season from a chaotic chore into a strategic advantage.

You are building something incredible. Now, go make sure you keep as much of your hard-earned profit as you legally can. It's not just smart; it's essential for your long-term success.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm