Stop Chasing Invoices: The 5-Clause Contract That Forces Clients to Pay on Time

The Founder's Anti-Ghosting Playbook: 5 Contract Clauses That Guarantee You Get Paid

Let's talk about something that keeps founders up at night—clients who vanish into thin air right when payment is due. You know the type: They're all smiles during the project, responsive to every email, and then poof—radio silence the moment you send that invoice.

I've been there. Early in my consulting days, I had a client who seemed perfect. Great communication, loved the work, raved about results. Then came invoice day. Suddenly, they were "traveling," then "in back-to-back meetings," then just... gone. Three months and countless follow-ups later, I finally got paid—minus the hours I spent chasing them down and the sleep I lost worrying about cash flow.

Here's the truth: Client ghosting isn't just frustrating; it's a business killer. When you're running a small business, every invoice matters. That unpaid $5,000 project isn't just a number—it's your team's salaries, your rent, your ability to take on new work without drowning in debt.

But here's what I've learned after working with hundreds of small business owners: You can prevent most payment ghosting before it happens. The secret? Building an anti-ghosting fortress right into your contracts.

Why Traditional Contracts Fail Small Businesses

Most small business owners grab a template online, swap out the names, and call it a day. These generic contracts might protect you legally, but they don't solve the real problem: getting paid on time without having to become a full-time debt collector.

Traditional contracts focus on what happens after things go wrong. They're reactive, not proactive. They tell you how to sue someone, not how to avoid needing to sue in the first place. For small businesses, by the time you're considering legal action, you've already lost—even if you win in court.

What you need instead are contracts that make ghosting harder than paying you. Contracts that create natural checkpoints, consequences, and incentives that keep clients engaged throughout your relationship.

The Psychology Behind Client Ghosting

Before we dive into the clauses, let's understand why clients ghost. It's rarely malicious. Usually, it's one of these scenarios:

The Overwhelmed Executive: They genuinely meant to pay but got buried in other priorities. Your invoice is sitting in an inbox with 500 unread emails.

The Budget Juggler: They're managing cash flow issues of their own and are buying time by avoiding the conversation.

The Scope Creeper: They're not happy with something but don't want confrontation. Instead of discussing it, they disappear.

The Organizational Chaos: No one knows who's supposed to approve the payment. Your contact is waiting on their boss, who's waiting on finance, who's waiting on... you get it.

Understanding these patterns helps us design contract clauses that address the root causes, not just the symptoms.

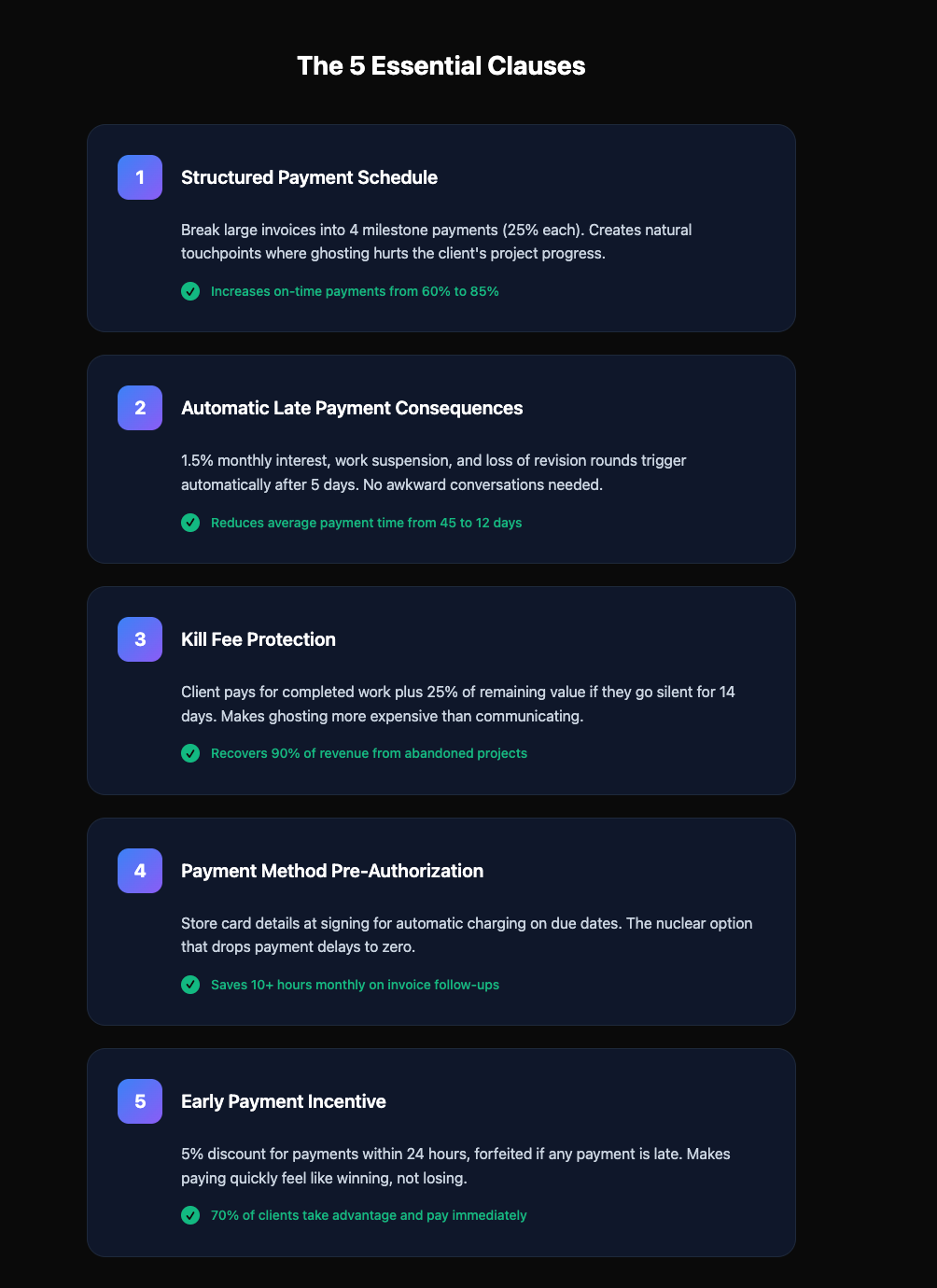

Clause #1: The Structured Payment Schedule Clause

What it looks like: "Payment shall be made according to the following schedule:

- 25% upon contract signing (non-refundable deposit)

- 25% upon delivery of initial concepts/phase one

- 25% upon client approval of final draft/phase two

- 25% upon project completion and delivery"

Why it works: This clause transforms one big scary payment into smaller, manageable chunks. It's psychological—paying $2,500 four times feels easier than paying $10,000 once. More importantly, it creates natural touchpoints where ghosting would actively hurt the client's interests.

Real-world example: Sarah, a web designer in Austin, switched from billing 50% upfront and 50% on completion to this four-payment structure. Her on-time payment rate jumped from 60% to 85%. Why? Clients couldn't disappear mid-project without losing access to work they needed.

Pro tip: Name each payment milestone after a client benefit, not your work. Instead of "Upon completing wireframes," write "Upon delivery of your custom site blueprint." This keeps the focus on what they're gaining, not what they owe.

Clause #2: The Automatic Late Payment Consequence Clause

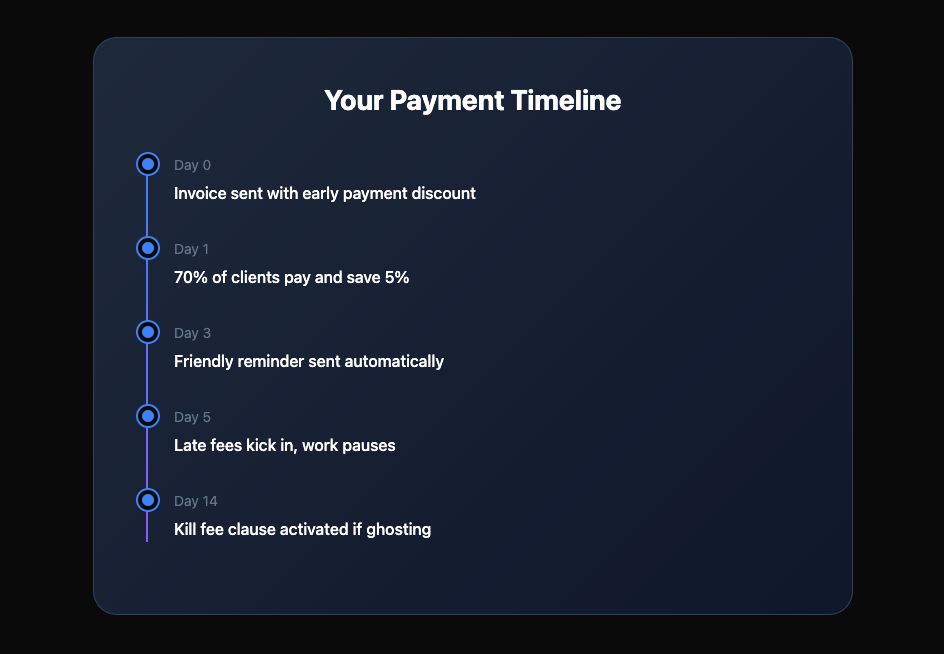

What it looks like: "Payments not received within 5 business days of invoice date will automatically trigger:

- 1.5% monthly interest charge on outstanding balance

- Suspension of all work until payment is received

- Loss of any early payment discounts

- Forfeiture of revision rounds included in original scope"

Why it works: This clause removes you from the role of bad cop. You're not choosing to punish late payers—it's automatic. Clients understand that ghosting has immediate, tangible consequences beyond just owing money.

Implementation tips:

- Send a friendly reminder 2 days before the deadline

- Include the specific consequences in your invoice emails

- Actually enforce these terms (clients talk, and word spreads if you don't)

Success story: Mark, a freelance copywriter, saw his average payment time drop from 45 days to 12 days after implementing this clause. The key? He positioned it as protecting both parties: "This ensures I can maintain the quality and timeline you expect."

Clause #3: The Kill Fee Protection Clause

What it looks like: "If client becomes non-responsive for 14 consecutive days during active project period, or fails to provide necessary approvals/materials within agreed timelines, project will be considered abandoned. Client remains liable for all work completed plus a 25% kill fee on remaining project value."

Why it works: This addresses the "scope creeper" ghoster who disappears because they're unhappy but won't say so. It creates urgency around communication and makes ghosting more expensive than having difficult conversations.

Key elements:

- Define "non-responsive" clearly (no reply to 2 emails and 1 phone call)

- Set reasonable timeline based on your industry

- Include provision for client to notify you of planned absences

Example in action: Jennifer, a brand strategist, had a client ghost mid-project after internal leadership changes. Because of this clause, she sent a formal notice after 14 days of silence. The client immediately responded, paid for completed work plus the kill fee, and everyone moved on professionally.

Clause #4: The Payment Method Pre-Authorization Clause

What it looks like: "Client agrees to provide credit card authorization or ACH details upon contract signing. These payment details will be securely stored and automatically charged on agreed payment dates unless alternative payment is received 24 hours prior."

Why it works: This is the nuclear option against ghosting. When payment is automatic, there's nothing to ghost about. It's particularly effective for retainer relationships or phased projects.

Best practices:

- Use a reputable payment processor with strong security

- Offer a small discount (2-3%) for clients who agree to auto-pay

- Always send notification 3 days before charging

- Include clear dispute resolution process

Real results: Tom's marketing agency implemented this for all retainer clients. Payment delays dropped to zero, and he saved 10 hours monthly on invoice follow-ups. Several clients actually thanked him for making their accounting simpler.

Clause #5: The Accelerated Payment Incentive Clause

What it looks like: "Client receives 5% discount on total project fee if all payments are made within 24 hours of invoice receipt. This discount is retroactively forfeited if any payment is more than 5 days late."

Why it works: Instead of just punishing late payment, this rewards prompt payment. It creates a positive reason to prioritize your invoices and makes ghosting feel like losing money, not saving it.

Smart additions:

- Combine with net-30 terms so early payment feels like a win

- Make the discount significant enough to matter

- Send invoices at beginning of week when clients are planning expenses

Case study: Lisa's design studio offered this to all clients. 70% took advantage of the early payment discount, improving her cash flow dramatically. The other 30% still paid faster than before—nobody wants to feel like they're overpaying.

Implementing Your Anti-Ghosting Contract

Having these clauses is only half the battle. Here's how to implement them effectively:

1. Present with confidence Don't apologize for protecting your business. Frame these clauses as benefiting both parties—you can focus on great work instead of chasing payments, which means better results for them.

2. Walk through the payment terms During your contract review, specifically discuss payment expectations. Many ghosting situations arise from misunderstandings that could've been prevented with a five-minute conversation.

3. Use the right tools Invest in proper invoicing software that can:

- Send automatic reminders

- Process stored payment methods

- Track who's viewed invoices

- Generate professional late notices

4. Be consistent Apply these terms uniformly. The moment you make exceptions, word spreads that your contracts are negotiable suggestions, not firm agreements.

5. Document everything Keep records of all communications, especially when clients acknowledge receipt of invoices or request delays. This documentation is crucial if you ever need to enforce your contract.

Red Flags to Watch For

Even with the best contract, some clients are destined to ghost. Watch for these warning signs:

- Reluctance to sign contracts with standard payment terms

- History of blaming previous vendors for "misunderstandings"

- Requests to defer all payment until project completion

- Vague responses about who handles payments

- Immediate attempts to expand scope during contract negotiations

When you see these flags, either walk away or require larger upfront deposits and shorter payment terms.

The Bigger Picture: Building Ghost-Proof Client Relationships

While contracts are crucial, they're just one part of ensuring timely payment. The best anti-ghosting strategy combines strong contracts with:

Clear communication: Set expectations early and often. Send project updates that remind clients of upcoming payment milestones.

Value demonstration: Regularly highlight the impact of your work. Clients who see clear ROI rarely ghost on payments.

Relationship building: Stay engaged throughout the project. The more connected clients feel, the less likely they are to disappear.

Professional boundaries: Being friendly doesn't mean being a pushover. Maintain professionalism while enforcing your terms.

Your Next Steps

Start by auditing your current contracts. Which of these five clauses could you implement immediately? Don't try to add all five at once—pick the one or two that address your biggest pain points.

Remember, cash flow management isn't just about tracking money—it's about preventing payment problems before they start. Every hour you spend chasing payments is an hour you're not growing your business.

The goal isn't to create an adversarial relationship with clients. It's to establish clear, professional boundaries that make paying you on time the easiest option. When you remove ambiguity and create natural consequences for ghosting, most clients will simply... pay you.

Because at the end of the day, you're not running a charity. You're running a business. And businesses that get paid on time are businesses that survive and thrive.

Start implementing these clauses in your next client contract template. Your future self—and your bank account—will thank you.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm