Scaling Up Without Going Broke: Your Financial Roadmap for Growth Spurts

You landed the big client. Your product went viral on TikTok. A major publication featured your story. Suddenly, the trickle of orders has become a flood, and the phone won't stop ringing. This is the moment every small business owner dreams of. But beneath the thrill of success lurks a terrifying question: Can we actually handle this?

Sudden growth is a high-quality problem, but it’s also a moment of extreme vulnerability. It’s the business equivalent of flooring the accelerator on a car you haven't checked the tires on. Without the right financial framework, a massive growth spurt can lead to cash flow crises, operational chaos, and even bankruptcy. The very success you worked so hard for can become the thing that sinks you.

But it doesn't have to be that way.

This guide is your financial roadmap. We're going to walk through how to prepare for, manage, and sustain growth without going broke. We'll cover everything from understanding the hidden costs of scaling to mastering your cash flow and building a budget for growth that makes your business expansion feel less like a frantic scramble and more like a well-executed plan.

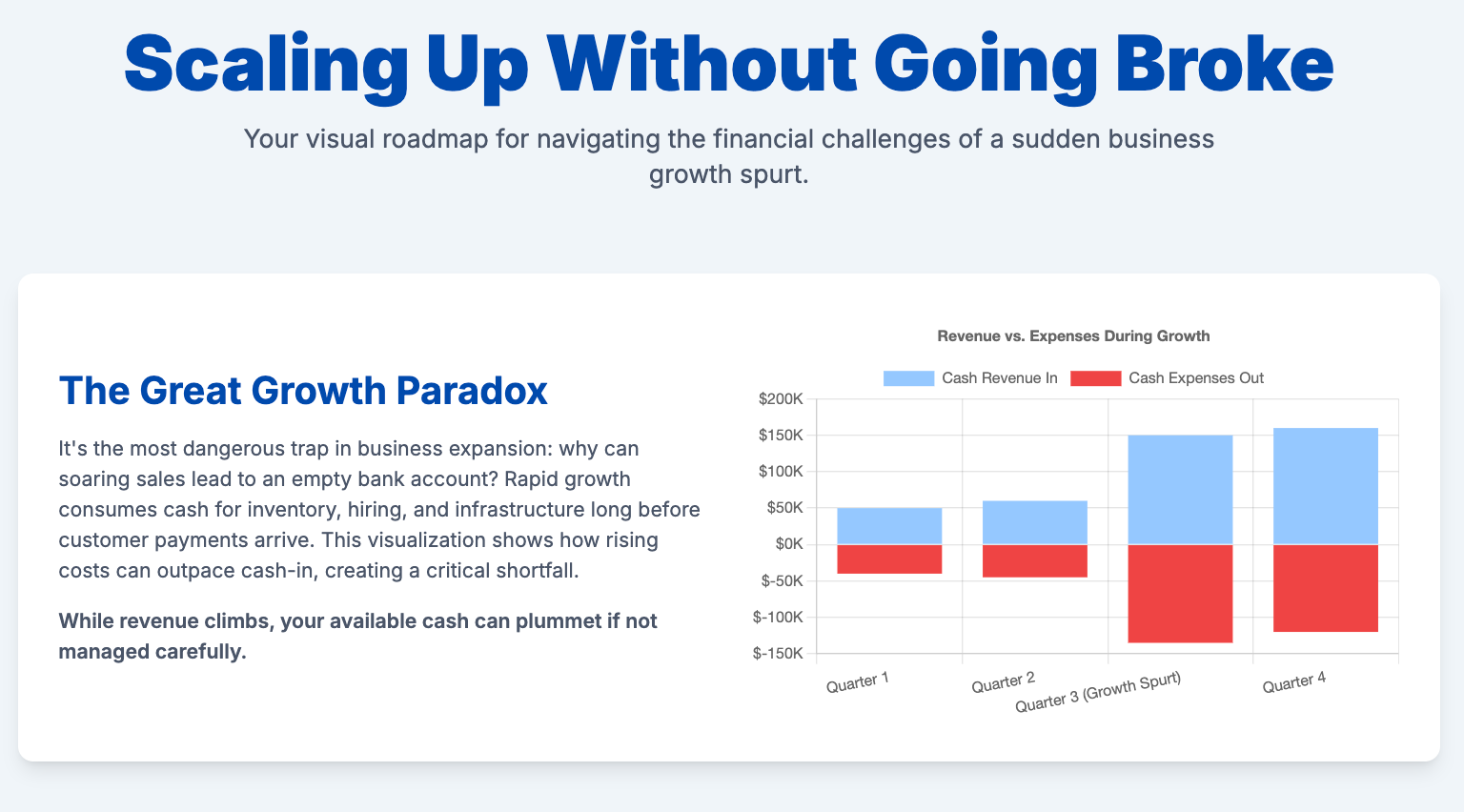

The Great Growth Paradox: Why More Sales Can Mean Less Cash

The most difficult concept for many owners to grasp is that rapid growth consumes cash. It seems counterintuitive. Aren't more sales supposed to mean more money? Yes, eventually. But in the short term, the opposite is often true.

Think about it:

- More Inventory: To meet a 5x increase in demand, you might need to buy 5x the raw materials today. You have to pay your suppliers long before your new customers pay you.

- More People: You need to hire more staff—customer service reps, production workers, salespeople. That means more payroll, training costs, and benefits expenses hitting your bank account now.

- More Infrastructure: You might need a bigger warehouse, more powerful software, additional equipment, or a larger marketing budget. These are significant upfront investments.

- More Accounts Receivable: You’re invoicing more clients, but the payment terms are still 30, 60, or even 90 days. So while your revenue on paper looks fantastic, your bank account is waiting for those payments to arrive.

This gap between spending money to facilitate growth and actually receiving the revenue from that growth is where businesses get into trouble. This is why scaling cash flow management isn't just important; it's the key to survival.

Step 1: Know Thyself—Conduct a Pre-Growth Financial Audit

Before you can budget for the future, you need a crystal-clear picture of your present. You can't draw a map to your destination if you don't know where you're starting from.

Actionable Tips:

- Deep-Dive into Your Financial Statements: Don't just glance at them.

- Income Statement (P&L): What are your true profit margins on each product or service? As you scale, can you maintain those margins? Volume discounts on materials might help, but overtime pay for staff could hurt.

- Balance Sheet: What are your assets and liabilities? How much debt are you carrying? How much equity do you have? This tells you how financially resilient your business is.

- Cash Flow Statement: This is the most critical document. It shows where your cash is actually coming from and going to. Analyze your operating, investing, and financing activities. Is your core business generating positive cash flow?

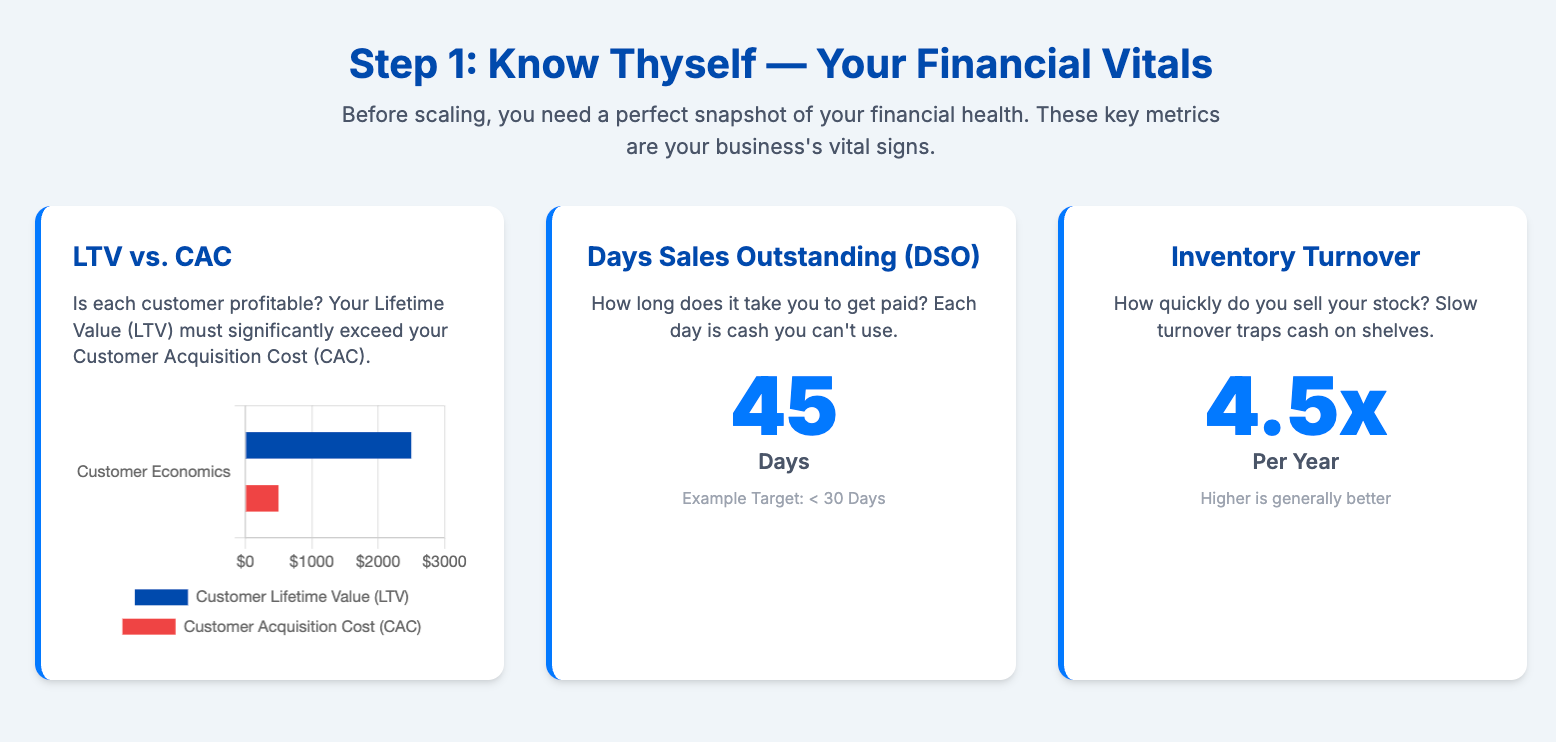

- Identify Your Key Metrics (KPIs): What are the vital signs of your business?

- Customer Acquisition Cost (CAC): How much does it cost to get a new customer?

- Customer Lifetime Value (LTV): How much profit does a customer generate over their entire relationship with you? A healthy business has a much higher LTV than CAC.

- Days Sales Outstanding (DSO): On average, how long does it take you to get paid? If your DSO is 45 days, that means you're acting as a bank for your customers for a month and a half.

- Inventory Turnover: How quickly are you selling through your inventory? Slow turnover ties up cash.

- Stress-Test Your Operations: Where are your bottlenecks? If orders doubled tomorrow, what would break first? Is it your production line? Your customer service team? Your shipping department? Be brutally honest. Each of these breaking points represents a future cost.

Step 2: Build a Dynamic Budget for Growth

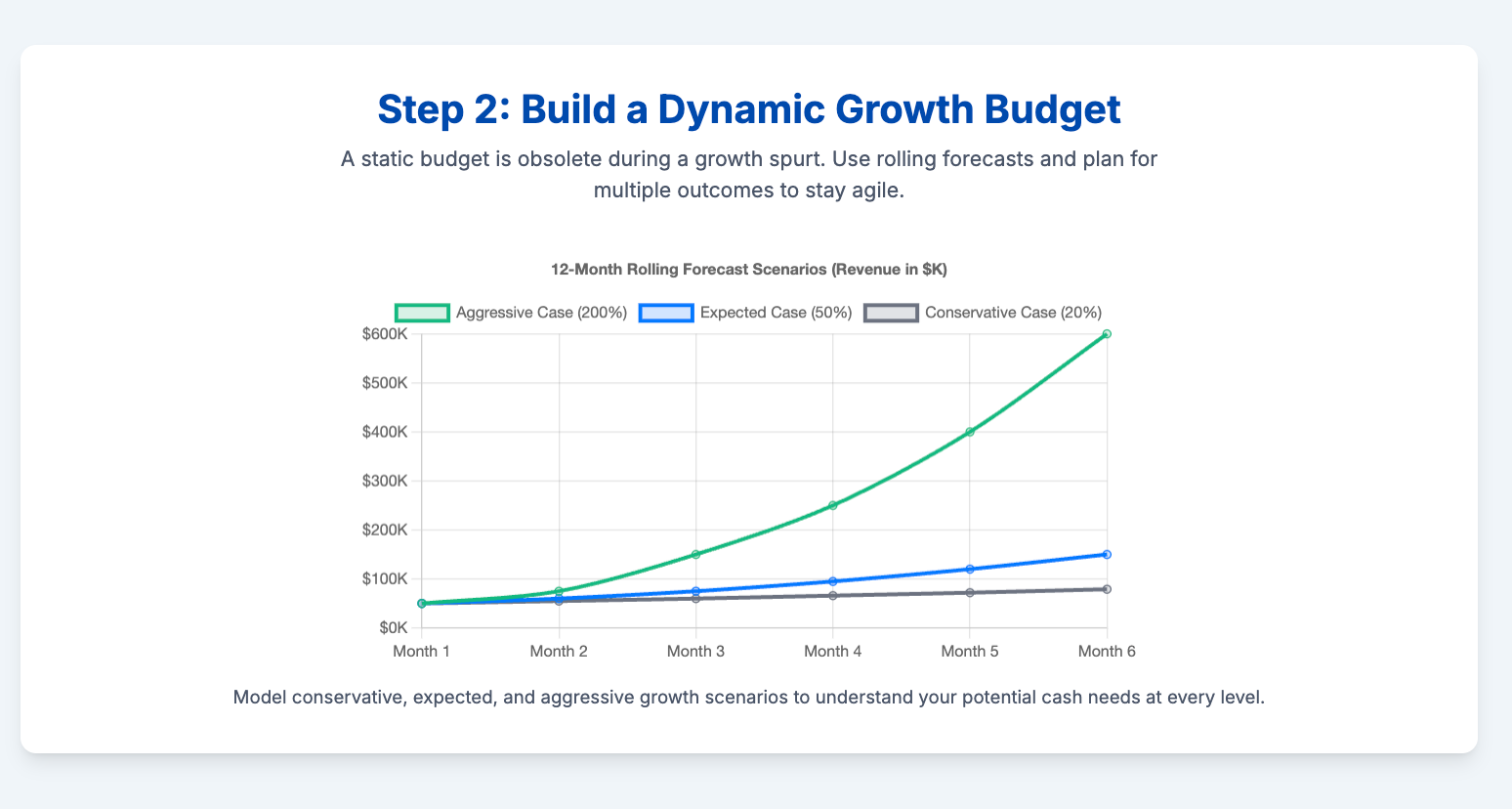

A static, set-it-and-forget-it annual budget is useless during a growth phase. Your business is changing weekly, if not daily. You need a living, breathing financial plan that can adapt. This is where financial forecasting becomes your superpower.

Best Practices for a Growth Budget:

- Scenario Planning is Non-Negotiable: Don't create one budget. Create three:

- The Conservative Case: What if growth is slower than expected (e.g., 20% growth)?

- The Expected Case: Your most realistic forecast (e.g., 50% growth). This should be your primary operational guide.

- The Aggressive Case (The "Oh Crap!") Scenario: What if that viral moment happens and you see 200% growth? What would you need in terms of cash, staff, and inventory?

- Use a Rolling Forecast: Instead of a 12-month calendar-year budget, use a 12- or 18-month rolling forecast. At the end of each month or quarter, you add a new period to the end of your forecast. This forces you to constantly look ahead and adjust your assumptions based on real-world data.

- Focus on Drivers, Not Just Numbers: Don't just budget "$10,000 for marketing." Base your budget on key drivers. For example: "Our marketing budget will be 15% of projected revenue," or "We will hire one new customer service rep for every 500 new customers." This makes your budget responsive. If revenue projections go up, the marketing and hiring budgets automatically adjust.

- Detail Your "Growth" Expenses: Create specific line items in your budget for the costs of expansion.

- Hiring Costs: Recruiter fees, signing bonuses, training time.

- Capital Expenditures: New laptops, machinery, office furniture.

- Marketing Expansion: Budget for testing new channels to sustain growth.

- Professional Fees: You may need more help from your accountant or a lawyer to manage contracts.

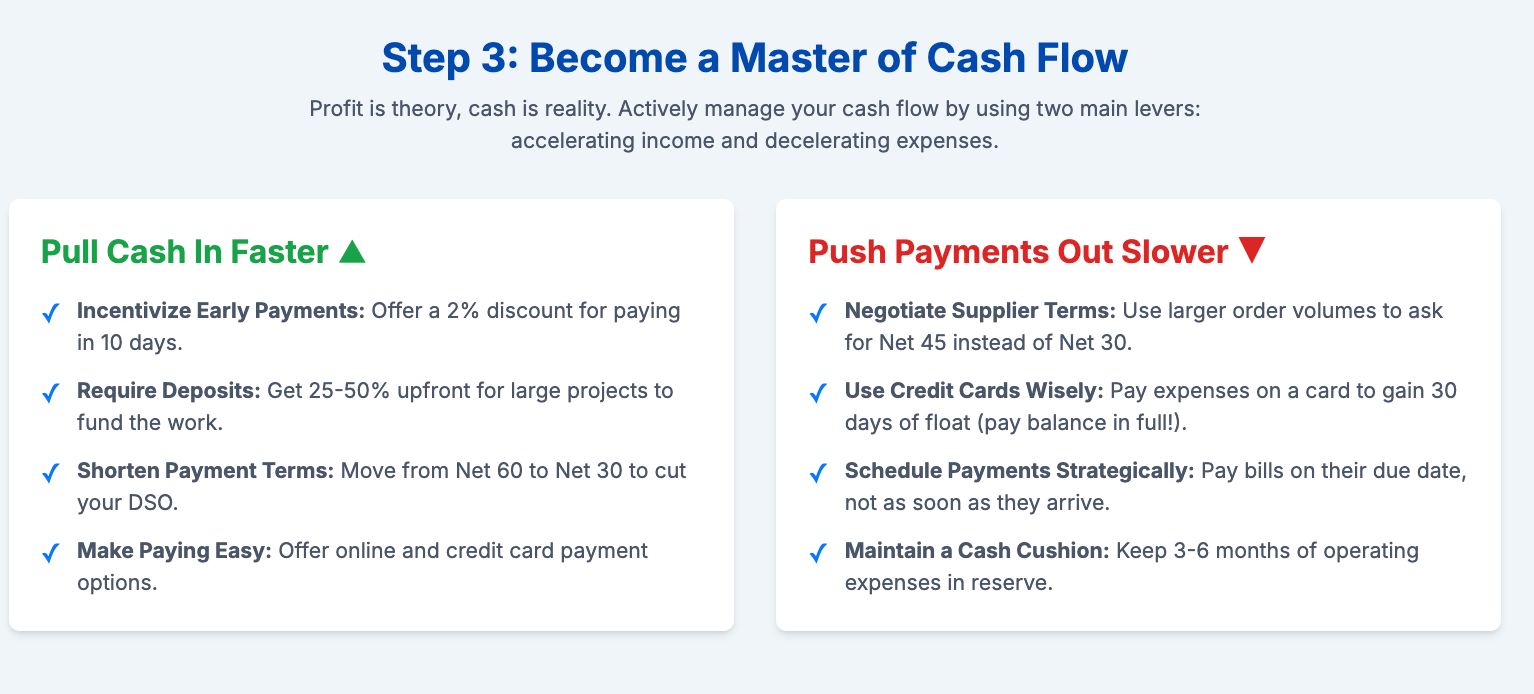

Step 3: Become a Master of Cash Flow

Profit is an opinion; cash is a fact. You can have the most profitable business on paper and still go bankrupt because you don't have the cash to pay your bills. Managing scaling cash flow is an active, daily discipline.

Tactics for Improving Cash Flow:

- Pull Cash In Faster:

- Incentivize Early Payments: Offer a 2% discount if invoices are paid within 10 days (known as "2/10, n/30"). The small hit to your margin is often worth the massive improvement in cash flow.

- Require Deposits or Upfront Payments: For large orders or custom projects, require a 25-50% deposit. This ensures your client has skin in the game and provides you with the cash to fund the work.

- Shorten Your Payment Terms: Can you move from Net 60 to Net 30? Or Net 30 to Net 15? Every day you shave off your DSO is cash in your pocket.

- Make it Easy to Pay You: Accept online payments, credit cards, and ACH transfers. The easier it is, the faster you'll get paid.

- Push Payments Out Slower (Strategically):

- Negotiate Better Terms with Suppliers: Just as your clients want longer to pay you, you can ask your suppliers for more time. If you're placing larger orders, you have leverage. Ask to go from Net 30 to Net 45.

- Use Business Credit Cards Wisely: Pay for expenses with a credit card to get an extra 30 days of float before the cash actually leaves your account. Warning: Pay the balance in full each month to avoid high-interest debt.

- Maintain a Cash Cushion: The old rule of thumb was to have 3-6 months of operating expenses in reserve. During a growth spurt, aim for the higher end of that range, or even more. This is your emergency fund for when a big client pays late or a critical piece of equipment fails.

Step 4: Funding Your Business Expansion

Even with perfect budgeting and cash flow management, rapid growth often requires more capital than the business can generate on its own. It's crucial to know your funding options before you're desperate. Seeking funding when you're in a crisis is a position of weakness.

Exploring Your Options:

- Debt Financing:

- Line of Credit: This is one of the most flexible tools. It's a revolving loan you can draw from as needed to cover short-term cash gaps (like buying inventory) and pay back as you get paid. Establish a relationship with your bank and secure a line of credit before you need it.

- Term Loan: This is a traditional loan for a specific amount with a set repayment schedule. It's best for large, planned investments like buying a major piece of equipment or opening a new location.

- SBA Loans: Government-backed loans often have more favorable terms and lower down payment requirements, but the application process can be lengthy. Start early.

- Equity Financing:

- Angel Investors or Venture Capital: This involves selling a portion of your company in exchange for cash. It's typically reserved for high-growth, high-potential businesses. Be prepared to give up some control and be held accountable for aggressive growth targets.

- Alternative Financing:

- Invoice Factoring/Financing: You sell your outstanding invoices to a third-party company (a "factor") at a discount. You get cash immediately (e.g., 85% of the invoice value) and the factor collects the full amount from your customer. It can be expensive, but it's a very fast way to unlock cash tied up in receivables.

- Revenue-Based Financing: You receive an upfront sum of cash in exchange for a percentage of your future monthly revenue until the investment is paid back with a predetermined return. This is non-dilutive (you don't sell equity) and payments flex with your sales.

The Mindset for Sustainable Growth

Beyond the spreadsheets and bank accounts, scaling successfully requires a mental shift.

- From Doer to Delegator: You can't do it all anymore. You must hire people you trust and empower them to make decisions. Your job shifts from working in the business to working on the business.

- Embrace "Good Enough": In a growth phase, perfection is the enemy of progress. You may need to launch a "good enough" version of a new service or accept a slightly less-than-perfect hire to meet demand. Focus on speed and iteration.

- Stay Obsessed with Your Numbers: The CEO or founder must be the Chief Financial Officer in spirit, even if you have a bookkeeper. You need to live and breathe your financial forecasts and cash flow statements. Set a weekly appointment with yourself to review them.

Growth is the goal, but smart, sustainable growth is the victory. By creating a dynamic budget for growth, mastering your scaling cash flow, and engaging in disciplined financial forecasting, you can turn the exhilarating, terrifying rollercoaster of business expansion into a powerful and profitable climb. Don't let the best thing that ever happened to your business be the thing that puts you out of business. Prepare, plan, and scale with confidence.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm