How to Talk Money with Your Team (Without Putting Them to Sleep)

Make your team actually care about the numbers with these simple communication strategies.

Let's be honest: talking about money with your team can feel as exciting as watching paint dry. The moment you pull up a spreadsheet, eyes glaze over, and everyone suddenly remembers an "urgent" email they need to check. Sound familiar?

Here's the secret: your team wants to know how the business is doing. They just don't want to sit through a mind-numbing presentation filled with corporate jargon and endless rows of numbers. The good news? Financial communication doesn't have to be a snoozefest. When done right, it can be one of the most engaging and motivating conversations you have.

Why Your Team Secretly Wants to Know the Score

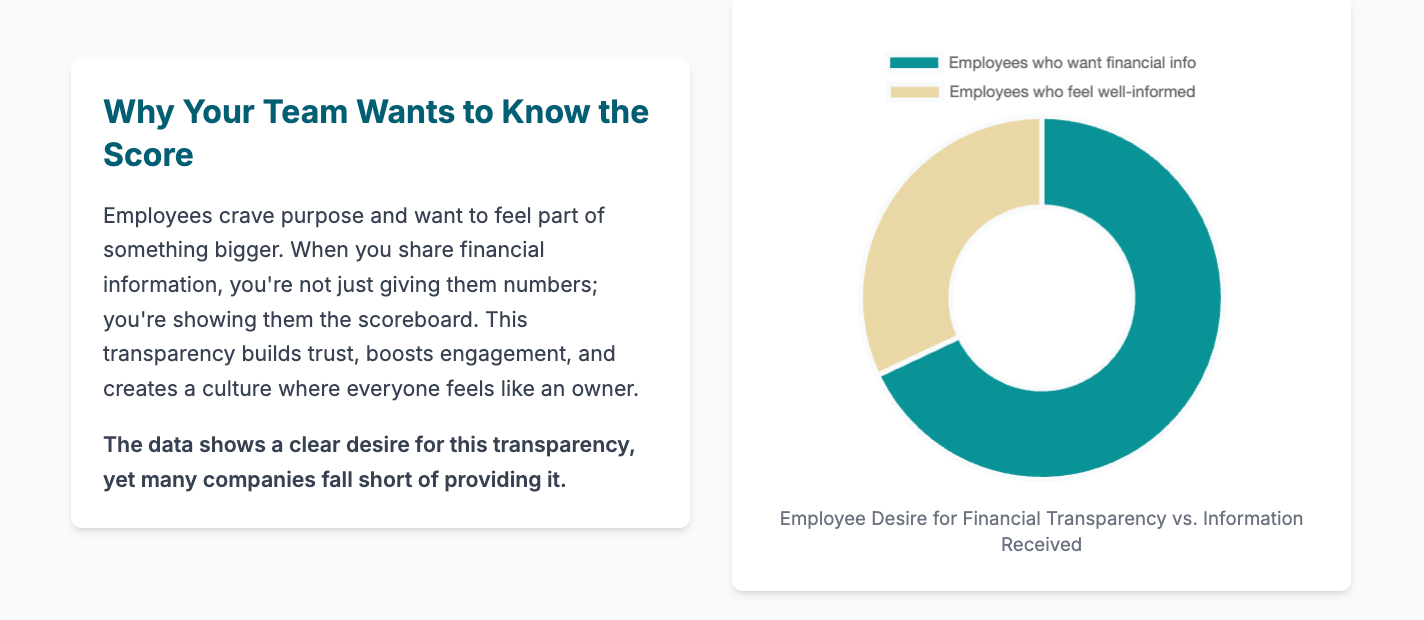

Before we get into the how, let's talk about the why. Your employees aren't just clocking in for a paycheck (well, not just for that). They crave a sense of purpose and want to feel like they're part of something bigger. They need to know their work matters and that they're contributing to a winning team.

When you share financial information openly, you're not just throwing numbers at them—you're showing them the scoreboard. You're connecting their daily efforts to real business results. This transparency builds trust, boosts engagement, and creates a culture where everyone feels like an owner, not just an employee.

Think about it: Would you play a sport with more passion if you could see the score, or if someone just told you to "keep playing hard" without any feedback? Your team is no different.

The Power of Open-Book Management

Open-book management isn't just a buzzword; it's a game-changer. Companies like Zingerman's Deli in Ann Arbor have built empires by teaching every employee, from dishwashers to managers, how to read and understand the financials.

The result? Employees who think like owners, proactively spot opportunities for improvement, and take immense pride in moving the needle on key metrics. But there's a catch: you can't just dump a profit and loss statement on the breakroom table and call it a day. You have to make the numbers accessible, relevant, and—dare we say it—interesting.

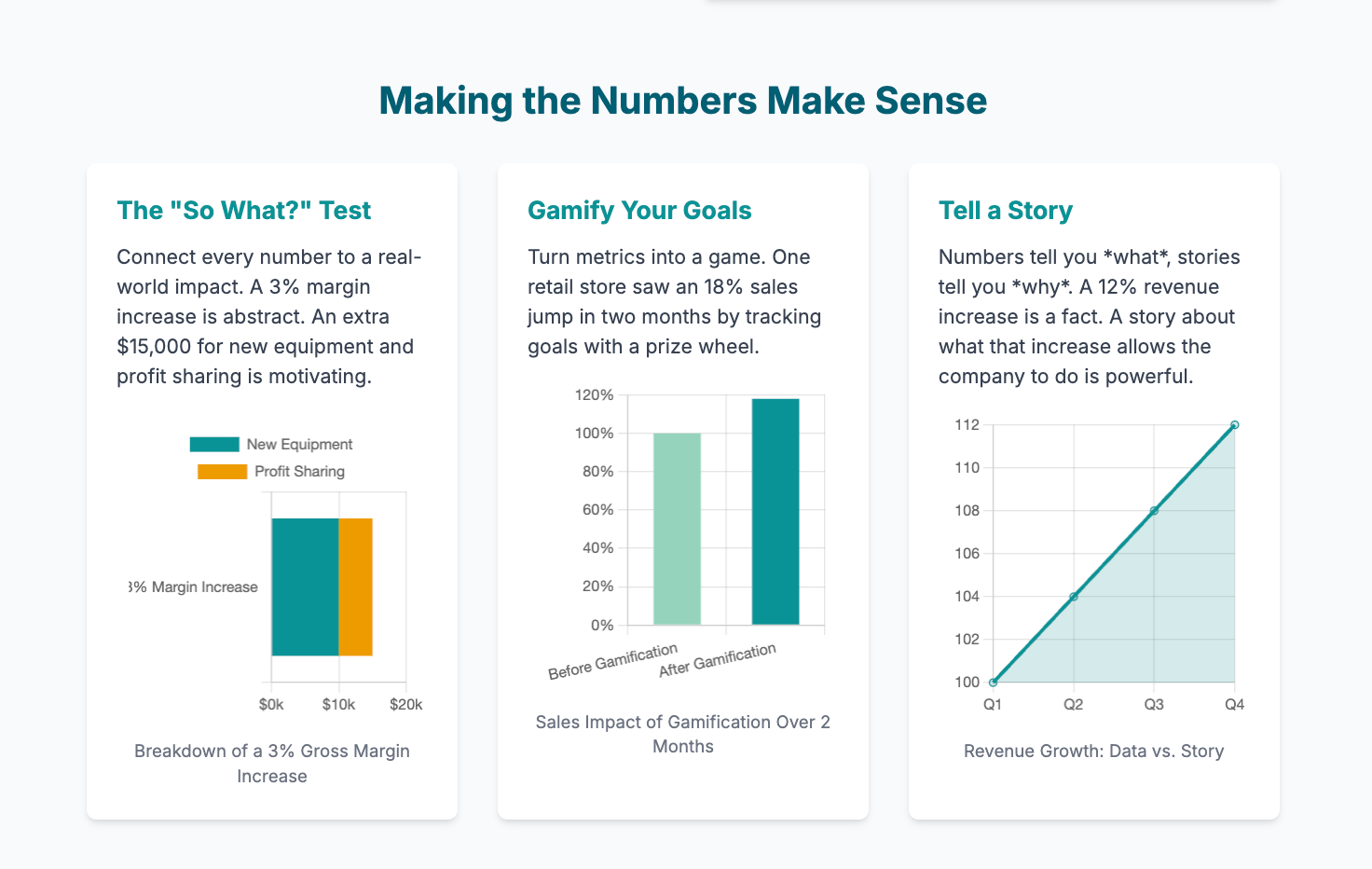

Start with the "So What?" Test

Every number you share must pass the "So What?" test. If you tell your team that gross margins increased by 3%, their silent, internal response will be, "So what? What does that mean for me?"

Instead, frame it with impact:

"Great news—our gross margins increased by 3% last quarter, which gives us an extra $15,000 to work with. We're investing $10,000 in that new equipment you've been asking for to make your jobs easier, and the other $5,000 is going directly into our profit-sharing pool."

Now that's a number that lands.

From Snoozefest to Strategy Session: Reinventing the Budget Meeting

Traditional budget meetings often feel like a necessary evil. Here’s how to flip the script and make them productive and even enjoyable.

1. Ditch the Stuffy Conference Room Who says financial talks require a boardroom? Host your meeting at a local coffee shop, cater lunch, or even hold a walking meeting. A simple change of scenery immediately signals that this isn't your typical, boring review.

2. Use Visuals That Don't Suck Step away from the 47-slide PowerPoint. Use simple, powerful visuals that tell a story.

- Draw a thermometer on a whiteboard to show progress toward a sales goal.

- Use actual pies to create a pie chart showing revenue breakdown (bonus: you get to eat the props).

- Create a simple infographic with a tool like Canva to make the data digestible and shareable.

One small business owner uses Monopoly money to explain cash flow. Each department head gets a stack representing their budget, and they physically move the money around to show how their decisions impact the entire company. It’s tactile, memorable, and far more engaging than any spreadsheet.

3. Gamify Your Goals Turn your metrics into a game.

- Create friendly competition between departments or shifts with a visible leaderboard.

- Celebrate wins with silly trophies, a preferred parking spot, or bragging rights.

- Set up a prize wheel. One retail store saw an 18% jump in sales after they started tracking daily goals with a giant wheel they'd spin for prizes whenever a target was hit.

The Power of Financial Storytelling

Numbers tell you what happened. Stories tell you why it matters. Instead of stating a dry fact, weave it into a narrative.

Instead of this: "Revenue increased 12% year-over-year."

Try this:

"Remember last year when we were so tight on cash we almost had to cancel the holiday party? Well, thanks to everyone's hard work, we've grown revenue by 12%. That's enough to not only have an amazing party but also hire two new team members to help with the workload."

See the difference? One is data. The other is a story that connects emotionally and shows the real-world impact of their collective effort.

Break Down the Jargon Barrier

Nothing kills engagement faster than financial jargon. Your team doesn't need an MBA to understand the health of the business. Translate finance-speak into plain English.

- Cash Flow: "Money coming in versus money going out."

- Gross Margin: "What's left after we pay for the things we sell."

- Operating Expenses: "The cost of keeping the lights on."

- EBITDA: Just don't. Seriously. Find a simpler, more relevant metric.

Create a one-page glossary of key terms if you must, but always favor simple, everyday language.

The Weekly Huddle: Bite-Sized Financial Updates

Instead of a massive, overwhelming quarterly review, try bite-sized weekly huddles. Spend 10-15 minutes each week focusing on one or two critical numbers. This approach is powerful because it's:

- Less Overwhelming: It's easier to digest one metric than twenty.

- Timely: You can address issues before they snowball into major problems.

- A Gradual Teacher: It builds financial literacy over time, like learning a language through daily practice.

- Aligning: These regular touchpoints keep everyone focused on the same priorities.

One manufacturing company implemented "Metric Mondays"—a 15-minute standing meeting to review one key number, discuss what influenced it, and brainstorm improvements. Their employee engagement scores shot up by 30% in six months.

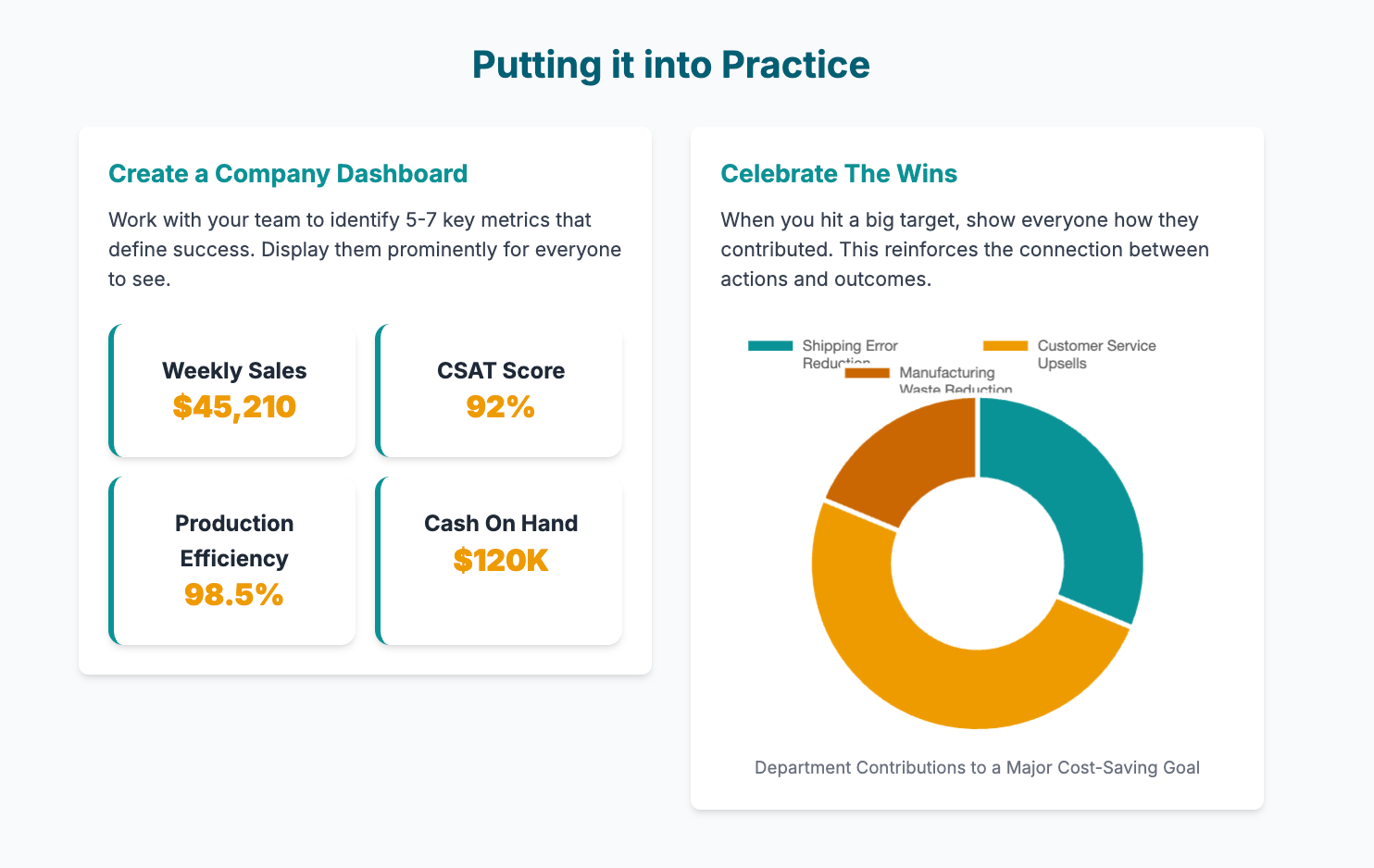

Create Your Company's Dashboard

Every car has a dashboard showing the essentials: speed, fuel, engine temperature. Your business needs one too. Work with your team to identify 5-7 key metrics that define success for your company. These might include:

- Daily/Weekly Sales

- Customer Satisfaction Score (CSAT)

- Production Efficiency or Output

- Cash on Hand

- Employee Retention Rate

Display these numbers prominently—on a TV monitor in the breakroom, in a daily email, or through a shared dashboard. When everyone can see the same scorecard, you create powerful alignment without needing to micromanage.

The Art of Celebrating Financial Wins

Positive reinforcement is crucial. When you hit a financial target, celebrate! The key is to make the celebration proportional to the achievement and tie it directly to the numbers.

- Small Win: Bring in donuts and announce, "We beat yesterday's sales target by 10%, so breakfast is on the company!"

- Big Win: Throw a pizza party and break down exactly how each team contributed. "Shipping reduced errors by 50%, saving us $5,000. Customer service increased upsells by 20%, adding $8,000. This is why we're celebrating!"

This approach reinforces the direct link between actions and outcomes and builds a culture of shared success.

Handling the Tough Conversations

Not all financial news is good. When you have to share challenging information, do it in a way that builds trust, not fear.

- Be Honest, Not Alarmist: "Sales are down 15% this month" is honest but scary. "Sales are down 15% this month. We've dug in and identified three key reasons why, and here's our plan to get back on track" is honest and constructive.

- Focus on What You Can Control: Don't dwell on market conditions or competitor actions. Focus the conversation on what your team can directly influence: customer service, product quality, and operational efficiency.

- Ask for Their Input: Some of the best cost-saving and revenue-generating ideas come from your front-line employees. Present the challenge and ask, "What are you seeing that we might be missing?" You'll be amazed at the solutions that emerge.

Your 30-Day Implementation Plan

Ready to get started? Here's a simple plan to transform your financial communication in one month.

- Week 1: Work with your team to identify your 5-7 key metrics and create a simple, visible dashboard.

- Week 2: Hold your first casual, 15-minute financial huddle. Focus on just one or two numbers.

- Week 3: Introduce one creative visual or gamification element to your huddle.

- Week 4: Host your first monthly "State of the Business" address to tell the bigger story.

Start small, be consistent, and listen to feedback.

The Bottom Line

Talking about money with your team doesn't have to be boring. By making financial conversations accessible, relevant, and even fun, you empower your employees to think and act like owners. The businesses that thrive are the ones where every team member understands the score and knows how they can help win the game.

You don't need to be a financial expert to start. You just need to care enough to translate the numbers into a story your team can rally behind.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm