Financial Red Flags: 5 Signs Your Business is in Trouble (Before It's Too Late)

Hey there, fellow entrepreneur. Let’s have a frank conversation. You pour your heart, soul, and probably more coffee than is medically advisable into your business. You’re the CEO, the head of marketing, the chief bottle-washer, and everything in between. You live and breathe your company, and the thought of it failing is, frankly, terrifying.

But here’s a tough question: How well do you really know your business's financial health? It’s easy to get caught up in the passion of your work and operate on gut feelings. You see money coming in, you pay the bills, and you assume everything is okay. The problem is, serious financial trouble doesn't usually announce itself with a marching band and a fireworks display. It starts as a whisper, a tiny crack in the foundation that, if ignored, can bring the whole house down.

See these signs? You might be closer to failure than you think. Ignoring these subtle but critical financial warning signs is one of the biggest contributors to business failure. The good news is that seeing them early gives you the power to act. This isn't about fear-mongering; it's about empowerment. It's about swapping anxiety for awareness and turning potential pitfalls into a strategic pivot. Let's pull back the curtain on the five most critical financial red flags that signal your business is in trouble, and what you can do about them right now.

Red Flag #1: Your Profit Margins Are Shrinking

This is one of the most deceptive financial warning signs because, on the surface, things might look great. Your revenue could be growing, you might be busier than ever, and you feel successful. But if the cost of doing business is growing faster than your revenue, you're on a dangerous path. You're working harder for less money, and that's simply not sustainable.

Your profit margin is the percentage of revenue you keep after accounting for all your costs. There are two main types to watch:

- Gross Profit Margin: This shows what you make after subtracting the direct costs of producing and selling your goods or services (Cost of Goods Sold or COGS).

- Net Profit Margin: This is the "bottom line." It’s what’s left after all expenses are paid, including rent, salaries, marketing, and taxes.

Example in the Wild:

Imagine you own a trendy coffee shop. Last year, you sold a latte for $4.00. The coffee, milk, and cup (your COGS) cost you $1.00, giving you a gross profit of $3.00 and a 75% gross margin. This year, you’re selling more lattes than ever, but the price of coffee beans has shot up. Your COGS for that same $4.00 latte is now $1.75. Your gross profit has shrunk to $2.25, and your margin has dropped to 56%. Even though you're selling more, you're making significantly less on each sale. If your rent and payroll have also increased, your net margin is getting squeezed even tighter.

How to Spot and Fix It:

- Calculate and Track Relentlessly: Don't guess. Calculate your gross and net profit margins every single month. Put it on your calendar. Use accounting software like QuickBooks or Xero to automate this. The trend is what matters. A one-month dip might be a fluke; a six-month slide is a siren.

- Analyze Your COGS: Where are your direct costs creeping up? Can you find a new supplier for your coffee beans? Can you negotiate a better price by buying in larger quantities? Every dollar saved on COGS goes directly to your gross profit.

- Review Your Pricing Strategy: Many business owners are terrified to raise prices. They fear losing customers. But if your costs have permanently increased, your prices must reflect that new reality. A small, well-communicated price increase is often far less damaging than slowly going broke.

- Optimize Your Overhead: Look at your net margin. Are there subscriptions you're not using? Is your marketing spend delivering a positive return on investment (ROI)? Cut the fat, but be careful not to cut muscle. Don't slash the marketing that's actually bringing in customers.

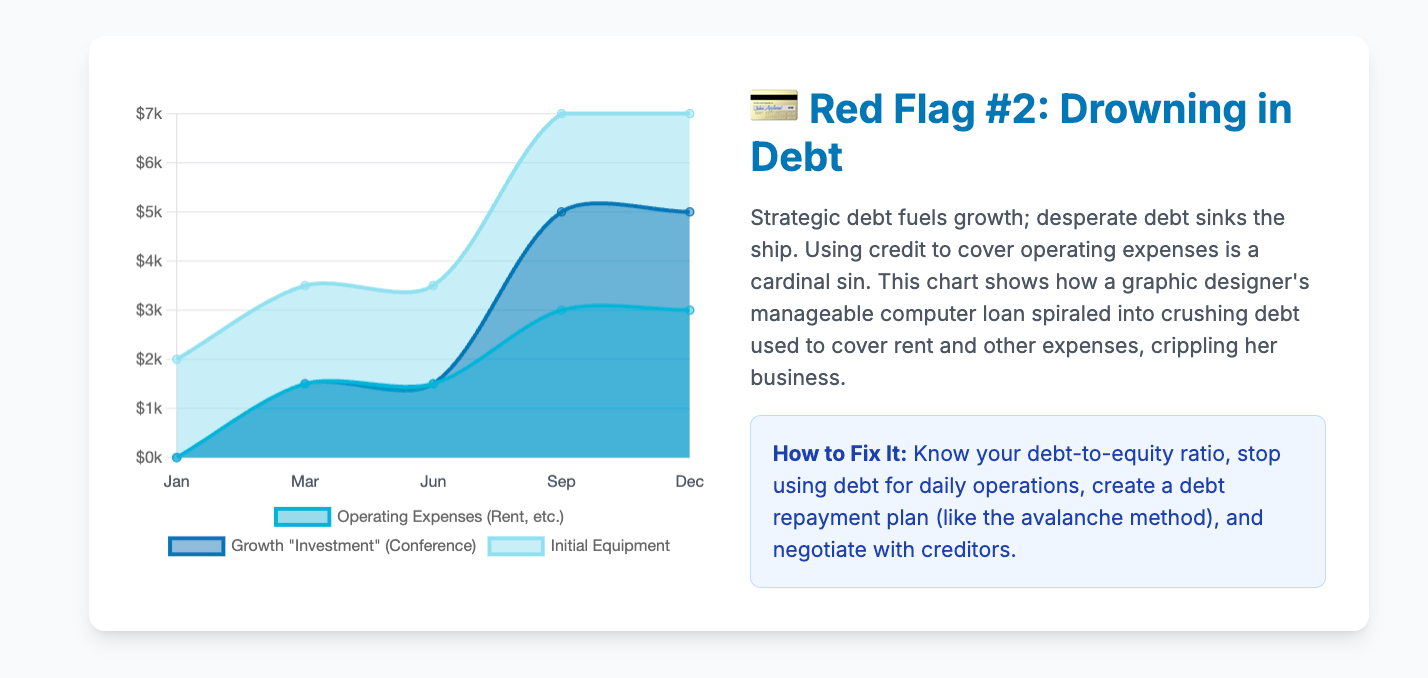

Red Flag #2: You're Drowning in Debt

Debt isn't inherently evil. Smart business owners often use loans or credit to fuel growth, purchase essential equipment, or manage temporary cash flow problems. But there's a world of difference between strategic debt and desperate debt. When you start "robbing Peter to pay Paul"—using one line of credit to make the minimum payment on another—you're no longer in control. The debt is controlling you.

This is a major indicator of business risk. High debt levels mean a huge portion of your income is immediately eaten up by interest payments, leaving you with very little to reinvest in the business, pay yourself, or build a safety net.

Example in the Wild:

A freelance graphic designer starts her business with a new computer financed on a credit card. That’s manageable. Then, a client pays late, so she uses the credit card to cover her rent. She decides to attend a big conference to find new clients and puts the flight and hotel on the card, too. Soon, she's maxed out. She takes out a small business loan not to invest in new software, but just to make the crushing credit card payments. Her monthly income is now almost entirely dedicated to servicing debt, and she has zero flexibility to handle a slow month or an unexpected expense.

How to Spot and Fix It:

- Know Your Debt-to-Equity Ratio: This sounds complicated, but it's simple. It’s your total liabilities (what you owe) divided by your total equity (what you own). A high ratio means you're heavily reliant on creditors. Track this quarterly.

- Stop Using Debt for Operating Expenses: This is a cardinal sin. If you need to use a credit card to pay for rent, utilities, or payroll, it's a massive red flag that your core business model is not generating enough cash.

- Create a Debt Repayment Plan: List all your debts from the highest interest rate to the lowest. This is the "avalanche" method. Throw every spare dollar at the debt with the highest interest rate while making minimum payments on the others. Once it's paid off, roll that entire payment amount onto the next-highest-rate debt. The psychological win and financial momentum are powerful.

- Negotiate with Creditors: If you're truly struggling, don't hide. Call your creditors. Explain the situation and ask if they can offer a temporary reduction in interest rates or a modified payment plan. It's not a guarantee, but it's always worth asking.

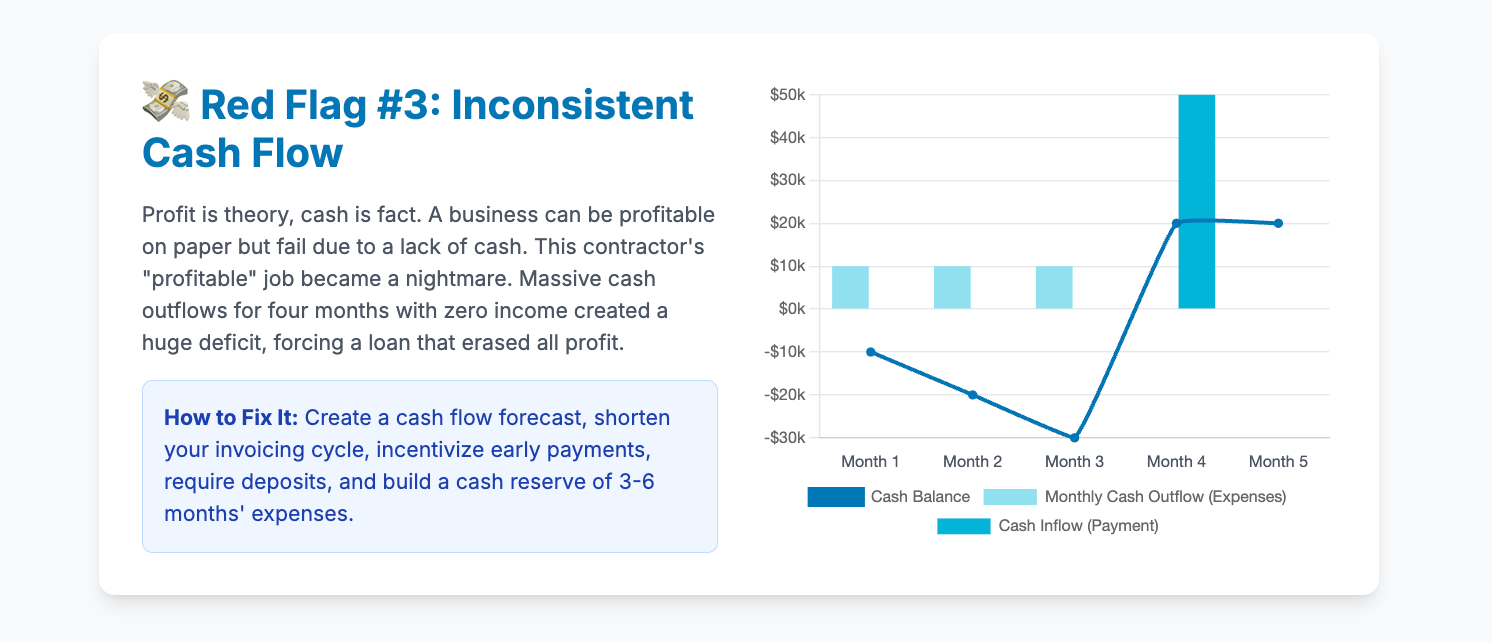

Red Flag #3: Inconsistent and Unpredictable Cash Flow

Cash flow is the lifeblood of your business. It's the rhythm of money moving in and out of your company. Profit is a long-term measure of success, but cash is what keeps the lights on today. You can have a profitable business on paper and still face business failure because you don't have enough cash in the bank to pay your employees this Friday. This is the definition of cash flow problems.

Inconsistent cash flow feels like a frantic cycle of feast and famine. One month you feel rich, the next you're scraping by. This volatility makes it impossible to plan, invest, or grow.

Example in the Wild:

A construction contractor wins a huge project. It's a "profitable" job that will take three months to complete. The problem? He has to buy all the materials and pay his crew weekly, but the client's contract states they will pay him in one lump sum 30 days after the project is complete. For four months, he has massive amounts of cash flowing out and nothing flowing in. He has to take out a high-interest loan just to survive, which eats away the entire profit from the job he was so excited about.

How to Spot and Fix It:

- Create a Cash Flow Forecast: This is non-negotiable. It’s a simple spreadsheet that projects your cash inflows (sales, invoice payments) and outflows (rent, payroll, supplies) over the next 3, 6, or 12 months. This is your crystal ball. It allows you to see future shortfalls and plan for them before they happen.

- Shorten Your Invoicing Cycle: Are you waiting until the end of the month to send invoices? Stop. Invoice immediately upon completion of the work. The sooner you send the invoice, the sooner you get paid.

- Incentivize Early Payments: Offer a small discount (e.g., 2% off) for clients who pay their invoices within 10 days. The small hit to your profit is often well worth the benefit of having cash in hand sooner.

- Require Deposits or Milestone Payments: For large projects, never finance the entire job for your client. Require a deposit upfront (e.g., 30-50%) and set up milestone payments throughout the project. This ensures your cash flow stays aligned with your expenses.

- Build a Cash Reserve: Aim to have at least 3-6 months' worth of essential operating expenses saved in a separate business savings account. This is your emergency fund. It’s what turns a catastrophe into a manageable inconvenience.

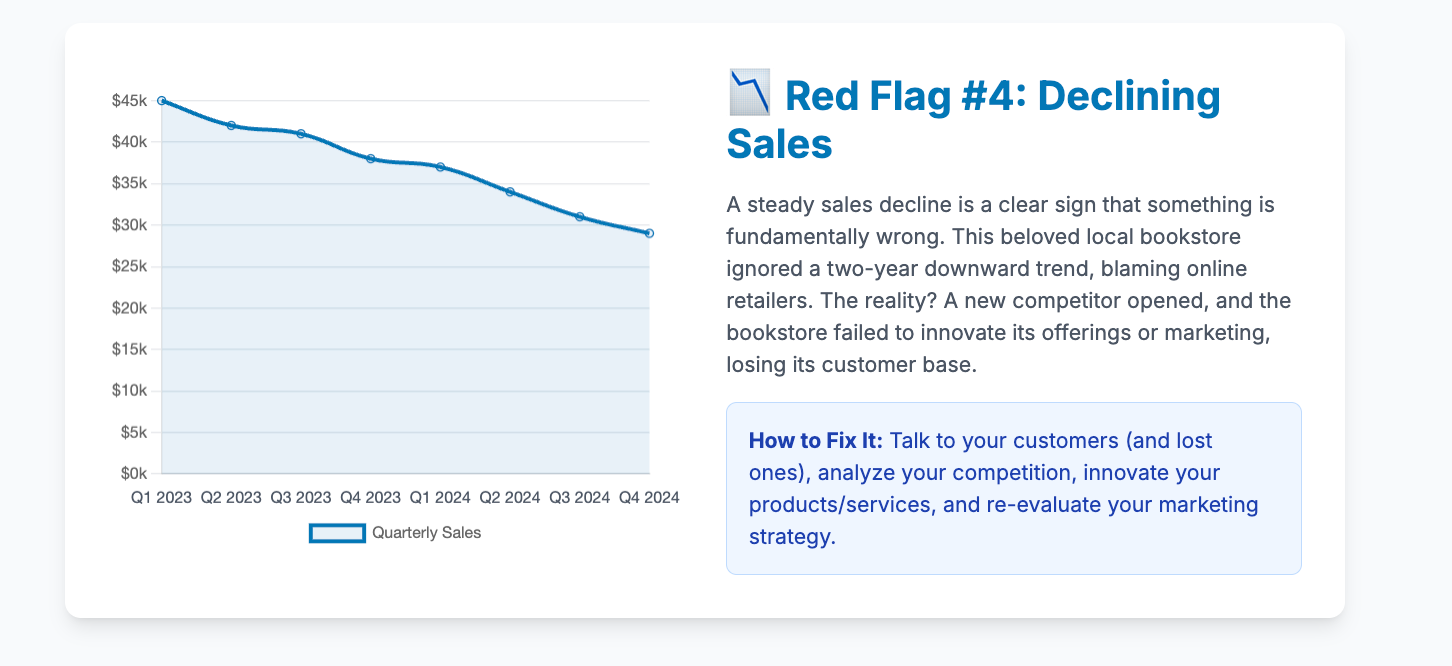

Red Flag #4: Your Sales are Declining (or Stagnant)

A steady decline in sales is the most obvious financial warning sign, but it's amazing how many business owners explain it away. "It's just a slow season." "The economy is bad." "It's a temporary blip." While sometimes true, a consistent downward trend is a sign that something is fundamentally wrong.

Your market might be changing, a new competitor might be eating your lunch, your marketing might be stale, or your product might no longer be meeting customer needs. Stagnant sales are just as dangerous. A business that isn't growing is, in reality, shrinking relative to inflation and market growth.

Example in the Wild:

A beloved local bookstore has been a community staple for 20 years. But over the last two years, sales have slowly but consistently ticked downward. The owner blames Amazon, but the reality is more nuanced. A new, modern bookstore opened across town with a coffee shop, author events, and a strong social media presence. The old bookstore's marketing is non-existent, their website is outdated, and they haven't changed their inventory in years. Their loyal customers are aging, and they're not attracting a new generation of readers.

How to Spot and Fix It:

- Talk to Your Customers (and Lost Customers): Why are they buying less? Why did they leave? Was it price? Service? A better offer elsewhere? A simple survey or a few honest phone calls can provide invaluable, and sometimes painful, insights.

- Analyze Your Competition: Do a deep dive into what your successful competitors are doing. What are their prices? What is their marketing message? How are they using social media? What can you learn and adapt?

- Innovate Your Offerings: The market is not static. Customer needs evolve. Do you need to update your service? Add a new feature to your product? Bundle services in a new way? Don't let your business become a relic.

- Re-evaluate Your Marketing: Is your message still resonating? Are you advertising on the right channels to reach your ideal customer? If you've been doing the same thing for years, it's time for a refresh. What worked in 2020 may not work today.

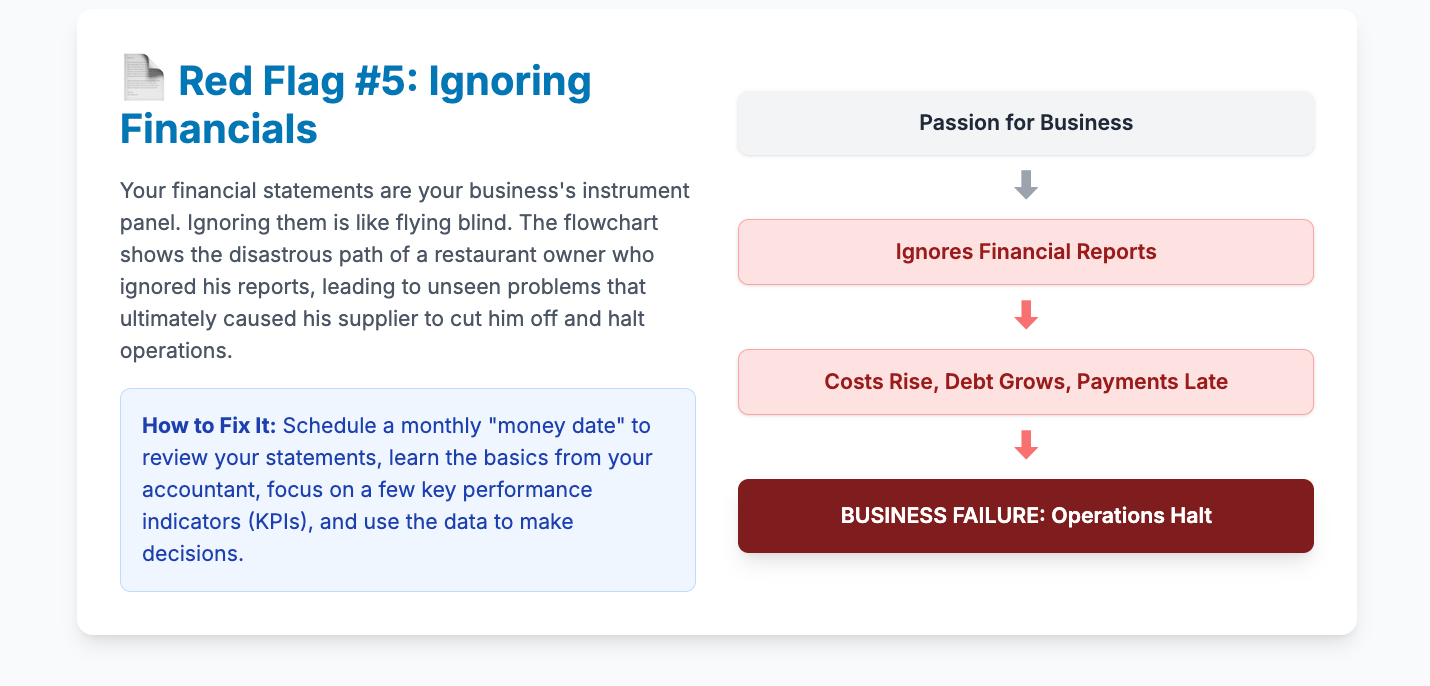

Red Flag #5: You're Ignoring Your Financial Statements

This is the red flag that enables all the others. Your financial statements—the Income Statement (P&L), the Balance Sheet, and the Cash Flow Statement—are the instrument panel of your business. Flying a plane without looking at the instruments is reckless, and so is running a business without understanding your financials.

Many owners find this part of the business boring, intimidating, or confusing, so they avoid it. They hand a shoebox of receipts to their accountant once a year and hope for the best. This is a recipe for disaster. You don't need to be a CPA, but you absolutely must understand the story your numbers are telling you.

Example in the Wild:

A restaurant owner is passionate about food but hates numbers. His accountant prepares monthly reports, but they go into a drawer, unread. He feels like the restaurant is busy, but he doesn't realize his food costs have skyrocketed (shrinking margins), he's taken on too much debt to renovate (high debt), and his accounts payable are stretching to 90 days (cash flow problems). One day, his primary food supplier cuts him off for non-payment, and the entire operation grinds to a halt. The financial warning signs were all there, sitting in that drawer, for months.

How to Spot and Fix It:

- Schedule a Monthly "Money Date": Set aside 1-2 hours every single month to sit down with your financial statements. No distractions.

- Learn the Basics: Ask your accountant or bookkeeper to walk you through your reports. Ask them, "What are the three most important numbers on this page I should be looking at? What do they mean? What should I be worried about?" Don't be afraid to say, "Explain that to me like I'm five."

- Focus on Key Performance Indicators (KPIs): You don't need to track 100 different metrics. Identify the 5-7 most important numbers for your specific business. For the coffee shop, it might be average customer ticket, profit margin per latte, and daily sales. For the contractor, it might be project profitability and accounts receivable aging.

- Use the Data to Make Decisions: The point of looking at your numbers isn't just to know them; it's to use them. Your financials should inform every major decision you make, from hiring a new employee to launching a new product to raising your prices.

The Bottom Line: From Fear to Action

Seeing one of these red flags doesn't mean your business is doomed. It means it's time to pay attention. It's a call to action. The most successful entrepreneurs aren't the ones who never face problems; they're the ones who see them coming and act decisively.

Stop running your business on hope and gut feelings alone. Embrace your numbers. Make them your ally. By regularly monitoring your margins, managing your debt, forecasting your cash flow, analyzing your sales, and reading your financial statements, you transform from a reactive victim of circumstance into a proactive, strategic CEO. You can spot the financial warning signs early, mitigate your business risk, and steer your company away from the rocks of business failure and toward the open waters of sustainable success. Now, go open up that financial report. Your future self will thank you.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm