Finally, a Bookkeeping System for People Who Hate Bookkeeping

Hate Bookkeeping? Here's the Absolute Simplest Way to Stay Organized.

Let's be honest, you didn't start your own business because you have a burning passion for spreadsheets and financial statements. You're a creator, a consultant, a maker, a doer. The very word "bookkeeping" is enough to send a shiver of dread down the spine of even the most seasoned solopreneur. It's that nagging task on your to-do list that's perpetually pushed to "later," a growing pile of receipts in a shoebox, and a vague sense of anxiety about tax time.

But what if you could implement a "bare minimum" system that keeps you organized, empowers you to make smarter business decisions, and saves you from a world of pain when the taxman comes knocking?

This isn't about becoming a certified public accountant overnight. This is about creating a simple, sustainable, and surprisingly empowering bookkeeping setup that works for you, the busy solopreneur.

Your 1-Hour Quick-Start Guide

Feeling overwhelmed? Don't read another word. Just do these three things in the next hour. This is your first, giant leap towards financial sanity.

- Open a Fee-Free Business Checking Account Online. Go to a bank you already use or an online-only bank. All you need is a dedicated space for business income and expenses. Do it now.

- Sign Up for a Free Bookkeeping Software Trial. Choose one from the toolkit below (Wave is free forever). Connect your new business bank account. This will take 10 minutes.

- Schedule a Weekly "Money Date" in Your Calendar. Block out 30 minutes for the same time every week. When the reminder pops up, your only job is to open your bookkeeping software and categorize the transactions from the past week. That's it.

Done? Amazing. You've just built the foundation of a solid bookkeeping system. Now, let's explore why this matters.

The Real Cost of Ignoring Your Books (It's More Than Just Money)

Before we dive into the "how," let's get real about the "why." Neglecting your bookkeeping isn't just about a messy office. It has tangible, often stressful, consequences:

- Missed Tax Deductions: Every forgotten coffee meeting with a client, every unrecorded software subscription, is money you're leaving on the table. Proper tracking ensures you claim every legitimate deduction you're entitled to.

- Chronic Financial Anxiety: When you don't know your numbers, you're flying blind. You're left guessing about your profitability, your cash flow, and whether you can afford that new piece of equipment. This uncertainty is a major source of stress for many solopreneurs.

- Poor Business Decisions: Should you raise your rates? Can you afford to hire a virtual assistant? Without a clear picture of your financial health, these critical decisions are based on gut feelings rather than hard data.

- A Nightmare at Tax Time: The frantic, last-minute scramble to organize a year's worth of financial records is a recipe for errors, missed deadlines, and potentially costly penalties.

- Roadblocks to Growth: If you ever want to apply for a business loan, a grant, or even just get a clear sense of your business's value, you'll need accurate financial records.

Think of your bookkeeping not as a chore, but as the control panel for your business. It's the source of truth that tells you what's working, what's not, and where you're headed.

The Three Pillars of a "Bare Minimum" Bookkeeping Setup

Ready to build a system that won't make you want to tear your hair out? Here are the three non-negotiable pillars of a simple and effective bookkeeping setup for any solopreneur.

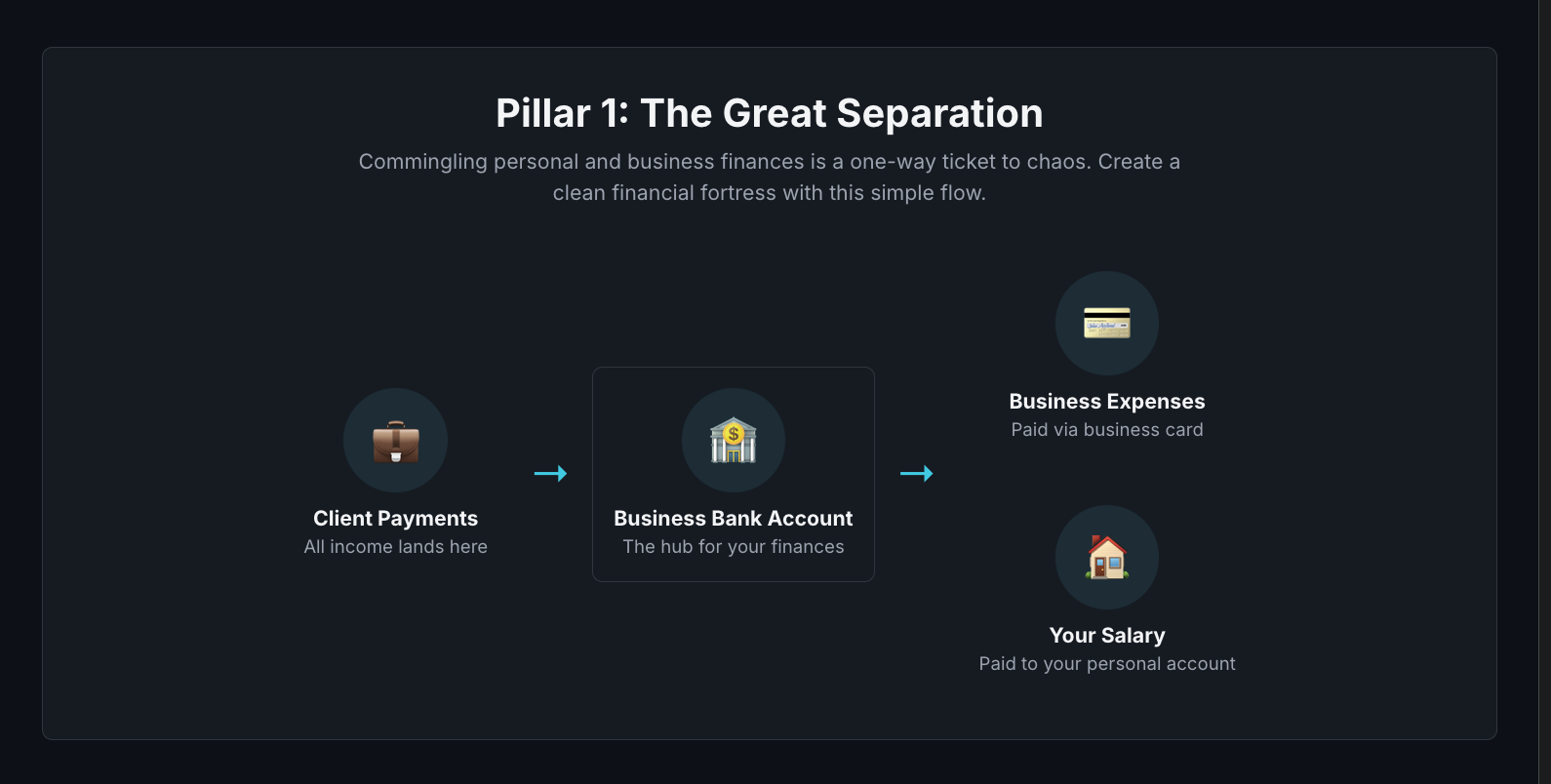

Pillar 1: The Great Separation - Your Business Finances Deserve Their Own Home

This is the single most important step you can take to simplify your bookkeeping. Commingling your personal and business finances is a one-way ticket to chaos. Imagine trying to untangle your grocery bill from your client invoices at the end of the year. No, thank you.

Your Actionable To-Do List:

- Open a Dedicated Business Bank Account: This is non-negotiable. All income from your business should be deposited into this account, and all business expenses should be paid from it. Most banks offer business checking accounts with low or no fees.

- Get a Business Credit or Debit Card: Use this card exclusively for business purchases. This creates a clean, easily trackable record of your spending.

- Pay Yourself a Salary: Instead of randomly dipping into your business account for personal expenses, establish a regular transfer from your business account to your personal account. This "owner's draw" or "salary" makes your personal income predictable and keeps your business finances pristine.

Best Practice Tip: When you receive a payment from a client, adopt the "Profit First" principle in its simplest form: immediately transfer a percentage (a good starting point is 25-30%) into a separate savings account specifically for taxes. This way, you won't be caught off guard by a hefty tax bill.

Pillar 2: Track Everything - The Art of Effortless Expense and Income Management

Once you've separated your finances, the next step is to diligently track every dollar that comes in and goes out of your business. The key here is to make this process as automated and painless as possible.

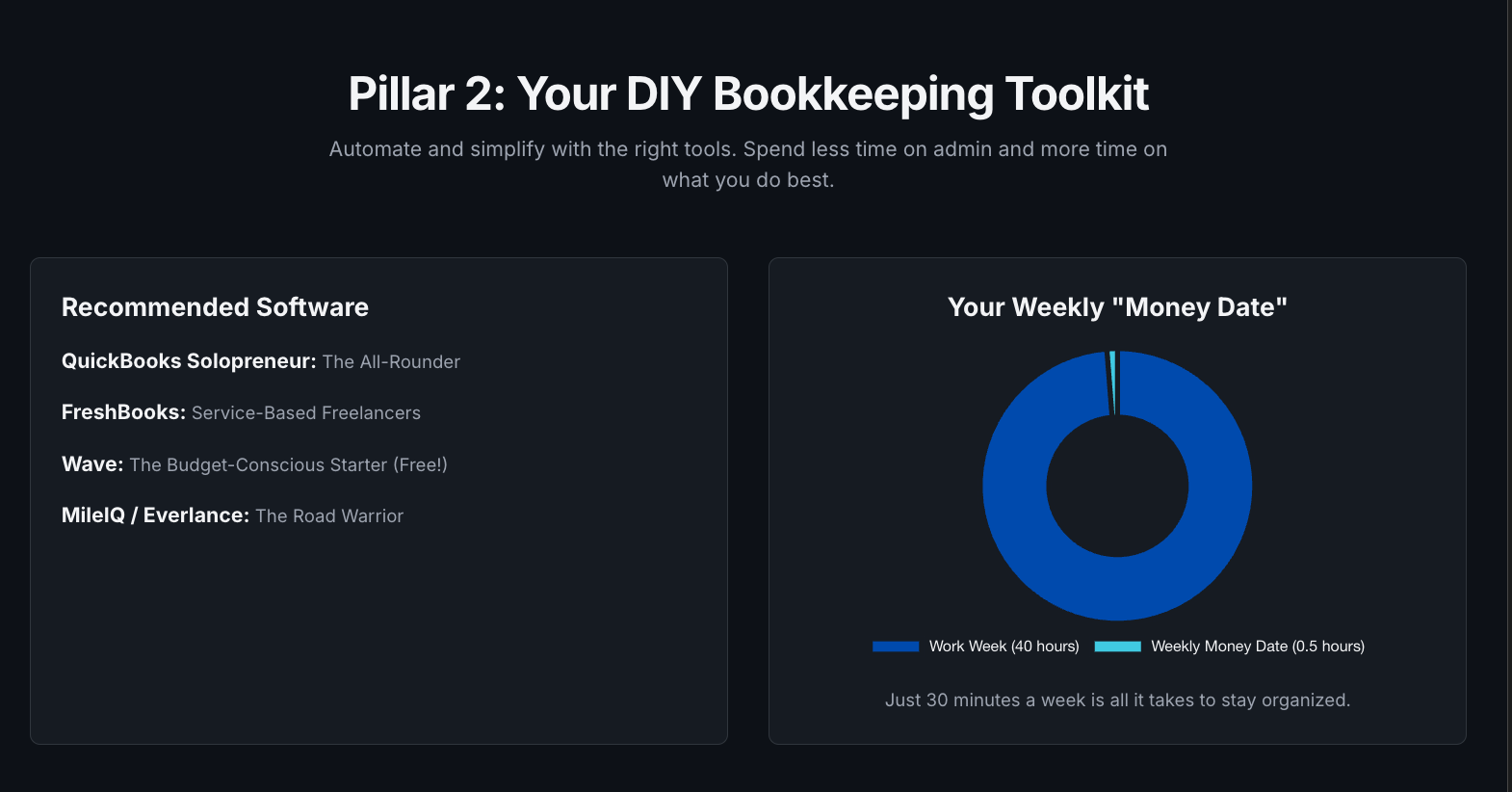

Your DIY Bookkeeping Toolkit

| Tool | Best For | Pros | Cons |

|---|---|---|---|

| QuickBooks Solopreneur | The All-Rounder | Specifically for solopreneurs, great tax estimation, simple interface, easy receipt capture. | Monthly fee after trial. |

| FreshBooks | Service-Based Freelancers | Excellent invoicing and time-tracking, very intuitive and user-friendly. | Can be pricier than other options. |

| Wave | The Budget-Conscious Starter | Free! Solid invoicing and accounting. A perfect starting point. | Basic features, mobile app is for receipt scanning only. |

| MileIQ / Everlance | The Road Warrior | Automatically tracks business mileage using your phone's GPS for easy deductions. | Subscription-based. |

Your Actionable To-Do List:

- Choose Your Weapon & Connect Your Accounts: The magic of modern bookkeeping software lies in its ability to connect directly to your business bank account and credit card. This means your transactions are automatically imported, saving you hours of manual data entry.

- The Weekly "Money Date": Keep that 30-minute weekly appointment with yourself. During this time, you'll categorize your expenses (e.g., "office supplies," "software subscriptions," "client meals"), and make sure everything is in order. A consistent weekly habit is far less daunting than a massive year-end cleanup.

Best Practice Tip: Use your software's receipt-scanning app. When you buy something for your business, snap a photo of the receipt immediately. This eliminates the dreaded shoebox of faded receipts and ensures you have a digital record of every expense.

Pillar 3: Know Your Numbers - Understanding the Story Your Finances Tell

You don't need to be a Wall Street analyst to understand the financial health of your business. For a solopreneur, there's really only one key financial report you need to consistently review: the Profit and Loss (P&L) Statement.

The P&L statement (sometimes called an "Income Statement") is a simple summary of your income and expenses over a specific period (e.g., a month, a quarter, a year). It answers the fundamental question: "Am I making money?"

A Simplified P&L Looks Like This:

- Income:

- Client Payments: $10,000

- Total Income: $10,000

- Expenses:

- Software Subscriptions: $150

- Home Office Expenses: $300

- Marketing and Advertising: $500

- Contractor Payments: $1,000

- Business Travel: $400

- Total Expenses: $2,350

- Net Profit (or Loss): $7,650

Your Actionable To-Do List:

- Generate Your P&L Statement Monthly: Your bookkeeping software can create this report for you with a single click.

- Ask Yourself These Questions:

- Is my income growing, shrinking, or staying the same?

- What are my biggest expenses? Are there any I can reduce?

- Am I consistently profitable?

- How does this month compare to last month or the same month last year?

Best Practice Tip: Don't just look at the numbers. Use them to make informed decisions. For example, if you see your software expenses creeping up, you might decide to cancel a subscription you're no longer using. If your income is stagnant, it might be a sign that it's time to raise your rates or seek out new clients.

Making Tax Time a Breeze: A Year-Round Approach

The beauty of this "bare minimum" bookkeeping setup is that it makes tax time significantly less stressful. When you've been diligently tracking your income and expenses all year, you won't have to scramble.

Your Tax Prep Checklist:

- Pay Your Quarterly Estimated Taxes: As a solopreneur, you must pay income and self-employment taxes throughout the year. Mark these deadlines on your calendar:

- April 15 (for Jan 1 - Mar 31 income)

- June 15 (for Apr 1 - May 31 income)

- September 15 (for Jun 1 - Aug 31 income)

- January 15 of next year (for Sep 1 - Dec 31 income)

- Know Your Deductions: Common tax deductions for solopreneurs include:

- Home Office: You can use the Simplified Method (a standard deduction of $5 per square foot, up to 300 sq ft) or the Actual Expense Method (tracking a percentage of your actual home expenses like mortgage interest, rent, utilities, etc.).

- Business software and subscriptions

- Office supplies & equipment

- Marketing and advertising costs

- Business mileage and travel

- A portion of your health insurance premiums

- Professional development and education

- Business meals (with clients)

When to Call in a Pro: Leveling Up Your Financial Game

This DIY system is perfect for most solopreneurs. But as your business grows, you might reach a point where doing it all yourself is no longer the best use of your time.

Signs It's Time to Hire a Bookkeeper or CPA:

- You're spending more than a few hours a month on bookkeeping.

- Your business is growing rapidly, with multiple income streams and complex expenses.

- You're considering hiring your first employee or contractor.

- You want to make a major business change, like forming an LLC or S-Corp.

- You simply hate doing it and the stress outweighs the cost of hiring help.

A good bookkeeper can manage your day-to-day records, while a CPA can provide high-level tax planning and business advice.

You've Got This: From Bookkeeping Hater to Financially Empowered Solopreneur

The "bare minimum" bookkeeping setup isn't about adding another complicated task to your already overflowing plate. It's about creating a simple, sustainable system that removes financial uncertainty and empowers you to build a more profitable and resilient business.

Start today. Open that business bank account. Sign up for a free trial of a bookkeeping software. Schedule your first "money date." In just a few small steps, you can transform your relationship with your finances from one of dread to one of clarity and control. And that, for any solopreneur, is a priceless asset.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm