Don't Let Year One Kill Your Dream: The Startup Founder's Guide to Cash Flow.

Let me paint you a picture that might feel uncomfortably familiar.

It's 2 AM. You're staring at your laptop screen, toggling between your bank account (depressing) and your revenue projections (optimistic fiction). Your credit card is maxed out, your savings account is a distant memory, and you're wondering if that corporate job you left six months ago would take you back.

Welcome to the startup journey that nobody Instagram-posts about.

I've been there. So have thousands of other founders who eventually made it to the other side. The difference between those who survive their first year in business and those who don't? It's not about having more money to start with. It's about understanding the brutal, beautiful reality of cash flow in year one—and knowing exactly what to do about it.

The Truth Nobody Tells You About Starting a Business

Here's what the motivational speakers won't tell you: The first year isn't about growth. It's about survival. And survival comes down to one thing: cash flow.

When I started my digital marketing agency with $1,200 in the bank, I thought I understood this. I had a business plan. I had projections. I had clients lined up.

What I didn't have was a clue about how cash actually moves through a business—or more accurately, how it doesn't move when you need it most.

The Cash Flow Reality Check

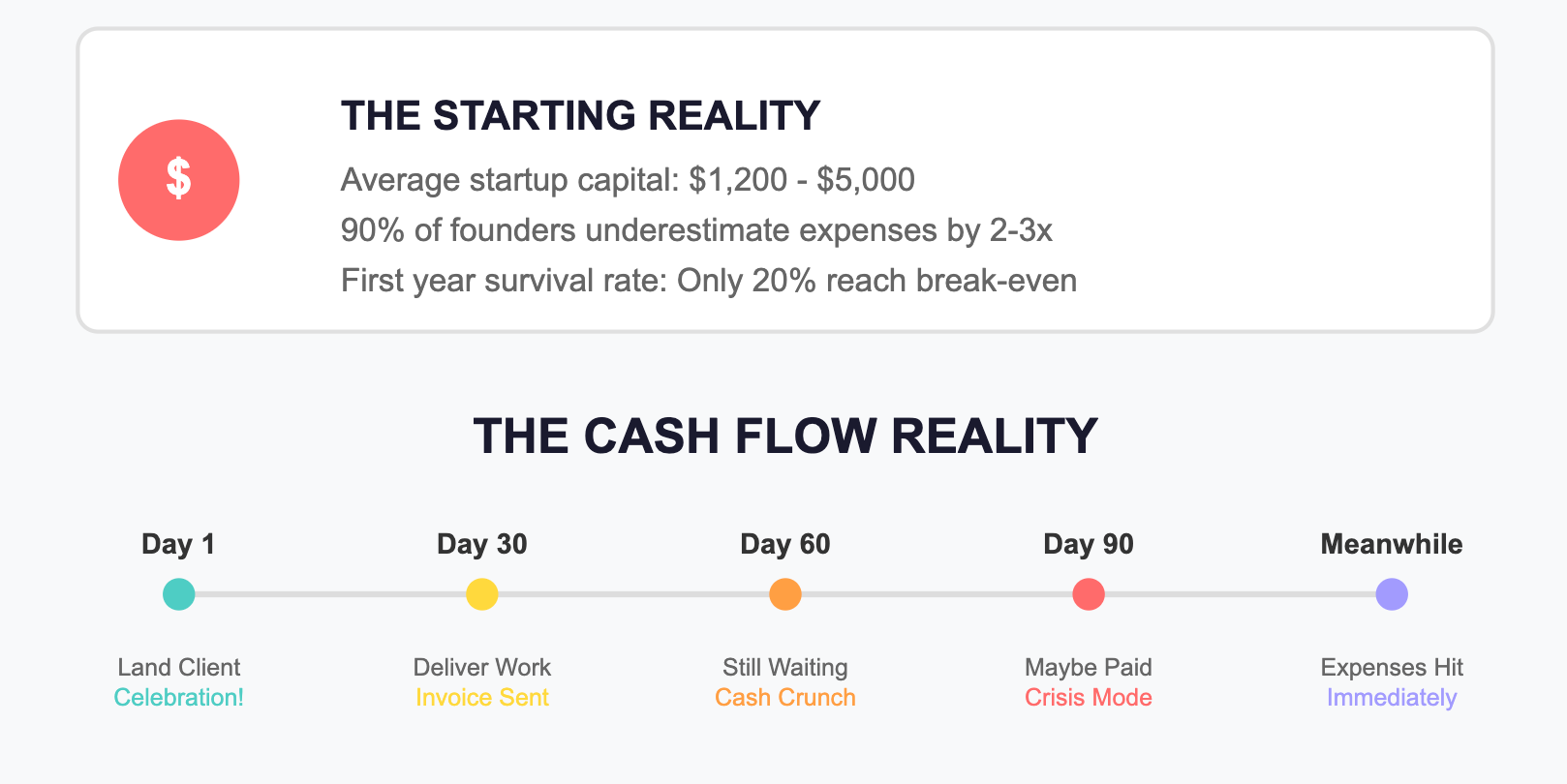

Let's get specific about what actually happens to your money in year one. Sarah Chen, who founded a successful e-commerce business that now does $2 million annually, broke it down for me perfectly:

"Everyone talks about revenue, but nobody talks about the 30-60-90 day payment cycles that will absolutely destroy you if you're not prepared. I had $50,000 in invoices outstanding while I was eating instant noodles because I couldn't afford groceries."

This is the cash flow story that repeats itself across every industry:

- You land a client (celebration!)

- You deliver the work (exhaustion)

- You invoice them (hope)

- You wait 30-90 days for payment (panic)

- Meanwhile, your expenses hit immediately (crisis)

The First 90 Days: When Reality Hits

The first three months of your startup journey will teach you more about money than any MBA program. Here's what typically happens:

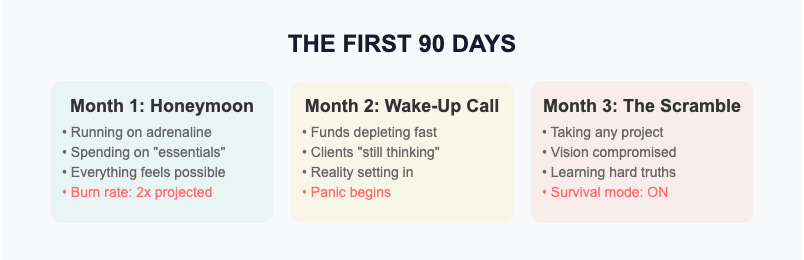

Month 1: The Honeymoon

You're running on adrenaline and whatever savings you've accumulated. Everything feels possible. You're spending money on business cards, websites, maybe even a co-working space membership. This is what I call "playing business" instead of doing business.

Month 2: The Wake-Up Call

Your initial funds are depleting faster than expected. That client who was "definitely going to sign" is still "thinking about it." You realize your burn rate (what you spend monthly) is double what you projected.

Month 3: The Scramble

This is when entrepreneur motivation gets tested. You're taking any project that pays, regardless of whether it aligns with your business vision. You're learning the difference between gross revenue and net profit the hard way.

The Psychology of Being Broke (And Why It's Actually Valuable)

Marcus Rodriguez, who built a software company from zero to a successful exit, told me something that changed my perspective:

"Being broke in year one isn't a bug—it's a feature. It forces you to get creative, to actually talk to customers, and to build a business instead of playing with toys."

When you have no money:

- You can't hire your way out of problems

- You can't buy your way to customers

- You have to actually solve real problems for real people

- You learn to negotiate everything

- You discover what's truly essential versus nice-to-have

The Hidden Expenses That Will Blindside You

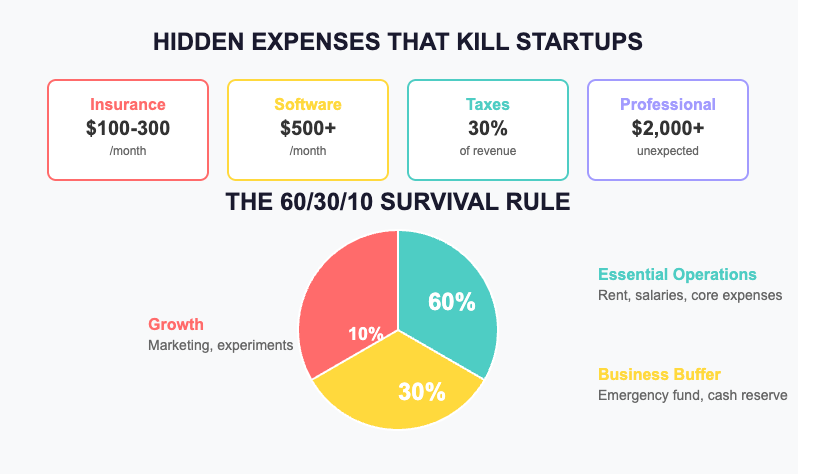

Every founder I've interviewed mentions expenses they never saw coming. Here are the top culprits:

Business Insurance: That general liability policy you legally need? $100-300/month you didn't budget for.

Software Subscriptions: They start at $9/month and somehow multiply into $500/month before you notice.

Taxes: Not just income tax—self-employment tax, quarterly estimates, state fees. Budget 30% of everything you make.

Professional Services: That "simple" legal document? $500. Basic accounting setup? $1,000. These add up fast.

The Time Tax: Every hour you spend on admin is an hour you're not making money. This invisible cost kills more startups than anything else.

Practical Cash Flow Strategies That Actually Work

After interviewing dozens of successful founders about their first year in business, clear patterns emerged. Here are the strategies that separate survivors from statistics:

1. The 60/30/10 Rule

Lisa Park, who grew her consulting firm to seven figures, swears by this: "60% of revenue goes to essential operations, 30% stays in the business as buffer, 10% goes to growth experiments. No exceptions."

2. Invoice Immediately, Follow Up Relentlessly

Create your invoice before you even finish the work. Send it the moment you deliver. Follow up after 7 days, 14 days, and 21 days. Be politely persistent.

3. The Two-Account System

Open two business checking accounts:

- Account 1: All revenue flows in here

- Account 2: Transfer only what you need for expenses

This creates forced scarcity and prevents lifestyle creep as revenue grows.

4. Negotiate Everything

Your landlord, software providers, suppliers—everyone expects negotiation. One founder saved $12,000 in year one just by asking for annual payment discounts on all services.

The Art of Bootstrapping: Real Examples

The Service-First Strategy

Tom Nielsen wanted to build a SaaS product but had no funding. His approach: "I sold consulting services around the problem my software would eventually solve. The consulting funded the development, and my clients became my beta users."

The Ladder Method

Start with the lowest-hanging fruit that generates immediate cash:

- Week 1-4: Freelance work in your expertise area

- Month 2-3: Productize your most requested service

- Month 4-6: Build recurring revenue streams

- Month 7-12: Scale what's working, cut what isn't

The Partnership Play

Maria Gonzalez couldn't afford developers for her app idea. Instead, she partnered with a technical co-founder, giving equity instead of cash. "I brought the customers, he brought the code. Neither of us had money, but together we had a business."

Managing the Emotional Rollercoaster

The cash flow story of year one isn't just about numbers—it's about mental health. Here's how successful founders manage the psychological burden:

Create Non-Negotiable Boundaries

- No checking bank accounts after 8 PM

- One full day off per week (yes, really)

- Exercise isn't optional—it's a business expense

Build Your Support Network Early

- Join founder communities (many are free)

- Find an accountability partner

- Consider a mentor who's been through this

Celebrate Tiny Wins

- First customer: Celebration

- First repeat customer: Bigger celebration

- First month of positive cash flow: Major milestone

The Breakthrough Moments You Can Expect

Around month 6-8, something shifts. The patterns become clearer. You start to see:

- Which customers pay on time (keep these)

- Which services have the best margins (do more)

- Which expenses are actually investments (continue)

- Which activities waste time (eliminate)

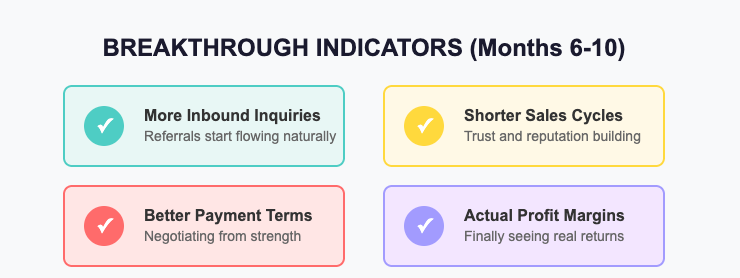

By month 9-10, if you've been disciplined, you'll notice:

- More inbound inquiries

- Shorter sales cycles

- Better payment terms negotiation

- Actual profit margins

The Final Push to Break-Even

The last quarter of year one is where discipline pays off. This is when successful founders:

- Raise prices (you're probably undercharging)

- Fire problem clients (they cost more than they pay)

- Systemize everything (time is money)

- Plan for year two (with actual data now)

Your Year One Action Plan

Here's your month-by-month survival guide:

Months 1-3: Foundation

- Focus on one service/product only

- Talk to 100 potential customers

- Make your first sale (at any price)

- Track every expense obsessively

Months 4-6: Validation

- Raise prices by 20%

- Hire a bookkeeper (even part-time)

- Build your first systems

- Create recurring revenue streams

Months 7-9: Optimization

- Cut unprofitable activities

- Double down on what works

- Build strategic partnerships

- Start building a cash reserve

Months 10-12: Preparation

- Plan for scale

- Document all processes

- Consider your first hire

- Set year two goals based on data

The Truth About Making It

Here's what nobody tells you about the startup journey: Break-even isn't about the money. It's about proving—to yourself and the world—that you can create value from nothing.

When you finally hit that month where revenue exceeds expenses, it's not just a financial milestone. It's validation that your idea works, that you can survive the worst, and that you're building something real.

Every successful founder has their broke-to-break-even story. The details vary, but the themes remain constant: resilience, creativity, and an almost irrational refusal to quit.

Your first year in business will test everything you think you know about yourself. It will be harder than you imagine and more rewarding than you can comprehend. The cash flow challenges are real, but they're also temporary.

The only question that matters is: Are you willing to pay the price of admission?

Because on the other side of that brutal first year is everything you're working for—freedom, impact, and the knowledge that you built something from nothing.

Welcome to the club. We've been waiting for you.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm