Burn Rate 101: How Much Runway Does Your Startup Really Have?

As a small business owner, you wear a dozen hats a day. You’re the CEO, the head of sales, the lead marketer, and sometimes, even the janitor. With so much to juggle, it’s easy to focus on the exciting metrics: new customers, website traffic, social media engagement. But there’s a quieter, more critical number lurking in your financial statements that can mean the difference between scaling your dream and shutting your doors for good.

It’s called your burn rate. And this is the simple calculation that tells you exactly how long your business can survive.

Imagine two startups. Startup A is getting tons of press, has a beautiful office, and a rapidly growing team. They’re the talk of the town. Startup B is much quieter. They’re heads-down, focused on a small but loyal customer base, and their team is lean. On the surface, Startup A looks like the clear winner. But six months later, Startup A has laid off half its staff and is desperately seeking a buyout, while Startup B has just become profitable.

What happened? Startup A had a dangerously high burn rate. They were spending money faster than they were making it, and their cash reserves evaporated.

This isn't just a cautionary tale for venture-backed tech companies. Understanding and managing your startup burn rate is a fundamental survival skill for every small business owner, whether you're running a coffee shop, a digital agency, or a subscription box service. This guide will walk you through everything you need to know to become the master of your cash flow and ensure your business has the fuel it needs to succeed.

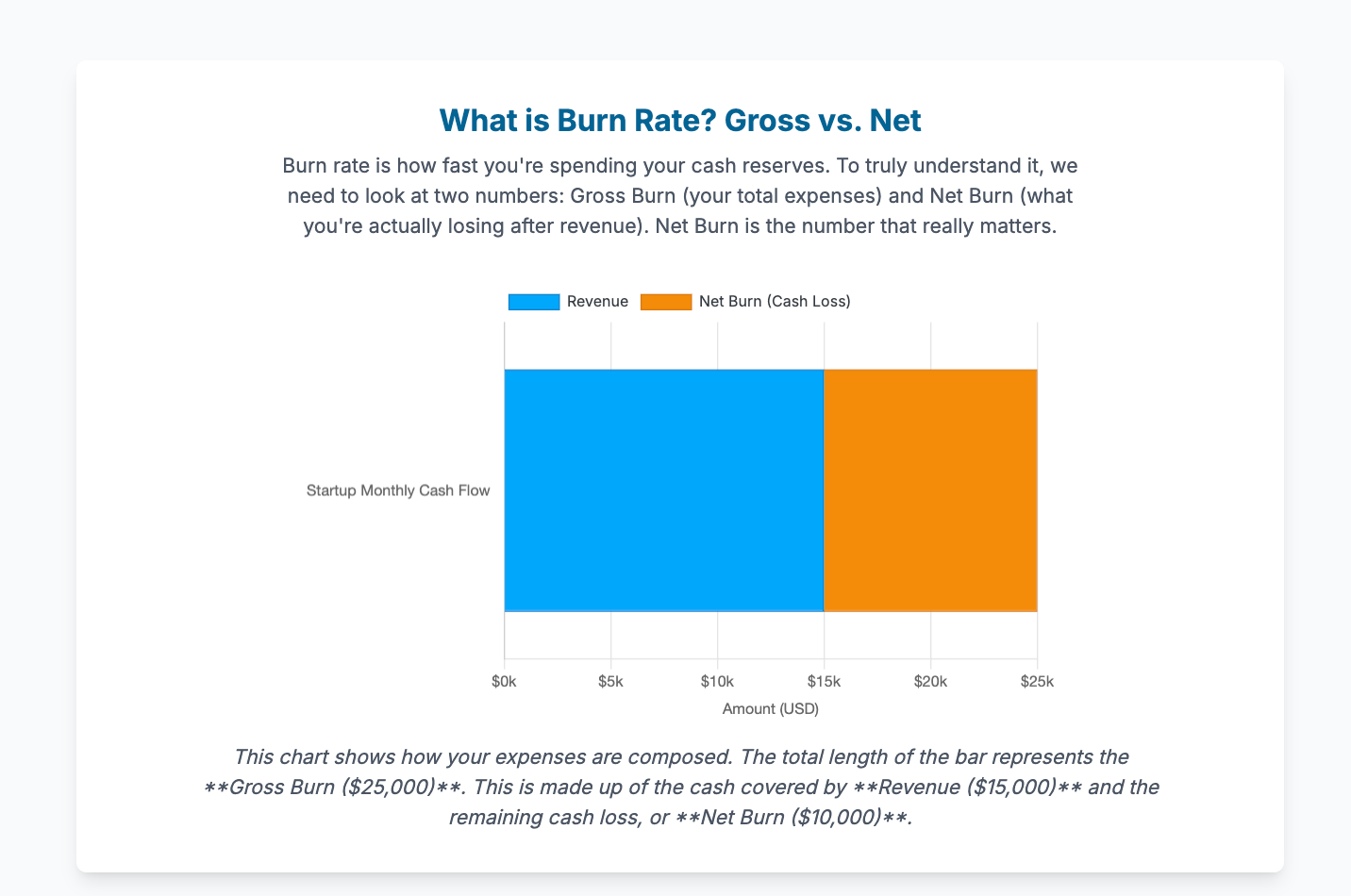

What is Burn Rate? Gross vs. Net Burn

At its core, burn rate is the speed at which your company is spending its cash reserves. It’s typically measured on a monthly basis. However, to get a truly accurate picture, we need to distinguish between two types: Gross Burn and Net Burn.

Gross Burn Rate

Your Gross Burn Rate is the total amount of cash your company spends in a month on operating expenses. Think of it as the total cash flowing out of your business. This includes everything you spend to keep the lights on, such as:

- Salaries and payroll taxes

- Rent or mortgage for your office or storefront

- Software subscriptions (e.g., CRM, accounting software, project management tools)

- Marketing and advertising costs

- Utilities

- Inventory and cost of goods sold (COGS)

- Professional services (legal, accounting)

Example: Let's say in a typical month, your business spends:

- $15,000 on salaries

- $5,000 on rent

- $2,000 on marketing

- $3,000 on software and other expenses

Your Gross Burn Rate would be $25,000 for that month.

Net Burn Rate

Gross Burn is useful, but it only tells half the story. It ignores the cash coming into your business. Your Net Burn Rate is the real measure of your company’s financial health. It’s the difference between your total cash outflows (expenses) and your total cash inflows (revenue).

The formula is simple:

Net Burn Rate = (Total Monthly Expenses) - (Total Monthly Revenue)

This number shows you how much cash your company is truly losing each month.

Example: Let's use our previous example. We know the company's Gross Burn (total expenses) is $25,000. Now, let's say in that same month, they generated $15,000 in revenue from sales.

- Net Burn Rate = $25,000 (Expenses) - $15,000 (Revenue) = $10,000

This means the company’s cash position decreased by $10,000 that month. This is the number that truly matters. If your revenue was $30,000, your Net Burn would be -$5,000, which means you’re cash-flow positive and increasing your cash reserves by $5,000 a month! For the rest of this article, when we say "burn rate," we'll be referring to the Net Burn Rate.

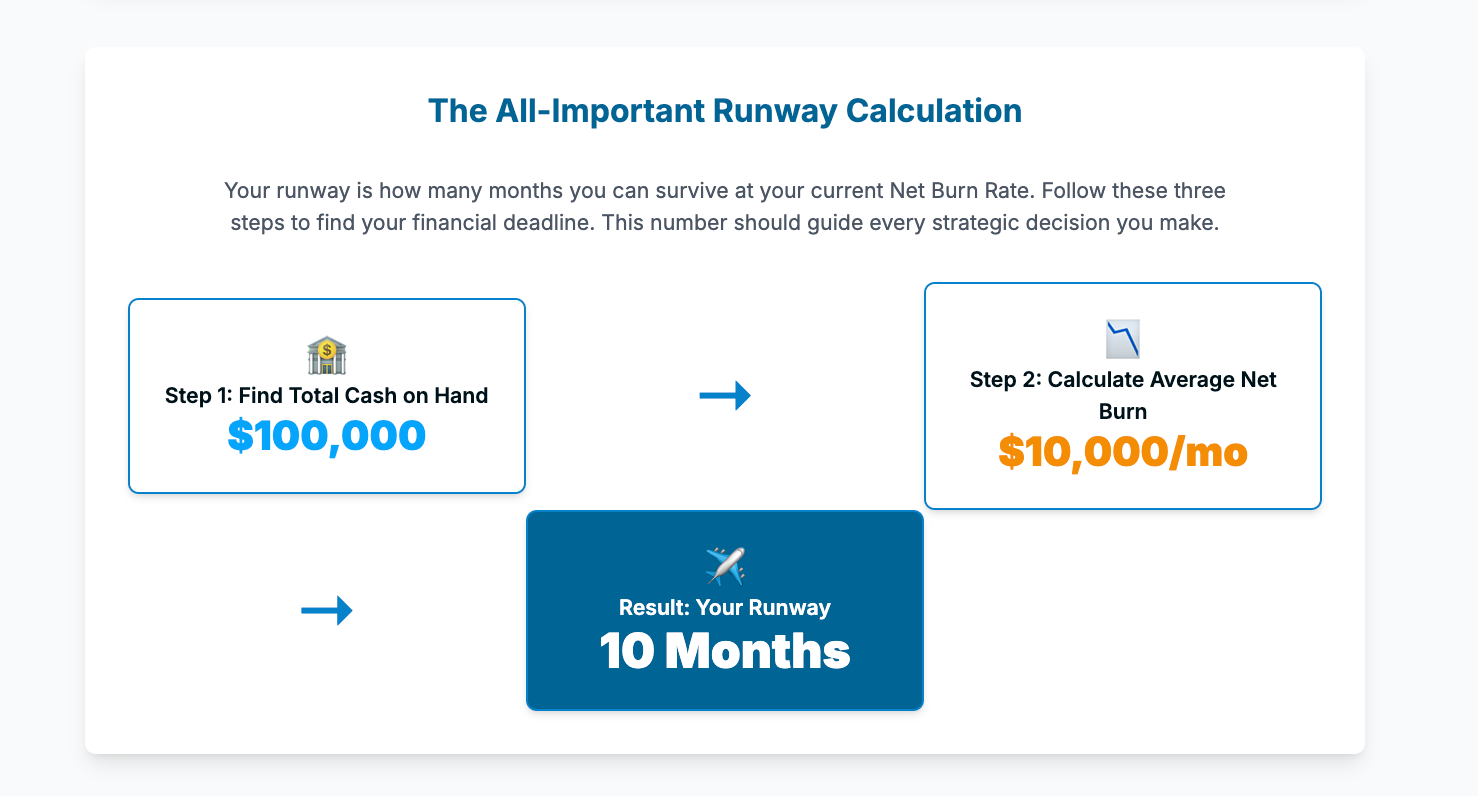

The All-Important Runway Calculation: How Long Can You Survive?

Now that you know your Net Burn Rate, you can calculate the single most important metric for any pre-profitable business: your runway.

Your runway is the amount of time, in months, your company can continue to operate before it runs out of money, assuming your revenue and expenses remain constant.

The Runway Calculation Formula

The runway calculation is just as straightforward as the burn rate formula:

Runway (in months) = Total Cash on Hand / Net Burn Rate

A Step-by-Step Guide to Calculating Your Runway

- Find Your Total Cash on Hand: This is the easiest step. Look at all your business bank accounts and add up the total cash you have available right now. Let's say you have $100,000.

- Calculate Your Average Monthly Net Burn: Don't just use last month's numbers. Business can be lumpy. To get a more accurate picture, calculate your average Net Burn Rate over the last three months.

- Month 1 Net Burn: $12,000

- Month 2 Net Burn: $8,000

- Month 3 Net Burn: $10,000

- Total Net Burn over 3 months = $30,000

- Average Monthly Net Burn = $30,000 / 3 = $10,000

- Divide Cash by Burn: Now, just plug the numbers into the formula.

- Runway = $100,000 / $10,000 = 10 months

You have 10 months of runway. This is your financial deadline. It tells you that you have 10 months to either become profitable or secure additional funding before your cash runs out. This is a powerful, motivating number that should guide your strategic decisions.

Best Practice: This is not a one-and-done calculation. You should recalculate your burn rate and runway at the end of every single month. It’s your financial pulse, and you need to check it regularly.

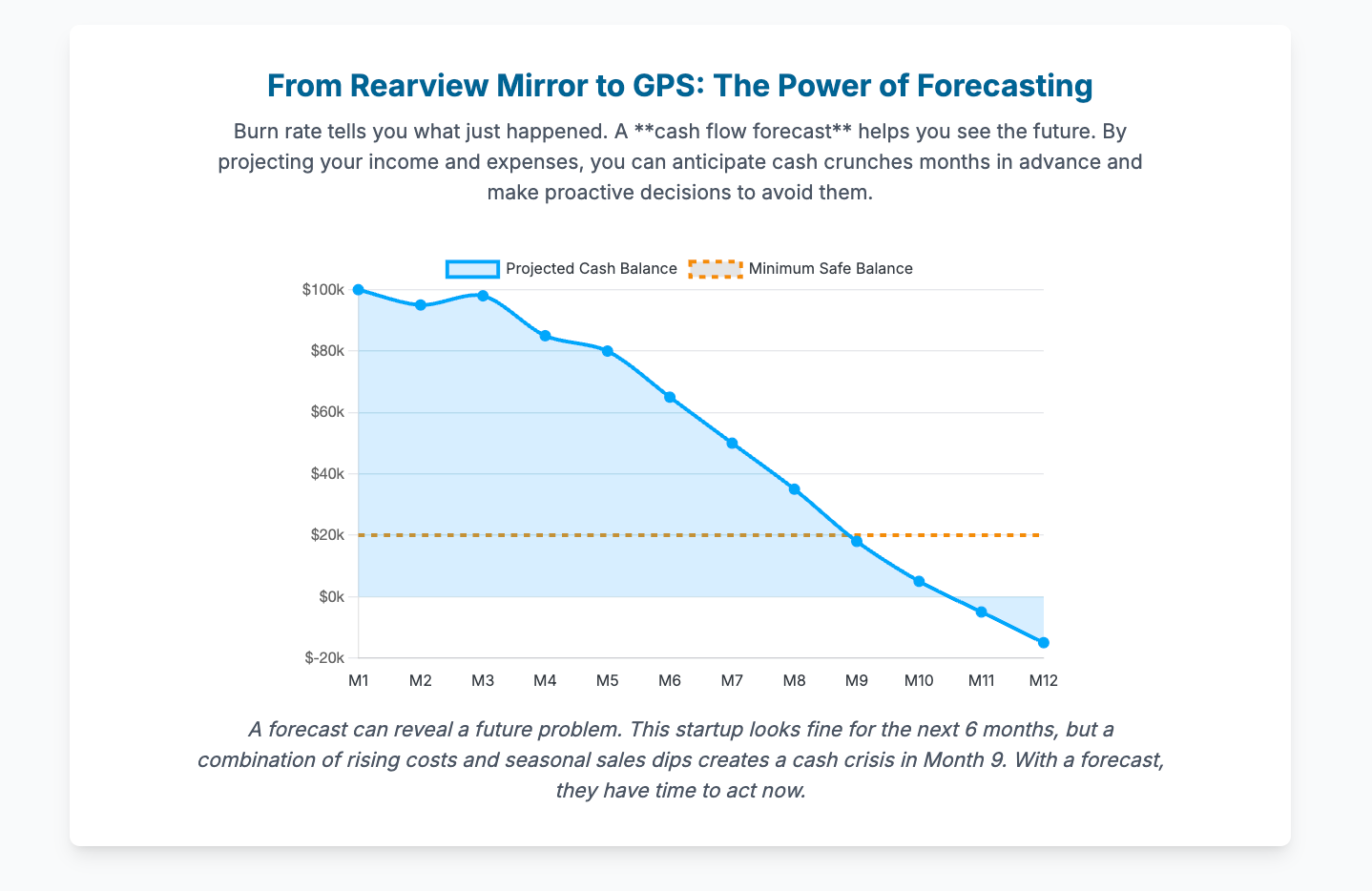

Beyond the Basics: The Power of a Cash Flow Forecast

Your burn rate and runway are like looking in the rearview mirror—they tell you what just happened. A cash flow forecast, on the other hand, is like your GPS. It helps you see the road ahead and navigate potential financial roadblocks before you hit them.

A cash flow forecast is a living document, usually a spreadsheet, that projects the cash moving in and out of your business over a future period, typically the next 6 to 12 months.

Why a Cash Flow Forecast is Crucial

- Anticipates Cash Crunches: It can show you that while you have cash now, you might have a shortfall in six months when a big annual insurance premium is due and sales are seasonally slow.

- Informs Strategic Decisions: Can you afford to hire that new salesperson? Should you invest in that big piece of equipment? Your cash flow forecast provides the data to answer these questions with confidence.

- Builds Credibility: If you’re seeking a loan or startup funding, a well-reasoned cash flow forecast shows that you are a sophisticated founder who understands the financial dynamics of your business.

How to Create a Simple Cash Flow Forecast

You don't need complex software. A simple spreadsheet will do.

- Rows: List all your categories of cash inflows (sales, loans, etc.) and cash outflows (all your expense categories).

- Columns: Use the next 12 months as your columns.

- Fill it Out:

- Start with your opening cash balance for the first month.

- Go month by month and project your cash inflows and outflows. Be conservative with your revenue estimates and realistic (or even slightly pessimistic) with your expense estimates.

- For each month, calculate: Opening Balance + Total Inflows - Total Outflows = Closing Balance.

- The closing balance of one month becomes the opening balance for the next.

This exercise will give you an unparalleled understanding of the financial rhythm of your business and transform how you make decisions.

How to Reduce Your Burn Rate and Extend Your Runway

If your runway calculation gave you a scare, don't panic. You have more control than you think. The goal is to reduce your burn rate, which will extend your runway. This isn't about thoughtless cost-slashing; it's about making strategic choices.

The Best Defense is a Good Offense: Increase Revenue

The most sustainable way to lower your net burn is to increase the cash coming in.

- Focus on Retention: It's cheaper to keep a customer than to acquire a new one. What can you do to improve customer satisfaction and reduce churn?

- Re-evaluate Pricing: Are you undercharging for your product or service? A small price increase can have a huge impact on your cash flow.

- Upsell and Cross-sell: What complementary products or premium services can you offer your existing customers?

Control the "Big Three" Expenses

For most businesses, the three largest expense categories are payroll, marketing, and office space.

- Payroll: Before making another full-time hire, ask yourself if the role can be filled by a freelancer, contractor, or part-time employee. Consider performance-based bonuses as a way to reward success without increasing fixed costs.

- Marketing: Scrutinize your marketing spend. Double down on the channels that provide a clear, measurable return on investment (ROI) and cut the ones that don't.

- Office Space: In the age of remote and hybrid work, a large, expensive office is often an unnecessary luxury. Could your team work from home or a more affordable co-working space?

Optimize Every Other Cost

- Conduct a "Subscription Audit": Go through your bank statements and cancel any software or services you're not using. You’ll be surprised at what you find.

- Negotiate with Vendors: Don't be afraid to ask your suppliers for better terms or a discount. The worst they can say is no.

- Foster a Lean Culture: Encourage your team to be mindful of expenses. When everyone treats the company's money like their own, small savings add up quickly.

Burn Rate and Startup Funding: Speaking the Investor's Language

If you plan to raise startup funding, your burn rate and runway will be under intense scrutiny. Investors are essentially buying you time. They want to know how you're using their capital and how long it will last.

What Investors Look For

- Capital Efficiency: Are you using your cash wisely to achieve meaningful milestones (e.g., building a product, acquiring customers)? A high burn rate with little to show for it is a major red flag.

- A Reasonable Runway: Typically, investors want to see that their investment will provide you with at least 12-18 months of runway. This gives you enough time to make significant progress before you need to start fundraising again, which is a major distraction.

- Financial Acumen: A founder who can speak intelligently about their burn rate, runway, and cash flow forecast is immediately more credible than one who can't.

The Fundraising "Danger Zone"

Best Practice: Start your fundraising process when you still have at least 6-9 months of runway. Fundraising always takes longer than you think. If you wait until you only have 2-3 months of cash left, investors will know you're desperate, and you'll lose all your negotiating leverage.

Conclusion: Your Burn Rate is a Strategic Tool, Not a Doomsday Clock

Your burn rate isn't a grade on your performance. It's a tool. It's a diagnostic metric that gives you clarity, focus, and control.

By understanding what it is, calculating it regularly, and using it to inform your decisions, you move from being a passenger in your business to being the pilot. You can see turbulence ahead, adjust your course, and manage your fuel with precision.

Mastering your burn rate empowers you to build a more resilient, sustainable, and ultimately, more successful business. Now, go open that spreadsheet and find your number. Your future self will thank you.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm