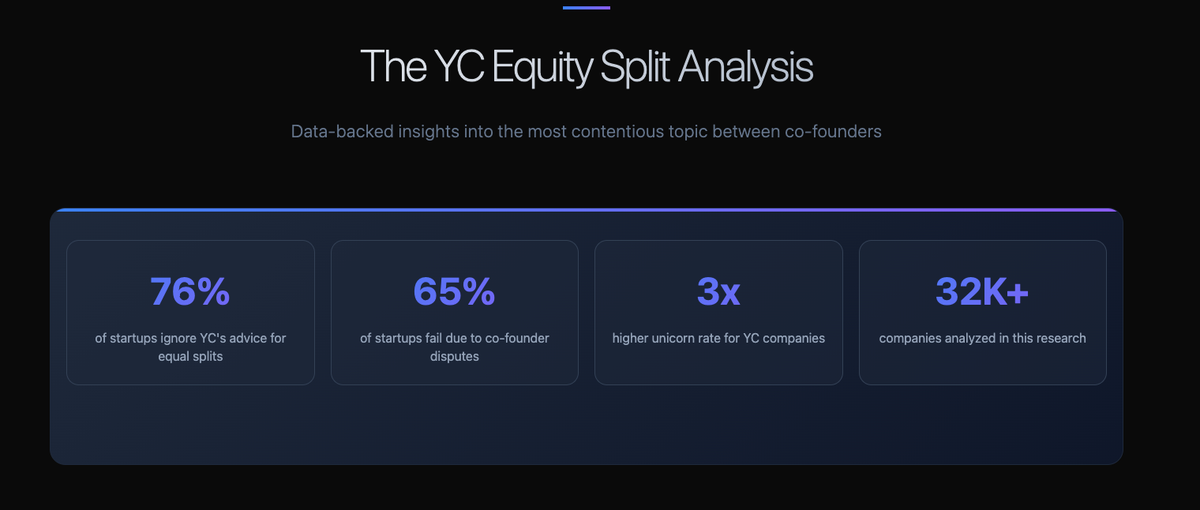

65% of startups fail because of THIS conversation. Here's the YC data that could save your company (hint: it's not just about the equity percentages)

Y Combinator tells founders to split equity equally, but 76% of startups don't. We dug into the data from 32,000+ companies and found that both equal AND unequal splits can work - but 65% of startups fail because founders screw up the conversation, not the percentages. The secret? It's all about vesting, documentation, and not being a jerk to your co-founder.

The equity conversation is about to blow up your startup before it even starts.

I've been obsessed with this topic ever since my first startup imploded over a 60/40 split that seemed "fair" at the time. So I spent the last month analyzing data from YC startups, Carta's database of 32,000+ companies, and every case study I could find.

What I discovered will probably make half of you angry and vindicate the other half.

Here's the thing that blew my mind: Y Combinator STRONGLY pushes for equal equity splits. Michael Seibel (YC's former Managing Director) literally said: "Equity should be split equally because all the work is ahead of you."

But guess what? Only 24% of founding teams actually split equity equally.

And here's where it gets weird...

YC startups achieve unicorn status at 2-3x the rate of non-YC companies. So either:

- YC is wrong about equal splits, or

- The split doesn't matter as much as HOW you do it

Spoiler: It's #2.

Let's look at the actual data from successful YC companies:

EQUAL-ISH SPLITS:

- Airbnb: 33% / 29% / 21% (Brian Chesky / Joe Gebbia / Nathan Blecharczyk)

- Stripe: Started 50/50 (Collison brothers)

- Reddit: Started 50/50 (Huffman / Ohanian)

UNEQUAL SPLITS:

- Dropbox: 25% / 10% (Drew Houston / Arash Ferdowsi)

- Coinbase: 19% / 6-8% (Brian Armstrong / Fred Ehrsam)

Both groups created billions in value. So what actually matters?

The 5 Factors That Actually Determine "Fair"

After analyzing everything, here's what actually moves the needle:

1. Time Commitment & Risk (Weight: 40%)

- Full-time from day one = full equity consideration

- Part-time involvement = 25-33% of full-time founder equity

- "First to jump" from cushy job = 5-10% risk premium

- Late co-founder (joining after 6-12 months) = 5-15% total equity

2. Actual Skills That Build the Product (Weight: 30%)

- Can you code the damn thing? 30-50% equity

- Can you sell the damn thing? 30-50% equity

- Can you only "ideate" and "strategize"? Good luck arguing for more than 10%

3. Money & Opportunity Cost (Weight: 20%)

- Every $50k in salary sacrificed = ~5% equity (using 50x multiplier)

- Cash invested = 2-3x value in equity (not more!)

- Network/customer connections = 5-10% if they actually convert

4. Future Contribution, Not Past "Ideas" (Weight: 10%)

- Your idea is worth <1% of final value

- Execution is worth 99%

- YC literally tells teams to ignore who had the idea first

5. The Secret Weapon: Vesting (This Changes Everything)

- 4-year vesting with 1-year cliff is NON-NEGOTIABLE

- This means even with unequal splits, everyone has to earn it

- Miss your cliff by even one day? You get ZERO. Harsh but necessary.

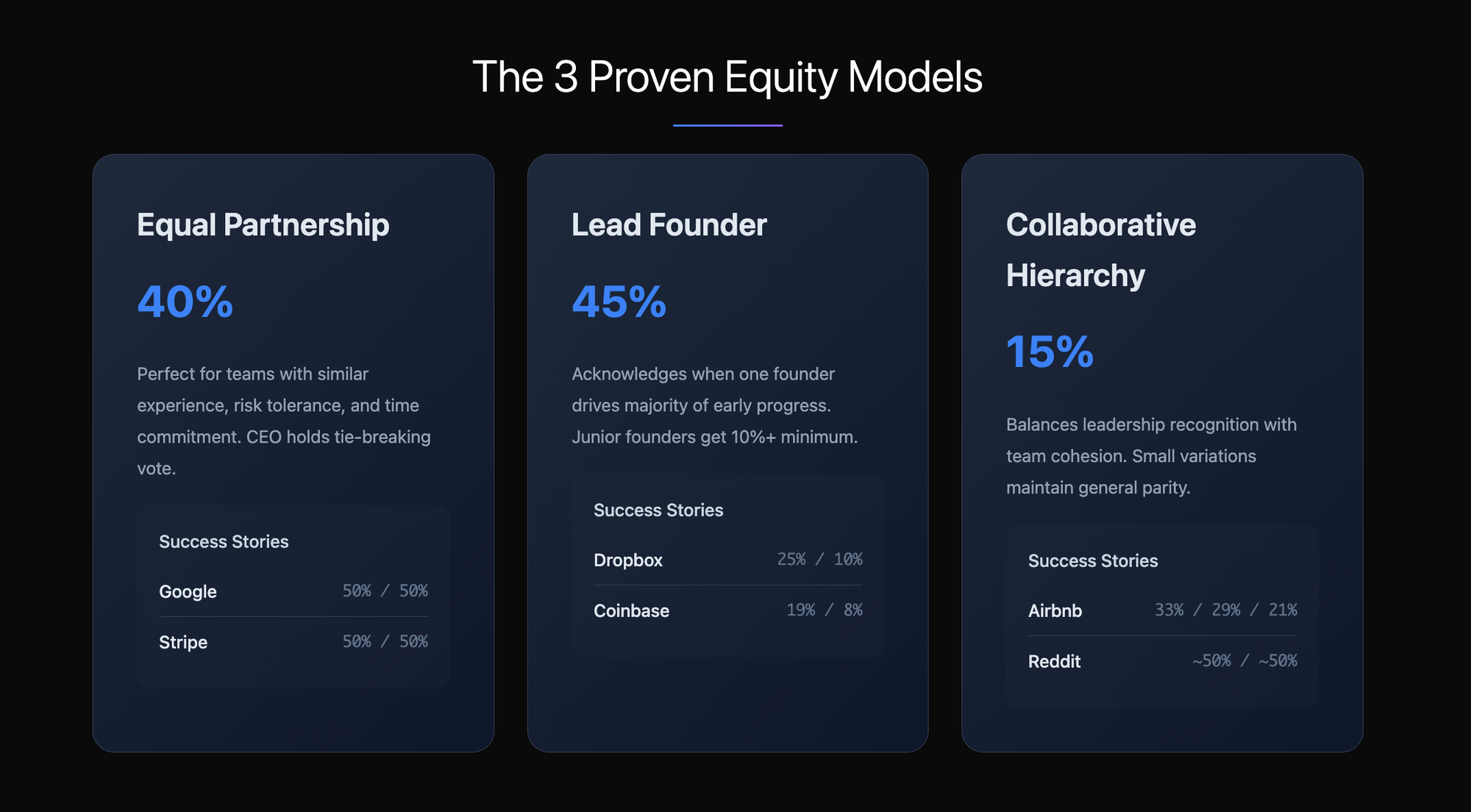

The 3 Models That Actually Work (Based on Pattern Analysis)

Model 1: The True Partnership (40% of successful companies)

- Split: 50/50 or 33/33/33

- When it works: Similar experience, risk, and commitment

- Critical success factor: CEO gets tie-breaking vote

- Example: Google (Page/Brin)

Model 2: The Lead Founder (45% of successful companies)

- Split: 60/40, 70/30, or 40/30/30

- When it works: Clear primary driver exists

- Critical success factor: Junior founder still gets 10%+ minimum

- Example: Dropbox

Model 3: The "Almost Equal" (15% of successful companies)

- Split: 35/32/33 or similar

- When it works: Want to recognize slight differences without creating hierarchy

- Critical success factor: Differences are small enough to not create resentment

- Example: Airbnb

The Legal Stuff That Will Save You

This is the boring part that everyone skips, then regrets forever:

WITHIN 24 HOURS:

- Create Delaware C-Corp (use Stripe Atlas or Clerky - $500-799)

- Issue founder stock with reverse vesting

- Sign IP assignment agreements (EVERY. SINGLE. FOUNDER.)

WITHIN 30 DAYS (OR YOU'RE IN TROUBLE):

- File 83(b) election with IRS

- No extensions. No exceptions. Miss this = potentially millions in unnecessary taxes

- Set 17 phone alarms. Not joking.

BEFORE FIRST EMPLOYEE/INVESTOR:

- Comprehensive founder agreement covering:

- What happens if someone leaves (buyback provisions)

- What happens if you hate each other (shotgun clause)

- What happens if someone slacks off (performance provisions)

- What happens if someone gets hit by a bus (succession planning)

The Communication Framework That Prevents 65% of Failures

Remember that stat? 65% of startups fail due to co-founder conflicts. Here's how to not be a statistic:

Week 1: Values Alignment (2-3 hours)

- "What does fair mean to each of us?"

- "What are we optimizing for - equality or contribution recognition?"

- If you can't agree here, stop now.

Week 2: Contribution Assessment (3-4 hours)

- List everything each person brings

- Be brutally honest about weaknesses

- Document it all (seriously, write it down)

Week 3: Scenario Planning (3-4 hours)

- "What if one of us has a kid and goes part-time?"

- "What if one of us gets a $500k job offer?"

- "What if we pivot and your skills become irrelevant?"

Week 4: Number Discussion (2-3 hours)

- Only NOW do you talk percentages

- Use the models above as starting points

- If it takes less than 10 hours total, you're rushing

Ongoing: Quarterly Check-ins

- "Are contributions matching equity?"

- "Anyone's situation changed?"

- "Any adjustments needed?"

Teams doing quarterly reviews have 3x higher founder satisfaction after 2 years.

The Scripts That Actually Work

Instead of: "You're not pulling your weight" Say: "When product development delays occur, it impacts my ability to secure customers"

Instead of: "I deserve more equity because it was my idea" Say: "Let's map out expected contributions over the next 5 years"

Instead of: "This isn't fair" Say: "Help me understand your perspective on contribution balance"

The Brutal Truth About Late Co-Founders

If you're joining 6+ months after inception:

- You're not getting equal equity. Period.

- 5-15% is standard, vesting over 4 years

- Your negotiation power depends on how desperately they need you

- Don't like it? Start your own company.

The Worst Case Scenarios Nobody Plans For

Scenario 1: The High-Performer Pivot Your technical co-founder becomes useless after a business model pivot. Solution: Performance-based equity grants can rebalance without renegotiating base equity.

Scenario 2: The Life Change Co-founder has twins, can only work 20 hours/week. Solution: Partial vesting suspension with catch-up provisions.

Scenario 3: The Better Offer Co-founder gets $1M job offer from Google. Solution: Accelerated partial vesting for staying (golden handcuffs).

After all this research, what's a practical approach?

Start with YC's assumption of equal splits. Then adjust based on reality.

Why? Because starting from equality forces you to justify every deviation. Starting from inequality creates resentment from day one.

The magic formula:

- Begin at 50/50 (or 33/33/33)

- Adjust for major commitment differences (-10% to +10%)

- Implement standard vesting immediately

- Document everything

- Review quarterly

The Million Dollar Mistakes to Avoid

- The "Idea Guy" Premium: Giving extra equity for the idea = startup death

- The "I Have Money" Power Play: Cash should never buy more than 10% extra

- The "We'll Figure It Out Later": No. You won't. It only gets harder.

- The "We Don't Need Vesting": Yes. You do. Even married co-founders.

- The "Quick Handshake Deal": Under 10 hours of discussion = ticking time bomb

Action Steps (Do These TODAY)

- Schedule the conversation - Stop avoiding it

- Use the 4-week framework - Don't rush

- Get legal docs from Clerky/Stripe Atlas - Worth every penny

- Set 83(b) deadline reminders - In every calendar you own

- Start contribution journal - Track everything from day one

The Bottom Line

The research is clear: It's not about the perfect split. It's about the process, documentation, and ongoing communication.

Equal splits work. Unequal splits work. What doesn't work is avoiding the conversation, rushing the decision, or assuming things will never change.

Your move, founders.

Need help growing your startup? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm