5 Signs Your Small Business Needs FP&A (Financial Planning & Analysis) Help

As a small business owner, you wear a lot of hats. You’re the CEO, the head of sales, the chief marketing officer, and often, the janitor. With so many responsibilities pulling you in different directions, it’s easy to let the high-level financial strategy slide. You look at your bank account, you pay your bills, you know what’s coming in and what’s going out (mostly), and you make decisions based on your gut.

For a while, that might even work. But as your business grows and the stakes get higher, relying on instinct alone is like navigating a ship through a storm without a compass or a map. This is where Financial Planning & Analysis (FP&A) comes in.

Don't let the corporate-sounding name intimidate you. At its core, FP&A is simply the process of using your financial data to look forward, not just backward. While your accountant or bookkeeper tells you what happened last month, FP&A helps you understand why it happened and what’s likely to happen next. It’s the difference between reading a history book and having a GPS for the road ahead.

But how do you know when it’s time to move beyond basic bookkeeping and embrace FP&A? The signs are often hiding in plain sight, disguised as everyday stress and frustration. If you're serious about building a resilient, profitable, and scalable business, you can't afford to ignore them. Here are five of the biggest signs that your small business needs FP&A help.

1. You're Flying Blind: Making Decisions by the Seat of Your Pants

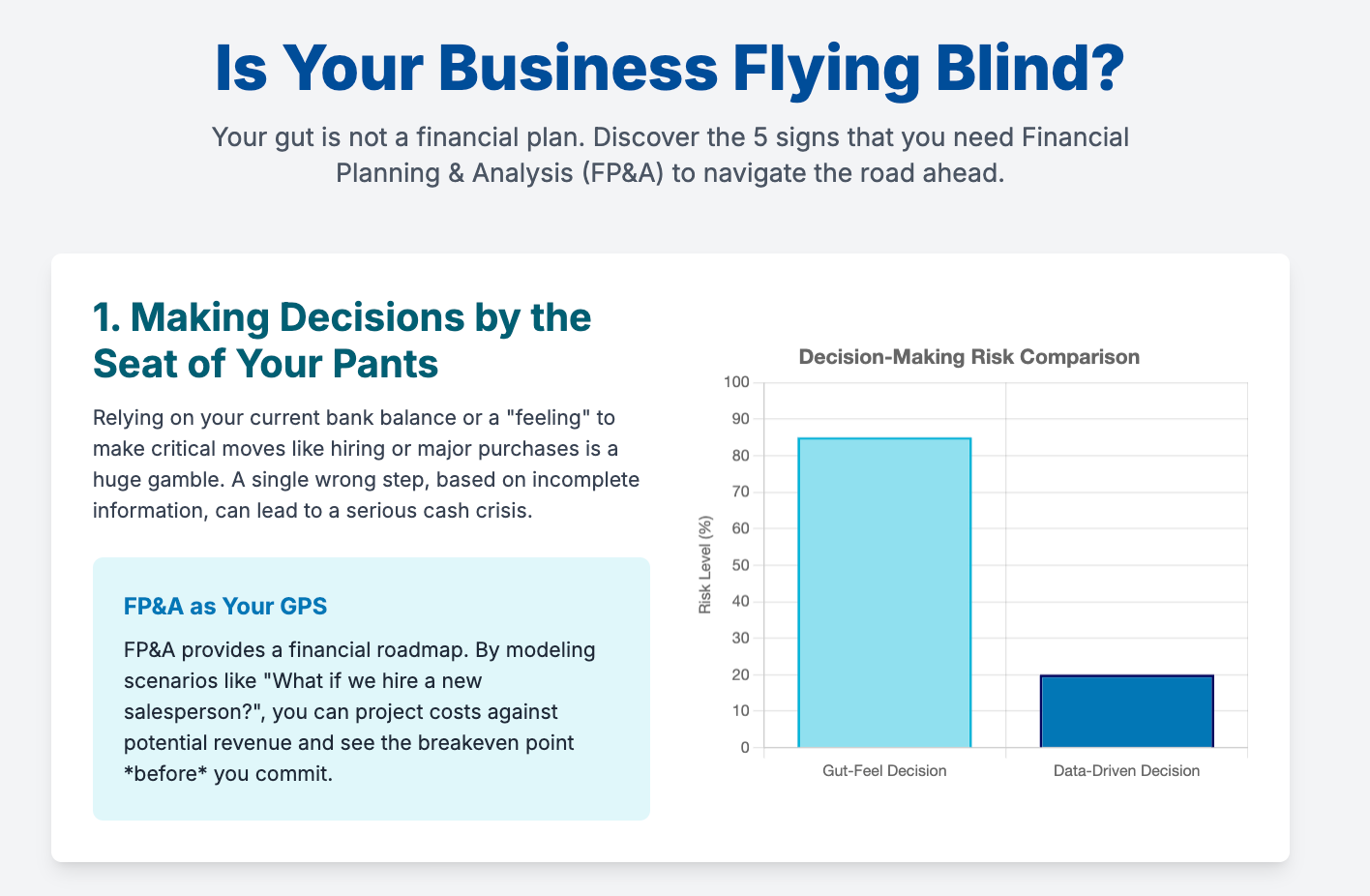

Do you find yourself making critical business decisions based on a "feeling"? Maybe you decide to hire a new employee because you feel busy, or you invest in a new piece of equipment because a competitor has one. While your intuition as a business owner is valuable, it shouldn't be your primary decision-making tool.

The Problem: Making decisions without a clear, data-driven financial picture is incredibly risky. Relying on your current bank balance is a classic mistake. It doesn't tell you about the big tax payment due next month or the seasonal dip in sales that’s right around the corner. You're essentially "flying blind," and a single wrong move could have serious consequences.

Real-World Example: Consider a boutique clothing store owner who sees a surge in sales for a particular style of jacket. Based on this, she uses a significant chunk of her cash to place a massive order for more jackets. What she didn't account for was an upcoming change in fashion trends and the fact that a new, larger competitor was opening a block away. Two months later, she's sitting on a mountain of unsold inventory and facing a severe cash flow crisis.

How FP&A Helps: FP&A provides the "financial roadmap" you've been missing. Through financial modeling and scenario planning, you can test your decisions before you commit to them.

- "What if we hire a new salesperson?" An FP&A model can project the costs (salary, benefits, training) against the potential revenue they might bring in, showing you the breakeven point.

- "What if we increase our prices by 5%?" You can model the potential impact on your sales volume and overall profitability.

- "What if a recession hits?" Scenario planning can help you understand potential impacts and build a contingency plan.

Actionable Tip: You don't need a complex, multi-tab spreadsheet to start. Begin by creating a simple cash flow forecast for the next three to six months. List all your anticipated income and all your expected expenses. This simple exercise will immediately give you more clarity and force you to think beyond the here and now

2. Your "Budget" Is a Static Document That Gathers Dust

You did it. At the beginning of the year, you sat down and created a detailed budget. You felt responsible and organized. But now, it's June, and you haven't looked at it since January. Sound familiar?

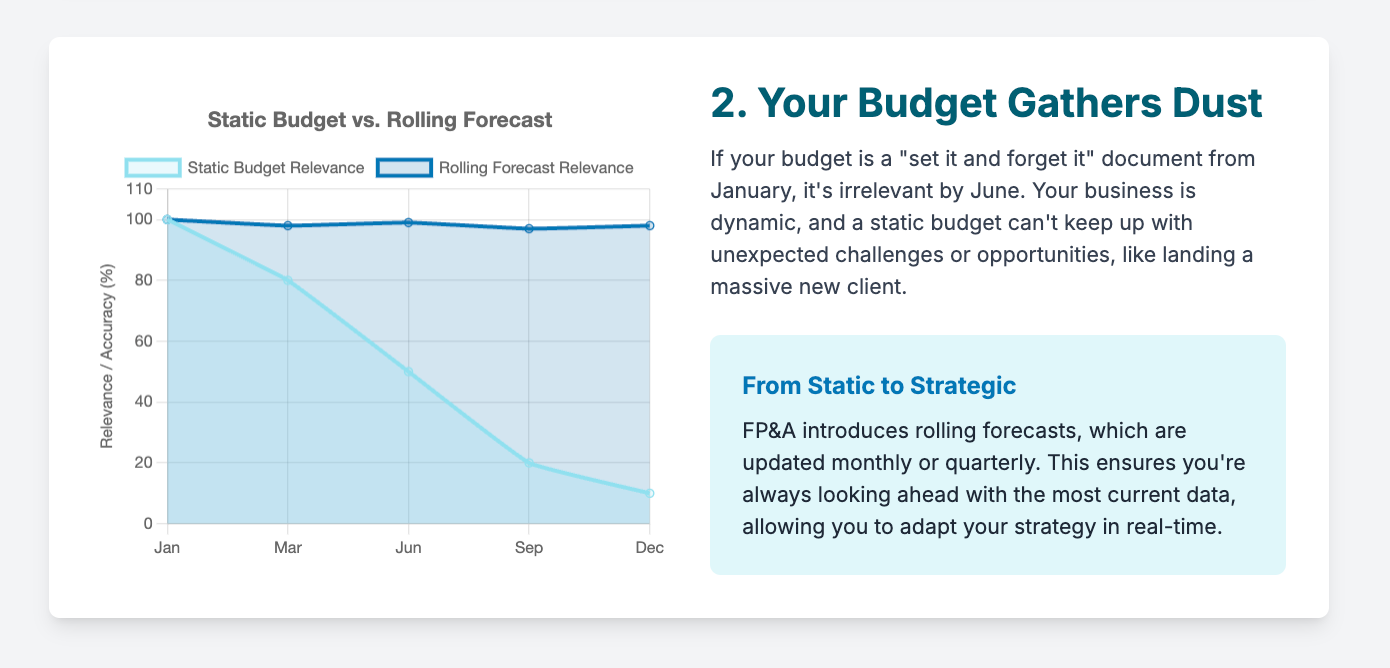

The Problem: For many small businesses, the budget is a "set it and forget it" document. It's an annual chore, not a dynamic tool for managing the business. The reality is that your business is constantly changing, and a static budget quickly becomes irrelevant.

Real-World Example: A small digital marketing agency creates an annual budget based on their existing client roster. In April, they unexpectedly land a massive new client that will significantly increase both their revenue and their costs (they need to hire freelancers and invest in new software). Because they aren't regularly updating their financial plan, they are slow to allocate resources effectively. They end up scrambling, their team gets burned out, and the profitability of the new project is much lower than it should have been.

How FP&A Helps: FP&A transforms budgeting from a once-a-year event into a continuous, strategic process. Two key FP&A concepts are crucial here:

- Rolling Forecasts: Instead of a fixed 12-month budget, a rolling forecast looks ahead for a set period (e.g., the next 12 or 18 months) and is updated every month or quarter. As one month ends, you add another to the end of your forecast. This ensures you're always looking ahead with the most current information.

- Variance Analysis: This is the simple but powerful process of comparing your actual results to what you budgeted. But it doesn't stop there. The real value comes from asking "why?" Why was revenue higher than expected? Why did we spend so much on marketing? This analysis provides critical insights that help you make better decisions in the future.

Actionable Tip: Schedule a monthly "budget vs. actuals" review with your team (or just yourself, if you're a solopreneur). Don't just look at the numbers; discuss the story behind them. This will turn your budget from a dusty document into one of your most valuable management tools.

3. You're Experiencing Rapid Growth (or You Want To)

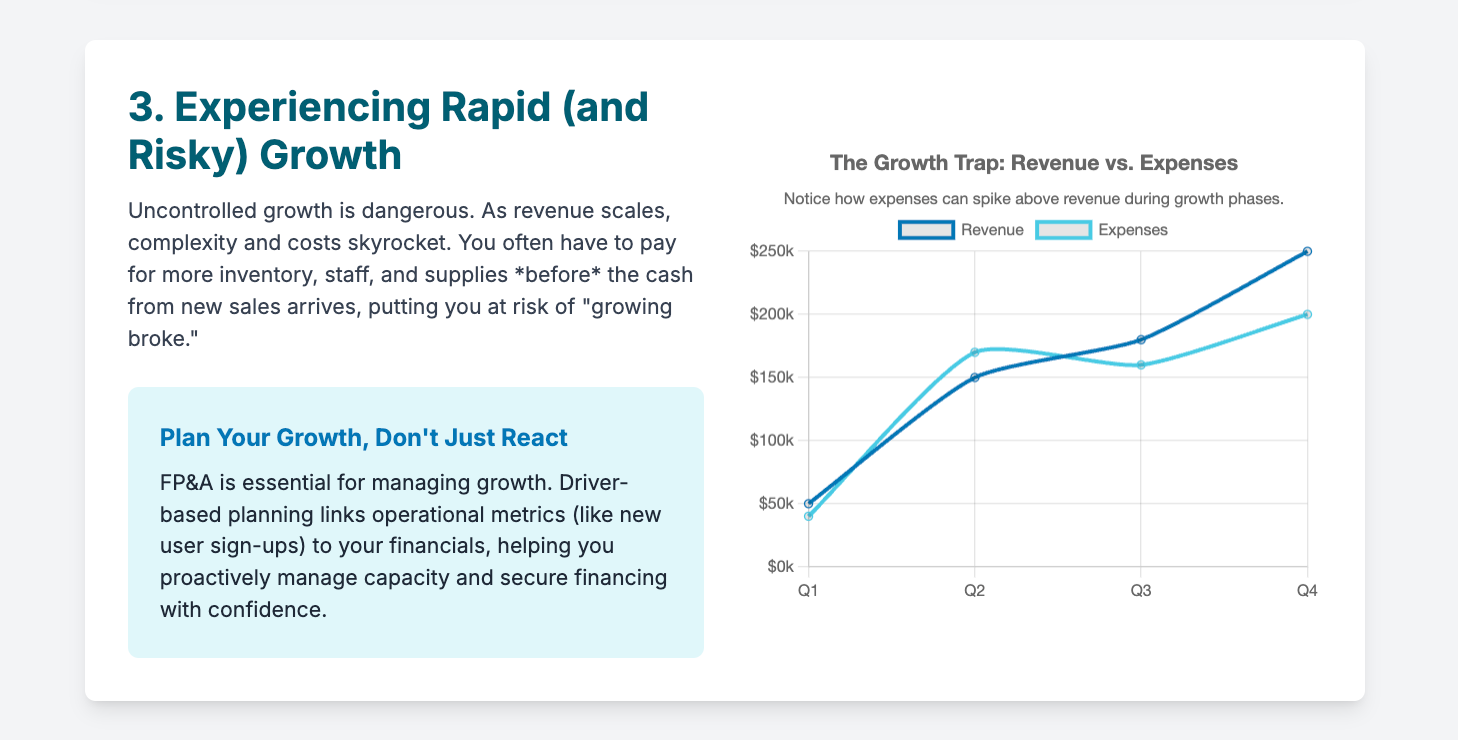

Growth is the goal, right? Yes, but uncontrolled growth can be just as dangerous as no growth at all. Scaling a business puts immense strain on your finances, operations, and people. If you're not prepared, you can "grow broke."

The Problem: As your revenue increases, so does your complexity. You need more inventory, more staff, more office space, more everything. These new expenses often have to be paid before you get the cash from your new sales. This is the classic growth trap.

Real-World Example: A subscription box company's marketing campaign goes viral. New orders flood in, and on paper, they are wildly successful. However, they have to pay their suppliers for all the new products upfront. Their shipping costs skyrocket. They need to hire more people to pack boxes. Because they didn't forecast the cash requirements of this growth, they run out of money and can't fulfill the orders they've already taken, leading to angry customers and a damaged reputation.

How FP&A Helps: FP&A is the essential toolkit for managing growth. It helps you plan for the future you want, not just react to the present you have.

- Capacity Planning: How many sales can your current team and infrastructure handle? At what point do you need to hire or invest in new equipment? FP&A helps you answer these questions proactively.

- Driver-Based Planning: This approach focuses on the key operational drivers that influence your financial results. For a software company, drivers might be new user sign-ups, customer churn rate, and server uptime. By building a financial model around these drivers, you can see exactly how changes in your operations will impact your bottom line.

- Financing Strategy: If you need to raise capital to fund your growth, investors will demand a sophisticated financial plan. An FP&A professional can help you build the forecasts and models that give lenders and investors confidence.

Actionable Tip: Identify the 3-5 most important Key Performance Indicators (KPIs) or "drivers" for your business. Start tracking them religiously and build a simple model in a spreadsheet that links these drivers to your revenue and expenses. This will help you understand the mechanics of your business's growth.

4. You Don't Know Your True Profitability (by Product, Service, or Customer)

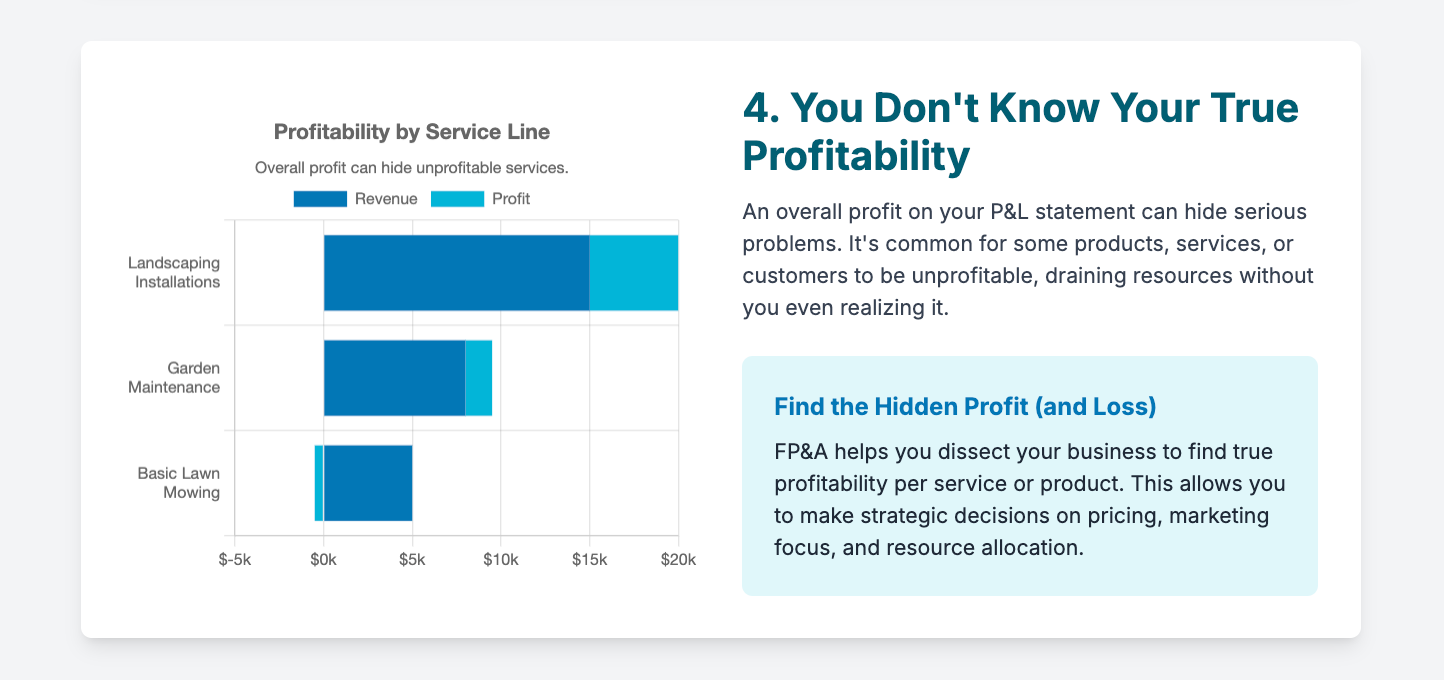

You get your profit and loss (P&L) statement at the end of the month, and it shows a profit. That's great! But do you know where that profit is coming from? Is every product you sell or every service you offer actually making you money?

The Problem: An overall profit figure can hide some ugly truths. It's very common for businesses to have certain products, services, or even types of customers that are actually unprofitable. You might be pouring time and resources into activities that are losing you money without even realizing it.

Real-World Example: A landscaping company offers a wide range of services, from basic lawn mowing to complex garden design and installation. Their overall business is profitable. However, a detailed analysis reveals that while their large installation projects are highly profitable, their "basic mowing" service is barely breaking even after accounting for travel time, fuel, and equipment maintenance. They are essentially treating it as a loss leader without a strategy to upsell those customers to more profitable services.

How FP&A Helps: FP&A allows you to dissect your business and understand your profitability at a granular level. By allocating your costs (both direct and indirect) to specific revenue streams, you can uncover powerful insights. This analysis helps you make strategic decisions about:

- Pricing: Are your prices high enough to cover all associated costs and generate a healthy margin?

- Marketing: Should you focus your marketing budget on attracting high-value customers or promoting your most profitable services?

- Resource Allocation: Should you discontinue a low-margin product or find a way to make it more profitable?

Actionable Tip: You don't have to analyze everything at once. Pick your top-selling product or service. Do a "deep dive" on its profitability. Try to account for every single cost associated with delivering it, including a portion of your overhead (rent, utilities, salaries). The results might surprise you.

5. You're Constantly Surprised by Cash Flow Problems

Profit is an opinion, but cash is a fact. You can have a profitable business on paper but have no cash in the bank. This is one of the most stressful and dangerous situations for a small business owner.

The Problem: You're profitable, but you're constantly juggling bills, delaying payments to vendors, and anxiously waiting for customer payments to clear. You're always reactive, putting out cash flow fires instead of proactively managing your money. This often happens in businesses with long payment cycles (e.g., construction, consulting) or those that need to hold a lot of inventory.

Real-World Example: A freelance graphic designer is having a great year, with lots of projects and happy clients. Her P&L statement shows a healthy profit. However, her standard contract terms are "payment upon completion," and many of her large corporate clients take 60-90 days to pay their invoices. Despite being "profitable," she constantly struggles to pay her own monthly bills and business subscriptions because the cash from her work takes so long to arrive.

How FP&A Helps: FP&A puts a major focus on cash flow forecasting and working capital management. It's not just about whether you're making money, but about the timing of when that money comes in and goes out.

- Cash Flow Forecasting: This is more detailed than a simple budget. It tracks the actual movement of cash in and out of your bank account, helping you anticipate future shortfalls and surpluses.

- Working Capital Management: FP&A helps you analyze and optimize your accounts receivable (how quickly you get paid), accounts payable (how quickly you pay your vendors), and inventory levels. Small improvements in these areas can have a massive impact on your available cash.

Actionable Tip: Create a 13-week cash flow forecast. This is a highly detailed, short-term tool that financial professionals use to manage cash on a weekly basis. It forces you to think about every single payment coming in and going out in the near future. There are many free templates available online to get you started.

From Surviving to Thriving

If you recognized your business in one or more of these signs, don't panic. It's a natural part of the business lifecycle. It's a sign that you've outgrown your old way of doing things and are ready for the next level of maturity.

Embracing FP&A doesn't mean you have to hire a full-time, six-figure CFO tomorrow. You can start small by implementing the tips in this article. You can leverage modern FP&A software that makes these tools more accessible than ever. You can also consider hiring a fractional CFO or an FP&A consultant who can provide expert guidance at a fraction of the cost of a full-time employee.

Making the shift from reactive, gut-feel decisions to proactive, data-driven strategies is the single most powerful thing you can do to secure the future of your business. It's an investment in clarity, confidence, and control. It's how you go from just surviving to truly thriving.

Need help growing your business? Unlock Your Business Growth Potential - Get a Free 30-Minute Consultation with a top Small Business advisory firm